Region:Europe

Author(s):Dev

Product Code:KRAB6468

Pages:80

Published On:October 2025

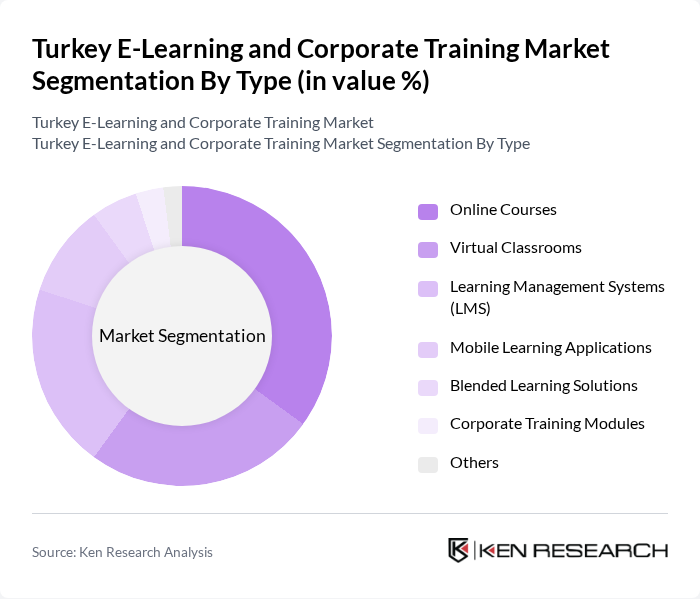

By Type:The market is segmented into various types, including Online Courses, Virtual Classrooms, Learning Management Systems (LMS), Mobile Learning Applications, Blended Learning Solutions, Corporate Training Modules, and Others. Among these, Online Courses have gained significant traction due to their flexibility and accessibility, allowing learners to engage with content at their own pace. Virtual Classrooms are also popular, especially in corporate settings, as they facilitate real-time interaction between instructors and participants. The demand for Learning Management Systems (LMS) is on the rise as organizations seek to streamline their training processes and track employee progress effectively.

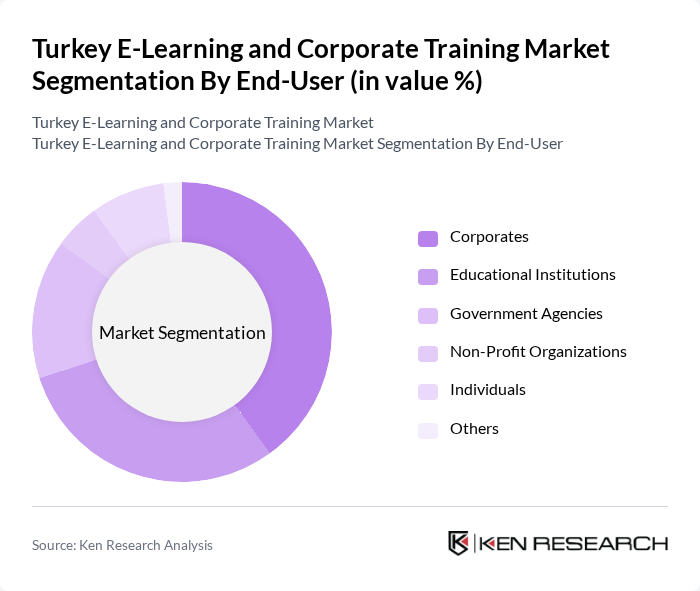

By End-User:The end-user segmentation includes Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, Individuals, and Others. Corporates are the leading end-users, driven by the need for employee skill enhancement and compliance training. Educational Institutions are increasingly adopting e-learning solutions to supplement traditional teaching methods. Government Agencies are also significant users, particularly in light of recent regulations mandating training for public sector employees. The rise of self-directed learning among Individuals is contributing to the growth of this segment as well.

The Turkey E-Learning and Corporate Training Market is characterized by a dynamic mix of regional and international players. Leading participants such as Udemy, Coursera, LinkedIn Learning, Pluralsight, Skillshare, Khan Academy, EdX, TalentLMS, Moodle, Docebo, SAP Litmos, Blackboard, LearnDash, Teachable, Google Classroom contribute to innovation, geographic expansion, and service delivery in this space.

The Turkey e-learning and corporate training market is poised for significant transformation, driven by technological advancements and evolving workforce needs. As organizations increasingly adopt hybrid learning models, the integration of artificial intelligence and gamification will enhance engagement and personalization in training programs. Furthermore, the emphasis on soft skills development will shape curriculum design, ensuring that employees are equipped with essential interpersonal skills. This dynamic environment presents opportunities for innovative solutions that cater to the diverse learning preferences of the workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Courses Virtual Classrooms Learning Management Systems (LMS) Mobile Learning Applications Blended Learning Solutions Corporate Training Modules Others |

| By End-User | Corporates Educational Institutions Government Agencies Non-Profit Organizations Individuals Others |

| By Content Type | Soft Skills Training Technical Skills Training Compliance Training Leadership Development Certification Programs Others |

| By Delivery Mode | Synchronous Learning Asynchronous Learning Hybrid Learning Self-Paced Learning Others |

| By Industry | IT and Software Healthcare Manufacturing Retail Finance Others |

| By Geographic Reach | National Regional International Others |

| By Pricing Model | Subscription-Based Pay-Per-Course Freemium Corporate Licensing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Corporate Training Programs | 150 | HR Managers, Training Coordinators |

| E-Learning Platform Usage | 100 | Content Developers, Platform Administrators |

| Employee Training Needs Assessment | 80 | Corporate Employees, Team Leaders |

| Industry-Specific Training Solutions | 70 | Industry Experts, Training Consultants |

| Technological Adoption in Training | 90 | IT Managers, Digital Transformation Officers |

The Turkey E-Learning and Corporate Training Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by the increasing adoption of digital learning solutions and the demand for continuous employee training in a competitive job market.