Region:Middle East

Author(s):Geetanshi

Product Code:KRAB6358

Pages:96

Published On:October 2025

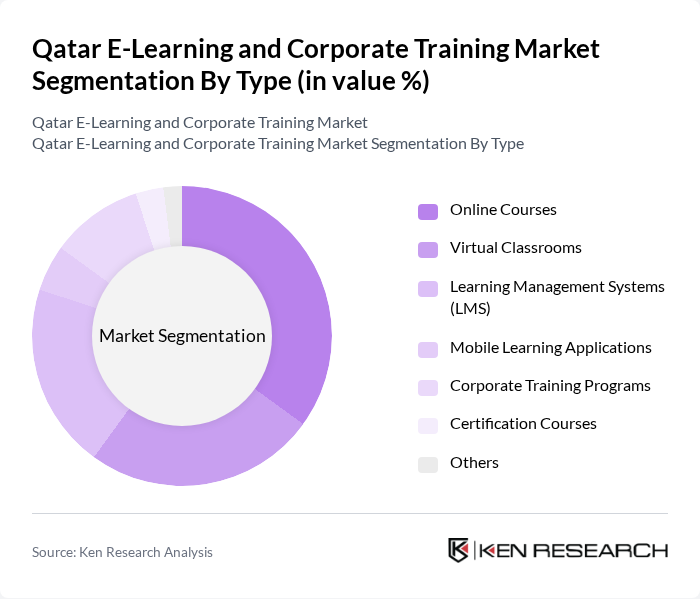

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Mobile Learning Applications, Corporate Training Programs, Certification Courses, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage with content at their own pace. Virtual Classrooms are also popular, especially in corporate settings, as they facilitate real-time interaction between instructors and participants. The demand for Learning Management Systems (LMS) is on the rise as organizations seek to streamline training processes and track employee progress effectively.

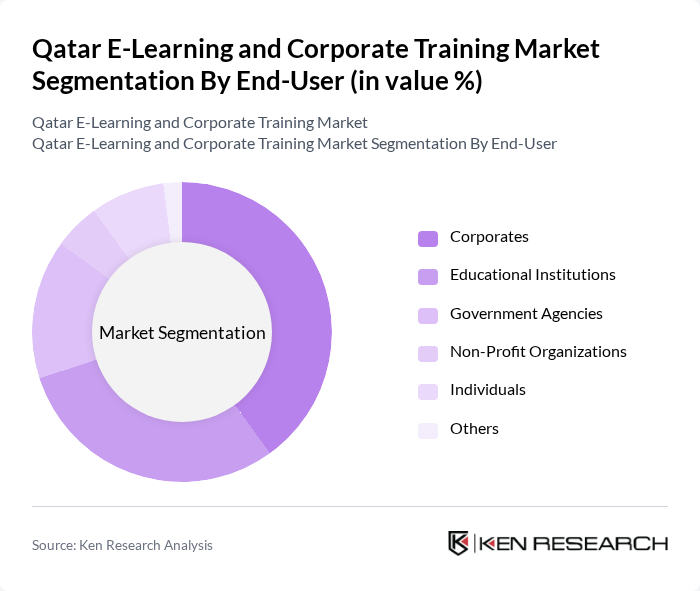

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, Individuals, and Others. Corporates are the leading end-users, driven by the need for continuous employee development and skills enhancement. Educational Institutions are also significant users, as they increasingly adopt e-learning solutions to complement traditional teaching methods. Government Agencies are investing in training programs to improve public sector efficiency and service delivery.

The Qatar E-Learning and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar University, Doha Institute for Graduate Studies, Qatari Businessmen Association, Edraak, Al Jazeera Media Institute, Qatar Foundation, LearnQatar, Qatari Ministry of Education and Higher Education, Qatar Skills Academy, Qatari Center for E-Learning, Qatar Chamber of Commerce, Qatari Institute of Management, Qatar E-Learning Center, Qatari Training Institute, Qatar Digital Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar e-learning and corporate training market appears promising, driven by ongoing technological advancements and increasing acceptance of digital learning methods. As organizations continue to embrace blended learning approaches, the integration of artificial intelligence and machine learning into training programs is expected to enhance personalization and engagement. Furthermore, the government's commitment to improving digital infrastructure will likely facilitate broader access to e-learning solutions, fostering a more inclusive educational environment across the nation.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Mobile Learning Applications Corporate Training Programs Certification Courses Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Individuals Others |

| By Content Type | Soft Skills Training Technical Skills Training Compliance Training Leadership Development Language Training Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Self-Paced Learning Others |

| By Duration | Short Courses (Less than 1 month) Medium Courses (1-3 months) Long Courses (More than 3 months) Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Professional Development Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education Institutions | 100 | University Administrators, Faculty Members |

| Corporate Training Programs | 80 | HR Managers, Training Coordinators |

| e-Learning Platform Users | 150 | Students, Corporate Employees |

| Content Development Firms | 60 | Instructional Designers, Content Creators |

| Government Education Officials | 50 | Policy Makers, Education Inspectors |

The Qatar E-Learning and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital learning solutions and government initiatives aimed at enhancing educational infrastructure.