Region:Middle East

Author(s):Dev

Product Code:KRAC8812

Pages:93

Published On:November 2025

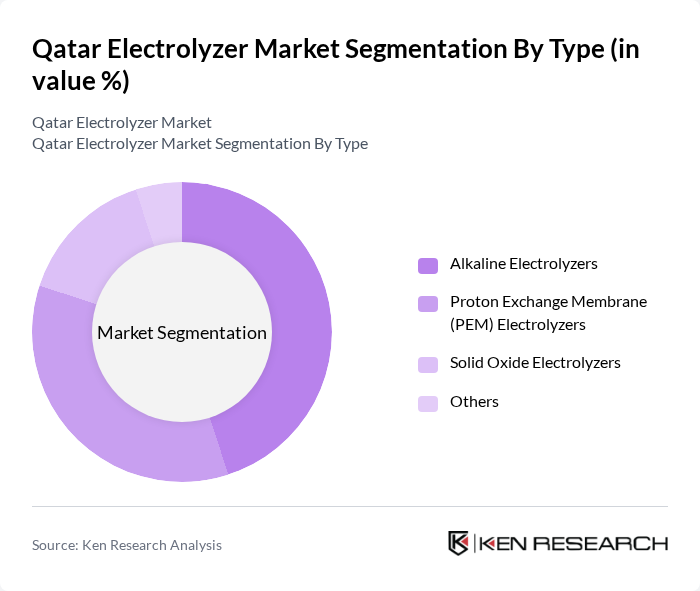

By Type:The market is segmented into various types of electrolyzers, including Alkaline Electrolyzers, Proton Exchange Membrane (PEM) Electrolyzers, Solid Oxide Electrolyzers, and Others. Each type has unique characteristics and applications, catering to different industrial needs .

The Alkaline Electrolyzers segment is currently dominating the market due to their cost-effectiveness and reliability in large-scale hydrogen production. They are widely used in industrial applications, particularly in the chemical and petrochemical sectors, where high purity hydrogen is required. The growing trend towards sustainable energy solutions and the increasing investments in renewable energy projects are further driving the demand for alkaline electrolyzers .

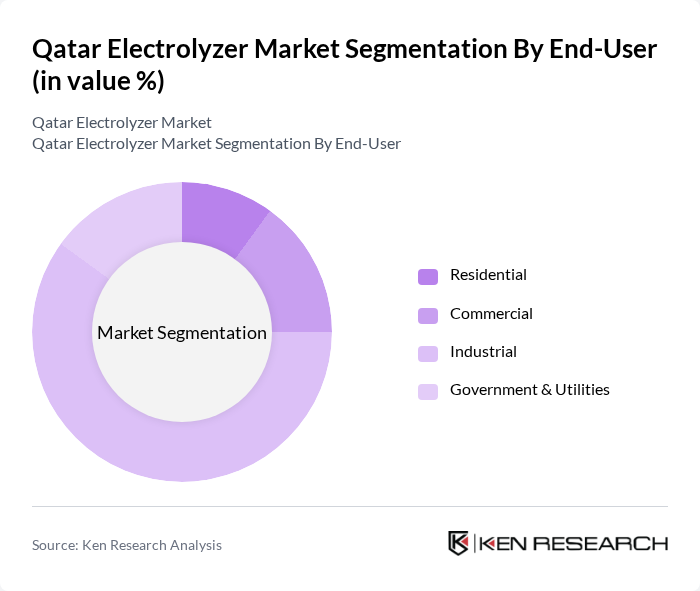

By End-User:The market is segmented based on end-users, including Residential, Commercial, Industrial, and Government & Utilities. Each segment has distinct requirements and applications for electrolyzers .

The Industrial segment is the leading end-user of electrolyzers, accounting for a significant share of the market. This dominance is attributed to the high demand for hydrogen in various industrial processes, including refining, ammonia production, and fuel cell applications. The increasing focus on decarbonization and the transition to green hydrogen in industrial operations are key factors driving this segment's growth .

The Qatar Electrolyzer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Energy, Nel ASA, ITM Power, Plug Power, Air Products and Chemicals, Inc., McPhy Energy, Enel Green Power, Ballard Power Systems, Cummins Inc. (Hydrogenics), Ceres Power Holdings plc, H2B2 Electrolysis Technologies, Green Hydrogen Systems, thyssenkrupp nucera, Linde plc, Toshiba Energy Systems & Solutions Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar electrolyzer market appears promising, driven by increasing investments in renewable energy and government support for hydrogen initiatives. As the country enhances its hydrogen infrastructure, the demand for efficient electrolyzers is expected to rise. Additionally, the focus on carbon neutrality and sustainable energy solutions will likely foster innovation and collaboration within the sector, positioning Qatar as a key player in the global hydrogen economy.

| Segment | Sub-Segments |

|---|---|

| By Type (e.g., Alkaline, PEM, Solid Oxide) | Alkaline Electrolyzers Proton Exchange Membrane (PEM) Electrolyzers Solid Oxide Electrolyzers Others |

| By End-User (Residential, Commercial, Industrial, Government & Utilities) | Residential Commercial Industrial Government & Utilities |

| By Application (Hydrogen Production, Energy Storage, Fuel Cells) | Hydrogen Production Energy Storage Fuel Cells Others |

| By Investment Source (Domestic, FDI, PPP, Government Schemes) | Domestic Investments Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Technology (Electrolysis, Renewable Energy Integration) | Electrolysis Technology Renewable Energy Integration Others |

| By Market Segment (Utility Scale, Distributed Generation) | Utility Scale Distributed Generation Others |

| By Policy Support (Subsidies, Tax Exemptions, Grants) | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Facilities | 45 | Plant Managers, Operations Directors |

| Renewable Energy Project Developers | 38 | Project Managers, Business Development Executives |

| Government Regulatory Bodies | 28 | Policy Makers, Energy Analysts |

| Research Institutions and Universities | 32 | Researchers, Academic Professors |

| Energy Consultants and Advisors | 37 | Consultants, Industry Experts |

The Qatar Electrolyzer Market is valued at approximately USD 15 million, driven by the increasing demand for green hydrogen production and government investments in renewable energy infrastructure.