Region:Africa

Author(s):Geetanshi

Product Code:KRAB6333

Pages:86

Published On:October 2025

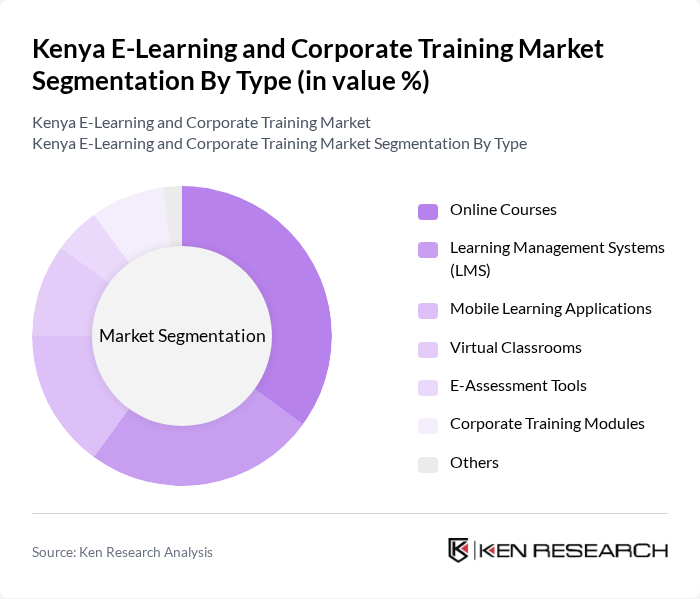

By Type:The e-learning and corporate training market in Kenya is segmented into various types, including Online Courses, Learning Management Systems (LMS), Mobile Learning Applications, Virtual Classrooms, E-Assessment Tools, Corporate Training Modules, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage with content at their own pace. Learning Management Systems (LMS) are also crucial as they provide a structured environment for both educators and learners, facilitating the management of educational content and tracking of learner progress.

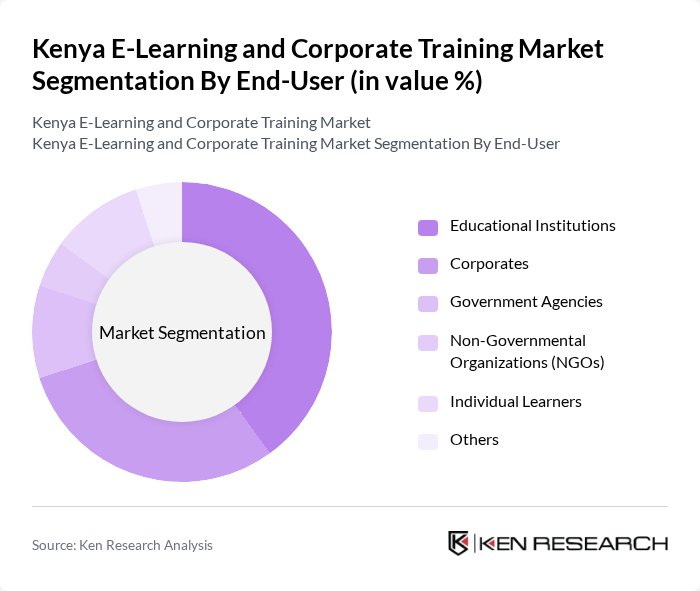

By End-User:The end-user segmentation of the e-learning and corporate training market includes Educational Institutions, Corporates, Government Agencies, Non-Governmental Organizations (NGOs), Individual Learners, and Others. Educational Institutions are the leading end-users, as they increasingly adopt e-learning solutions to enhance their teaching methodologies and reach a wider student base. Corporates also represent a significant segment, utilizing e-learning for employee training and development to improve skills and productivity.

The Kenya E-Learning and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Safaricom PLC, Jomo Kenyatta University of Agriculture and Technology, Strathmore University, eLimu, M-Shule, Kenya Institute of Curriculum Development, Andela, Coursera, Udemy, TalentLMS, Edmodo, Google for Education, Microsoft Education, LinkedIn Learning, Khan Academy contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kenya e-learning and corporate training market appears promising, driven by technological advancements and increasing acceptance of digital education. As internet access continues to improve, more learners are expected to embrace online platforms. Additionally, the government's ongoing investment in digital education initiatives will likely enhance infrastructure and accessibility. The integration of innovative technologies, such as AI and gamification, will further enrich the learning experience, making it more engaging and effective for users across various demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Learning Management Systems (LMS) Mobile Learning Applications Virtual Classrooms E-Assessment Tools Corporate Training Modules Others |

| By End-User | Educational Institutions Corporates Government Agencies Non-Governmental Organizations (NGOs) Individual Learners Others |

| By Content Type | Academic Content Professional Development Content Compliance Training Content Soft Skills Training Content Technical Skills Training Content Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Blended Learning Mobile Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Others |

| By Geographic Reach | National Regional International Others |

| By User Demographics | Age Group (Youth, Adults) Professional Background (Students, Working Professionals) Educational Background (High School, University) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Higher Education E-Learning Adoption | 150 | University Administrators, IT Directors |

| Corporate Training Program Effectiveness | 100 | HR Managers, Training Coordinators |

| Government E-Learning Initiatives | 80 | Policy Makers, Educational Consultants |

| Private Sector E-Learning Solutions | 70 | Business Development Managers, Learning & Development Heads |

| Technology Integration in Training | 90 | Instructional Designers, E-Learning Developers |

The Kenya E-Learning and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital technologies and the increasing demand for flexible learning solutions.