Region:Middle East

Author(s):Dev

Product Code:KRAA9706

Pages:90

Published On:November 2025

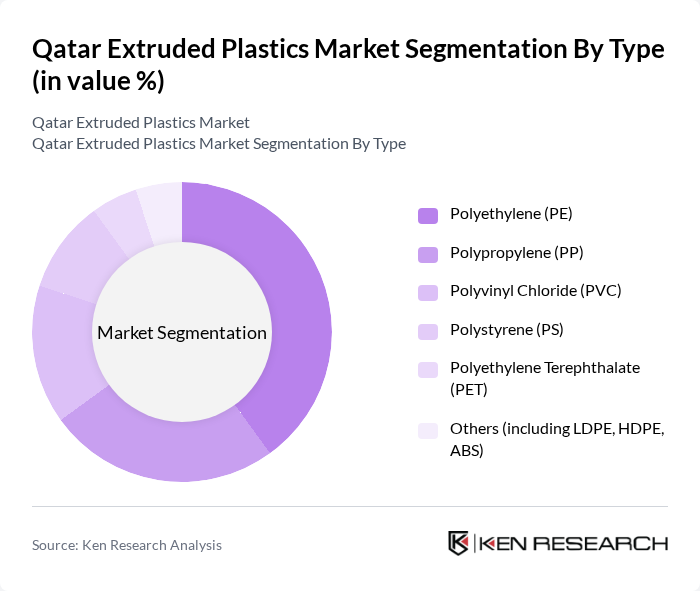

By Type:The market is segmented into various types of extruded plastics, including Polyethylene (PE), Polypropylene (PP), Polyvinyl Chloride (PVC), Polystyrene (PS), Polyethylene Terephthalate (PET), and Others (including LDPE, HDPE, ABS). Among these, Polyethylene (PE) is the leading subsegment due to its versatility and widespread use in packaging, construction, and infrastructure applications. The demand for PE is driven by its lightweight nature, durability, and cost-effectiveness, making it a preferred choice for manufacturers. PE accounts for the largest share among resin types in the Middle East, supporting its dominance in the Qatar market .

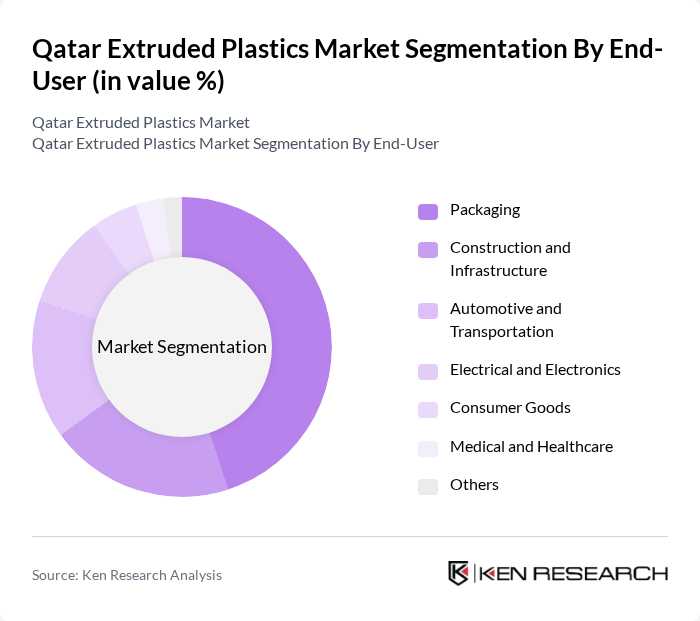

By End-User:The extruded plastics market is further segmented by end-user industries, including Packaging, Construction and Infrastructure, Automotive and Transportation, Electrical and Electronics, Consumer Goods, Medical and Healthcare, and Others. The Packaging segment is the dominant subsegment, driven by the increasing demand for flexible and durable packaging solutions in the food and beverage industry. The shift towards sustainable packaging options, such as recyclable and compostable films, is accelerating growth in this segment. Construction and infrastructure remain key end-users due to ongoing urbanization and investment in utilities and transportation, while automotive demand is supported by lightweighting trends and fleet expansion .

