Region:Middle East

Author(s):Rebecca

Product Code:KRAC3977

Pages:98

Published On:October 2025

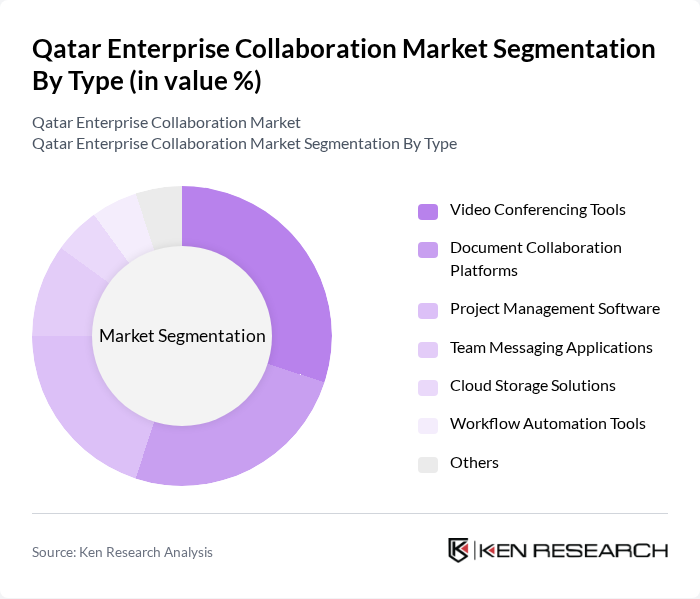

By Type:The segmentation by type includes various tools and platforms that facilitate collaboration among enterprises. The subsegments are Video Conferencing Tools, Document Collaboration Platforms, Project Management Software, Team Messaging Applications, Cloud Storage Solutions, Workflow Automation Tools, and Others. Each of these tools serves distinct purposes, catering to different aspects of enterprise collaboration.

The Video Conferencing Tools segment is currently dominating the market due to the surge in remote work and virtual meetings, especially following the global pandemic. Organizations are increasingly relying on video conferencing solutions to maintain communication and collaboration among teams, regardless of geographical barriers. This trend has led to a significant increase in the adoption of platforms like Zoom and Microsoft Teams, which offer robust features tailored for enterprise needs.

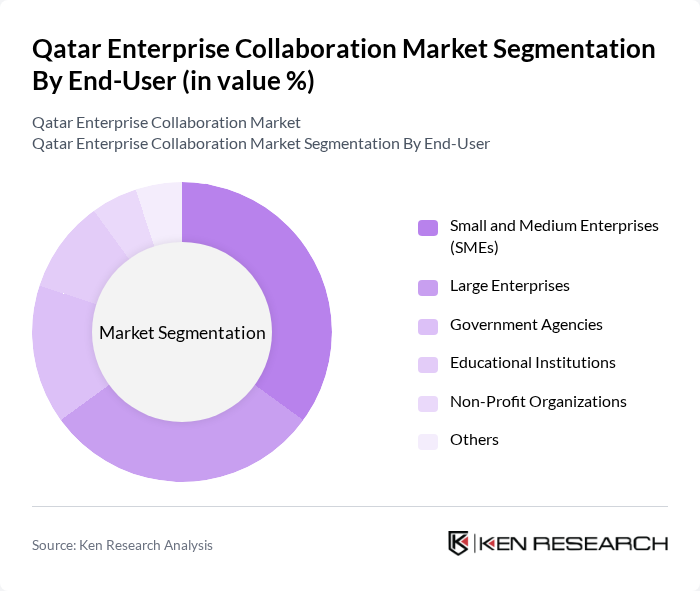

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Enterprises, Government Agencies, Educational Institutions, Non-Profit Organizations, and Others. Each of these user categories has unique requirements and preferences when it comes to collaboration tools, influencing their adoption rates and market dynamics.

Small and Medium Enterprises (SMEs) are leading the end-user segment, driven by their need for cost-effective and scalable collaboration solutions. SMEs are increasingly adopting cloud-based tools that offer flexibility and ease of use, allowing them to compete with larger organizations. The growing trend of digital transformation among SMEs is further propelling the demand for collaboration tools, making this segment a key player in the market.

The Qatar Enterprise Collaboration Market is characterized by a dynamic mix of regional and international players. Leading participants such as Microsoft Corporation, Google LLC, Cisco Systems, Inc., Zoom Video Communications, Inc., Slack Technologies, Inc., Atlassian Corporation Plc, Box, Inc., Dropbox, Inc., Salesforce.com, Inc., Trello, Inc., Asana, Inc., Monday.com Ltd., Notion Labs, Inc., Zoho Corporation Pvt. Ltd., RingCentral, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar enterprise collaboration market appears promising, driven by ongoing digital transformation and the increasing shift towards hybrid work environments. As organizations continue to adapt to new working models, the demand for innovative collaboration tools is expected to rise. Furthermore, advancements in artificial intelligence and machine learning will enhance the functionality of these tools, making them more intuitive and effective. This evolution will likely lead to greater integration with existing systems, fostering a more collaborative and productive workforce.

| Segment | Sub-Segments |

|---|---|

| By Type | Video Conferencing Tools Document Collaboration Platforms Project Management Software Team Messaging Applications Cloud Storage Solutions Workflow Automation Tools Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Educational Institutions Non-Profit Organizations Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud On-Premises Solutions |

| By Industry Vertical | IT and Telecommunications Healthcare Finance and Banking Retail Manufacturing Others |

| By Application | Internal Communication Client Collaboration Project Management Remote Work Facilitation Training and Development Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time License Fee Freemium Model |

| By User Size | Individual Users Small Teams Medium-Sized Teams Large Teams Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Large Enterprises Collaboration Tools | 100 | IT Directors, Collaboration Tool Administrators |

| SME Adoption of Collaboration Solutions | 70 | Business Owners, Operations Managers |

| Sector-Specific Collaboration Needs (Healthcare) | 50 | Healthcare Administrators, IT Managers |

| Education Sector Collaboration Platforms | 60 | School Administrators, IT Coordinators |

| Government Use of Collaboration Tools | 40 | Public Sector IT Managers, Policy Makers |

The Qatar Enterprise Collaboration Market is valued at approximately USD 150 million, driven by the increasing adoption of digital transformation initiatives, remote work trends, and the demand for enhanced communication tools among businesses.