Region:Europe

Author(s):Geetanshi

Product Code:KRAB6373

Pages:92

Published On:October 2025

By Type:The market can be segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Mobile Learning Applications, Blended Learning Solutions, Corporate Training Programs, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage with content at their own pace. Virtual Classrooms are also popular, especially in corporate settings, as they facilitate real-time interaction between instructors and participants. The demand for Learning Management Systems (LMS) is on the rise as organizations seek to streamline training processes and track employee progress effectively.

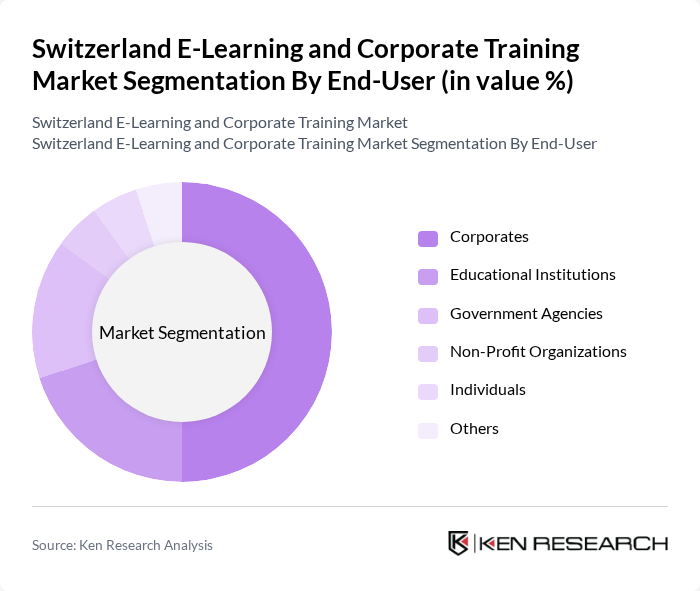

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, Individuals, and Others. Corporates are the leading end-users, driven by the need for continuous employee development and compliance training. Educational Institutions are increasingly adopting e-learning solutions to enhance their curriculum and provide students with flexible learning options. Government Agencies are also investing in e-learning to improve public service training and skill development initiatives.

The Switzerland E-Learning and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Swiss Learning Hub, Educa.ch, Talentsoft, LinkedIn Learning, Coursera, Udemy, Skillsoft, Moodle, SAP Litmos, Pluralsight, OpenClassrooms, EdX, LearnWorlds, Docebo, TalentLMS contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-learning and corporate training market in Switzerland appears promising, driven by ongoing technological advancements and a growing emphasis on workforce development. As companies increasingly recognize the value of upskilling, the demand for innovative training solutions is expected to rise. Furthermore, the integration of AI and personalized learning experiences will likely enhance engagement and effectiveness, positioning e-learning as a critical component of corporate training strategies in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Mobile Learning Applications Blended Learning Solutions Corporate Training Programs Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Individuals Others |

| By Application | Compliance Training Soft Skills Development Technical Skills Training Leadership Development Onboarding Programs Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Hybrid Learning Self-Paced Learning Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Corporate Licensing Others |

| By Content Type | Video-Based Content Text-Based Content Interactive Content Assessments and Quizzes Others |

| By Certification Type | Accredited Certifications Non-Accredited Certifications Micro-Credentials Professional Development Units (PDUs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| E-Learning Platform Usage | 100 | IT Managers, Learning & Development Specialists |

| Employee Training Needs Assessment | 80 | Employees, Team Leaders |

| Industry-Specific Training Solutions | 70 | Sector Experts, Corporate Trainers |

| Technology Adoption in Training | 90 | Chief Learning Officers, E-Learning Developers |

The Switzerland E-Learning and Corporate Training Market is valued at approximately USD 1.5 billion, reflecting a robust growth driven by the increasing adoption of digital learning solutions and the need for continuous employee training.