The Qatar Extruded Plastics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Plastic Products Company (QPPC), Qatar National Plastic Factory (QNPF), Qatar Petrochemical Company (QAPCO), Doha Plastic Company, Al Jazeera Plastic Products Company, Qatar Industrial Manufacturing Company (QIMC), Qatar Chemical Company Ltd. (Q-Chem), Gulf Plastic Industries Co. (GulfPlast), United Plastic Industries Qatar, Al Sada Plastic Pipes Factory, Al Wataniya Plastics, Qatar Modern Plastic Company, Al Muftah Plastics, Qatar Polymer Industrial Company, Al Amoudi Plastic Factory contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar extruded plastics market is poised for significant transformation, driven by sustainability initiatives and technological advancements. As the government continues to invest in infrastructure and sustainable practices, the demand for innovative plastic solutions will rise. Companies are likely to focus on developing eco-friendly materials and enhancing production efficiency. Additionally, the integration of smart manufacturing technologies will streamline operations, allowing for greater customization and responsiveness to market needs, ultimately shaping a more resilient industry landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Polyethylene (PE) Polypropylene (PP) Polyvinyl Chloride (PVC) Polystyrene (PS) Polyethylene Terephthalate (PET) Others (including LDPE, HDPE, ABS) |

| By End-User | Packaging Construction and Infrastructure Automotive and Transportation Electrical and Electronics Consumer Goods Medical and Healthcare Others |

| By Application | Film and Sheet Extrusion Pipe and Profile Extrusion Wire and Cable Coating Blow Molding Injection Molding Others |

| By Product Form | Rigid Plastics Flexible Plastics Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Doha Al Rayyan Umm Salal Al Khor Others |

| By Sustainability Initiatives | Recycled Content Usage Biodegradable Options Eco-friendly Manufacturing Processes Circular Economy Participation Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Usage | 100 | Project Managers, Procurement Officers |

| Packaging Industry Insights | 90 | Product Managers, Supply Chain Analysts |

| Automotive Applications | 60 | Design Engineers, Quality Assurance Managers |

| Consumer Goods Sector | 50 | Marketing Managers, Product Development Leads |

| Recycling and Sustainability Initiatives | 40 | Sustainability Managers, Environmental Compliance Officers |

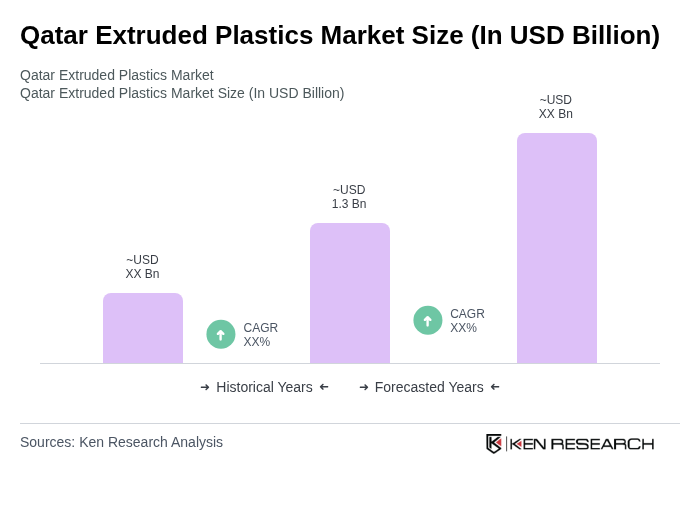

The Qatar Extruded Plastics Market is valued at approximately USD 1.3 billion, driven by increasing demand in sectors such as construction, packaging, and automotive, alongside ongoing infrastructure development and urbanization efforts.