Region:Middle East

Author(s):Rebecca

Product Code:KRAD1568

Pages:87

Published On:November 2025

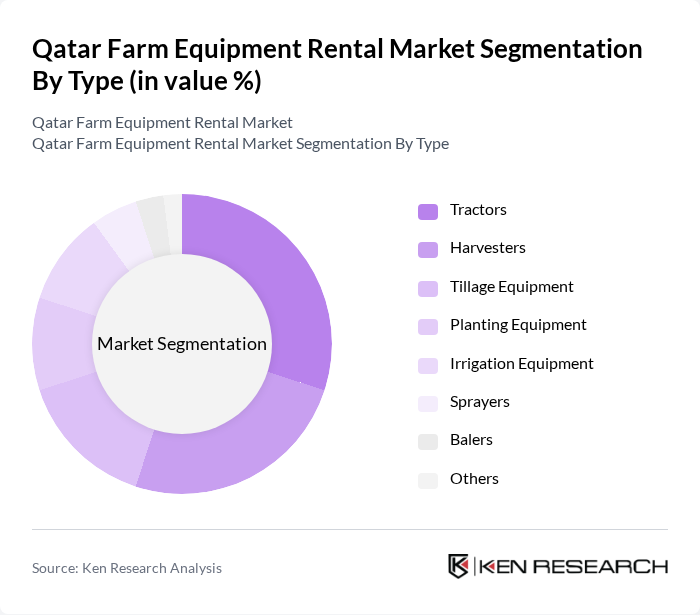

By Type:The market is segmented into various types of farm equipment available for rental, including tractors, harvesters, tillage equipment, planting equipment, irrigation equipment, sprayers, balers, and others. Tractors and harvesters are the most commonly rented due to their essential roles in land preparation and crop harvesting, while irrigation equipment and resource-efficient sprayers are increasingly in demand for sustainable farming.

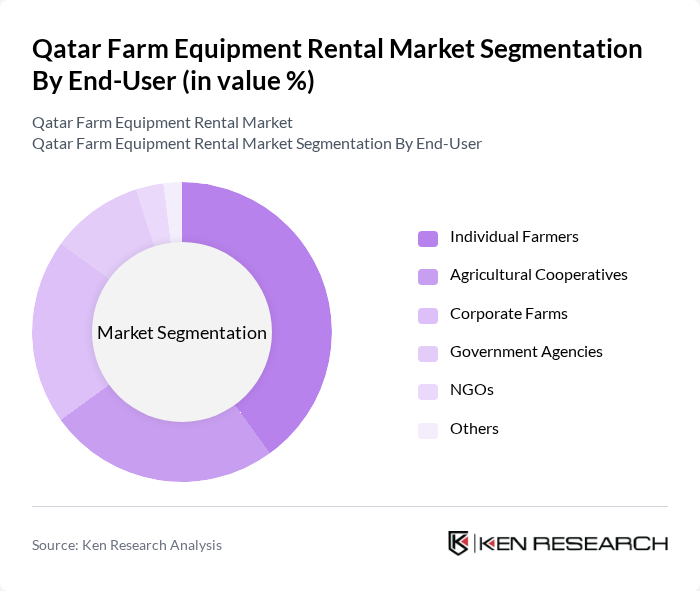

By End-User:The end-user segmentation includes individual farmers, agricultural cooperatives, corporate farms, government agencies, NGOs, and others. Individual farmers and corporate farms are the primary users, as flexible access to equipment supports seasonal workloads and diverse crop cycles. Cooperatives increasingly pool resources to jointly lease equipment, reflecting the rise of shared economy models in Qatar’s agricultural sector.

The Qatar Farm Equipment Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al-Futtaim Auto & Machinery Company (FAMCO), Qatar Tractor & Equipment Co., Gulf Equipment & Technology, Al Jaber Group, Qatari Agricultural Development Company (QADCO), Al Mana Group, Al-Attiyah Group, Qatar National Import & Export Co., Doha Equipment Rental, Qatar Construction Equipment Rental, Al-Mansoori Specialized Engineering, Al Khaliji Equipment Rental, Qatar Industrial Equipment, Al Suwaidi Equipment & Transport, Qatar Farm Equipment Rental Services contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar farm equipment rental market is poised for significant transformation as digital platforms gain traction, facilitating easier access to rental services. In future, the integration of precision agriculture technologies is expected to enhance operational efficiency, attracting more farmers to rental options. Additionally, the growing emphasis on sustainable farming practices will likely drive demand for eco-friendly equipment rentals, positioning the market for robust growth in the coming years as awareness and accessibility improve.

| Segment | Sub-Segments |

|---|---|

| By Type | Tractors Harvesters Tillage Equipment Planting Equipment Irrigation Equipment Sprayers Balers Others |

| By End-User | Individual Farmers Agricultural Cooperatives Corporate Farms Government Agencies NGOs Others |

| By Equipment Size | Small Equipment (<30 HP) Medium Equipment (31–70 HP) Large Equipment (>70 HP) Others |

| By Rental Duration | Short-term Rentals Long-term Rentals Seasonal Rentals Others |

| By Geographic Distribution | Urban Areas Rural Areas Coastal Regions Desert Regions Others |

| By Customer Type | Individual Farmers Corporate Farms Government Projects Others |

| By Payment Model | Pay-per-use Subscription-based Lease-to-own Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Farm Equipment Rental Companies | 60 | Owners, Managers, Operations Directors |

| Agricultural Cooperatives | 40 | Cooperative Leaders, Procurement Officers |

| Individual Farmers | 100 | Smallholder Farmers, Large-scale Farmers |

| Government Agricultural Departments | 40 | Policy Makers, Agricultural Advisors |

| Equipment Manufacturers | 50 | Sales Managers, Product Development Heads |

The Qatar Farm Equipment Rental Market is valued at approximately USD 160 million, driven by increasing agricultural productivity demands and the adoption of resource-efficient tools, such as advanced irrigation systems.