Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6318

Pages:99

Published On:October 2025

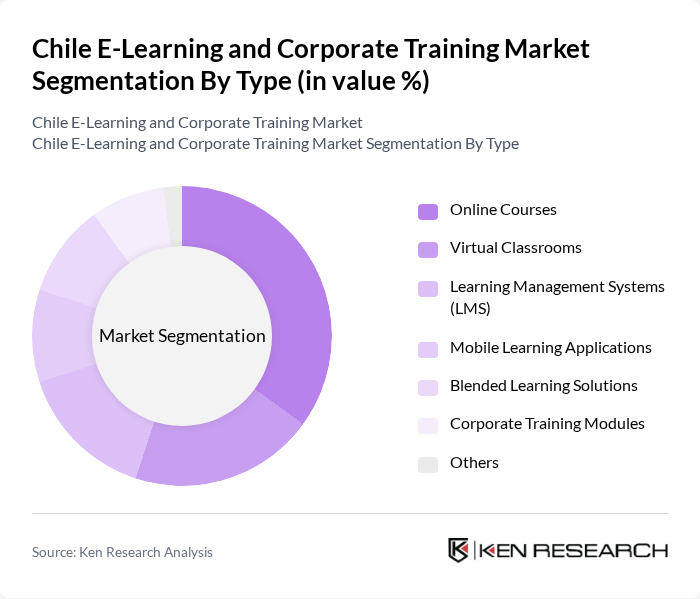

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Mobile Learning Applications, Blended Learning Solutions, Corporate Training Modules, and Others. Among these, Online Courses have gained significant traction due to their convenience and the ability to cater to diverse learning needs. The increasing preference for self-paced learning and the availability of a wide range of subjects have made this sub-segment particularly popular among individual learners and professionals seeking skill enhancement.

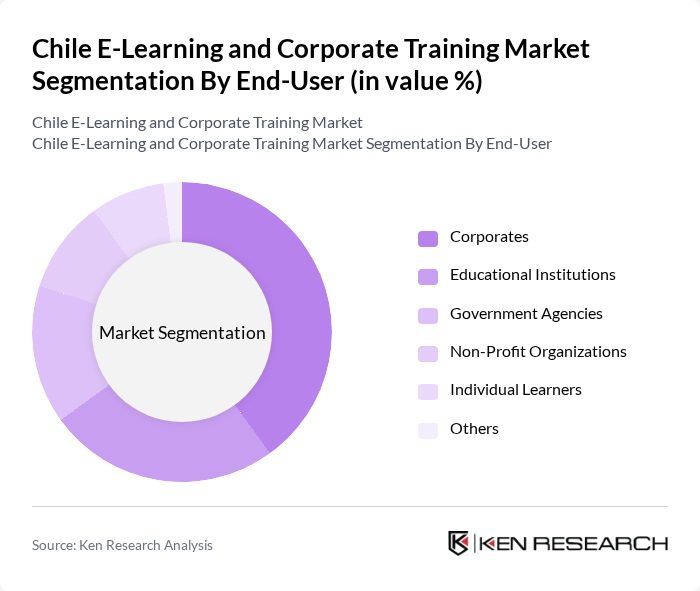

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, Individual Learners, and Others. Corporates are the leading end-users in the market, driven by the need for employee training and development to enhance productivity and adapt to changing industry demands. The increasing focus on upskilling and reskilling employees in various sectors has led to a surge in corporate training initiatives, making this segment a key driver of market growth.

The Chile E-Learning and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Duoc UC, Universidad de Chile, Platzi, Crehana, Coderhouse, EdX, Coursera, Udemy, Skillshare, LinkedIn Learning, OpenClassrooms, Khan Academy, Google Digital Garage, Microsoft Learn, SAP Learning Hub contribute to innovation, geographic expansion, and service delivery in this space.

The Chilean e-learning and corporate training market is poised for significant evolution, driven by technological advancements and changing workforce dynamics. As organizations increasingly adopt hybrid work models, the demand for online training solutions will continue to rise. Furthermore, the integration of artificial intelligence and personalized learning experiences will enhance engagement and effectiveness. Companies that leverage these trends will likely gain a competitive edge, positioning themselves for sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Mobile Learning Applications Blended Learning Solutions Corporate Training Modules Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Individual Learners Others |

| By Content Type | Soft Skills Training Technical Skills Training Compliance Training Leadership Development Language Training Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Hybrid Learning Self-Paced Learning Others |

| By Certification Type | Professional Certifications Academic Certifications Skill-Based Certifications Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Model Others |

| By Geographic Focus | Urban Areas Rural Areas Regional Focus Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| E-Learning Platform Users | 120 | Employees, Learners |

| Educational Institutions | 100 | Administrators, Faculty Members |

| Industry-Specific Training Providers | 80 | Training Managers, Course Designers |

| Government Education Officials | 50 | Policy Makers, Program Directors |

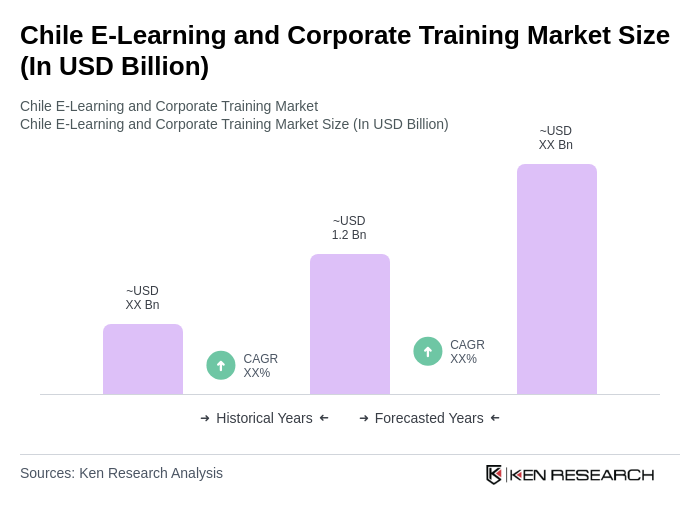

The Chile E-Learning and Corporate Training Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by the adoption of digital learning solutions and the increasing demand for continuous professional development among employees.