Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7732

Pages:80

Published On:October 2025

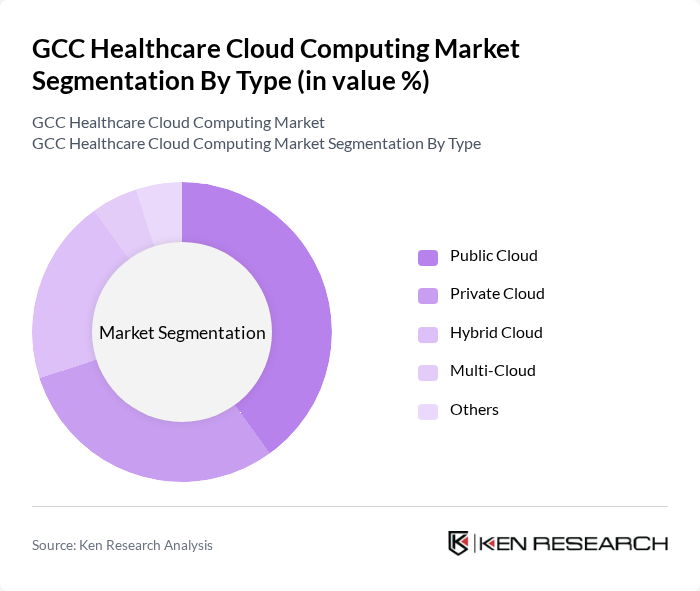

By Type:The market is segmented into various types, including Public Cloud, Private Cloud, Hybrid Cloud, Multi-Cloud, and Others. Among these, the Public Cloud segment is gaining traction due to its cost-effectiveness and scalability, making it a preferred choice for many healthcare providers. The Private Cloud segment is also significant, as it offers enhanced security and compliance, which are critical in the healthcare sector.

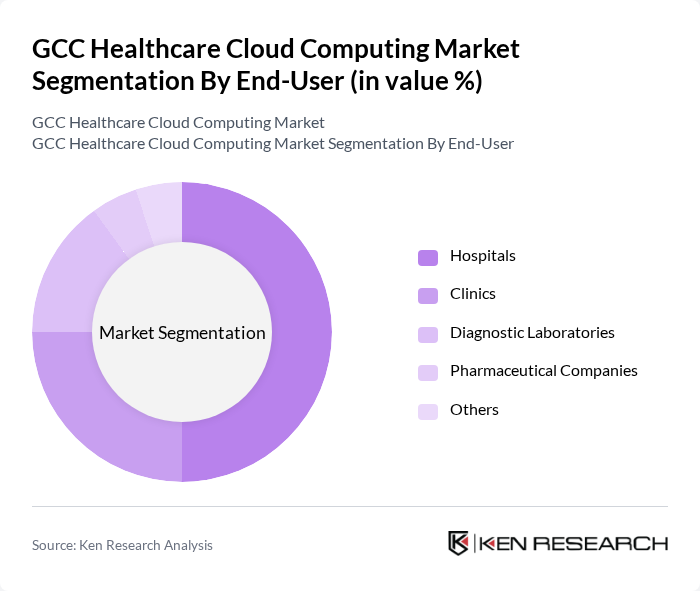

By End-User:The end-user segmentation includes Hospitals, Clinics, Diagnostic Laboratories, Pharmaceutical Companies, and Others. Hospitals are the leading end-users, driven by the need for efficient patient management systems and data storage solutions. Clinics and diagnostic laboratories are also increasingly adopting cloud solutions to streamline operations and enhance service delivery.

The GCC Healthcare Cloud Computing Market is characterized by a dynamic mix of regional and international players. Leading participants such as AWS (Amazon Web Services), Microsoft Azure, Google Cloud Platform, IBM Cloud, Oracle Cloud, Salesforce Health Cloud, Cerner Corporation, Allscripts Healthcare Solutions, Meditech, Philips Healthcare, Siemens Healthineers, GE Healthcare, Dell Technologies, and VMware contribute to innovation, geographic expansion, and service delivery in this space.

The GCC healthcare cloud computing market is poised for significant transformation, driven by technological advancements and increasing digital health initiatives. As healthcare providers prioritize patient-centric care models, the integration of artificial intelligence and data analytics will enhance decision-making processes. Furthermore, the shift towards hybrid cloud solutions is expected to gain momentum, allowing organizations to balance security and flexibility. This evolving landscape will create new opportunities for innovation and collaboration among stakeholders in the healthcare sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Public Cloud Private Cloud Hybrid Cloud Multi-Cloud Others |

| By End-User | Hospitals Clinics Diagnostic Laboratories Pharmaceutical Companies Others |

| By Application | Patient Management Data Storage and Backup Telemedicine Solutions Health Information Exchange Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By Service Model | Software as a Service (SaaS) Platform as a Service (PaaS) Infrastructure as a Service (IaaS) |

| By Region | GCC Countries Others |

| By Pricing Model | Subscription-Based Pay-As-You-Go Tiered Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Departments | 150 | IT Managers, Chief Information Officers |

| Healthcare Clinics | 100 | Practice Managers, Healthcare Administrators |

| Telemedicine Providers | 80 | Operations Directors, Technology Officers |

| Pharmaceutical Companies | 70 | IT Directors, Compliance Officers |

| Health Insurance Firms | 90 | Data Analysts, IT Strategy Leads |

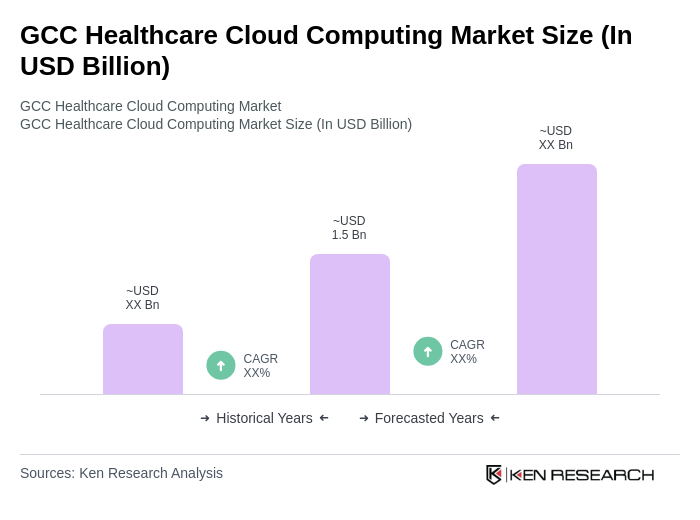

The GCC Healthcare Cloud Computing Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the adoption of digital health solutions, efficient data management, and increased telemedicine services across the region.