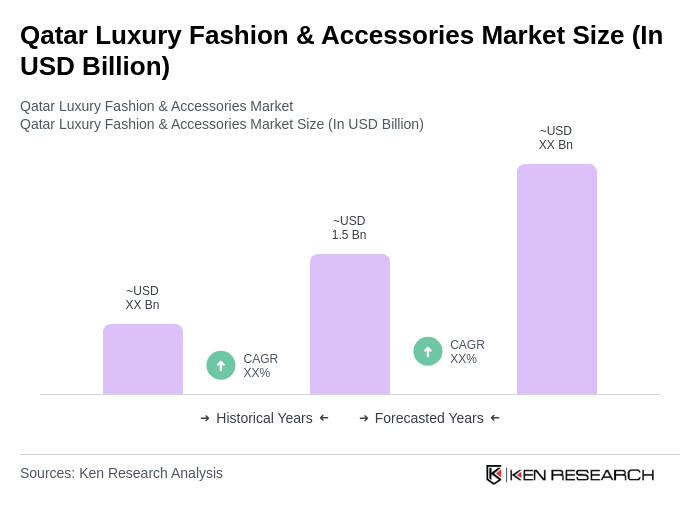

Qatar Luxury Fashion & Accessories Market Overview

- The Qatar Luxury Fashion & Accessories Market is valued at USD 1.5 billion, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes, a robust tourism sector, and a rising preference for luxury brands among affluent consumers. The market has seen a notable rise in demand for high-end fashion and accessories, reflecting the country's economic prosperity, strategic infrastructure investments, and cultural inclination towards luxury. The digitalization of luxury shopping and the demand for personalized experiences are also significant growth drivers, with leading brands leveraging technology and sustainability trends to enhance consumer engagement .

- Doha is the dominant city in the Qatar Luxury Fashion & Accessories Market, attributed to its status as a cultural and economic hub. The presence of luxury shopping malls, high-end boutiques, and flagship stores of international brands has made it a prime destination for both locals and tourists. The influx of expatriates, affluent visitors, and the nation’s strategic investment in luxury tourism and hospitality infrastructure further bolster the market, positioning Qatar as a key player in the luxury retail landscape of the Middle East .

- The Qatar Standards and Metrology Authority oversees the regulation of luxury goods, ensuring quality, authenticity, and safety of products sold in the country. Regulatory oversight is provided under the “Qatar Standards and Metrology Law, Law No. 4 of 1990,” which mandates compliance with national standards for imported and locally produced goods. The Authority enforces certification, labeling, and periodic inspection requirements for luxury fashion and accessories, supporting consumer confidence and market stability .

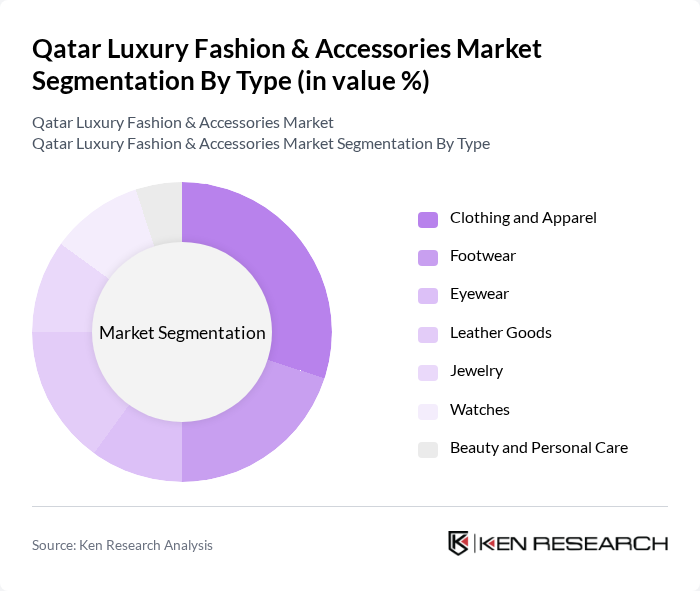

Qatar Luxury Fashion & Accessories Market Segmentation

By Type:The luxury fashion and accessories market is segmented into clothing and apparel, footwear, eyewear, leather goods, jewelry, watches, and beauty and personal care. Among these, clothing and apparel hold the largest market share, driven by high demand for designer wear, occasion wear, and premium tailoring. Consumers are increasingly inclined towards high-quality, fashionable clothing that reflects their status and lifestyle. The trend of personalization, bespoke tailoring, and customization in clothing further drives this segment, supported by regular fashion events and the presence of both international and local luxury brands .

By End-User:The market is segmented by end-user into men, women, and unisex categories. The women’s segment remains the largest, driven by a higher propensity to spend on luxury fashion and accessories, including clothing, jewelry, and beauty products. Women are more likely to invest in a diverse range of luxury items, reflecting their desire for self-expression and status. The growing trend of gender-neutral and unisex fashion is also expanding, appealing to a broader audience and supported by international luxury brands introducing inclusive collections .

Qatar Luxury Fashion & Accessories Market Competitive Landscape

The Qatar Luxury Fashion & Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Jazeera Fashion, Qatar Luxury Group, Al Fardan Group, Fifty One East, The Pearl-Qatar, Dior (Christian Dior Couture Qatar), Louis Vuitton (Louis Vuitton Qatar), Gucci (Gucci Qatar), Chanel (Chanel Qatar), Prada (Prada Qatar), Burberry (Burberry Qatar), Versace (Versace Qatar), Fendi (Fendi Qatar), Valentino (Valentino Qatar), Bvlgari (Bulgari Qatar) contribute to innovation, geographic expansion, and service delivery in this space.

Qatar Luxury Fashion & Accessories Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:Qatar's GDP per capita is projected to reach approximately $84,000, reflecting a robust economic environment. This increase in disposable income allows consumers to allocate more funds towards luxury fashion and accessories. The affluent population, which constitutes about 20% of the total demographic, is increasingly seeking high-end products, driving demand in the luxury sector. As purchasing power rises, so does the willingness to invest in premium brands and exclusive items.

- Rising Tourism and Expat Population:Qatar welcomed over 4 million tourists, with expectations for continued growth in future. The influx of tourists, coupled with a significant expatriate community of around 2.5 million, creates a vibrant market for luxury fashion. Tourists often indulge in high-end shopping experiences, contributing to the overall market growth. The diverse cultural backgrounds of expatriates also enhance the demand for varied luxury products, catering to different tastes and preferences.

- Growing Demand for High-Quality Products:The luxury fashion segment in Qatar is witnessing a shift towards high-quality, artisanal products. In future, the market for luxury goods is expected to see a notable increase in demand for sustainable and ethically produced items. Consumers are becoming more discerning, prioritizing quality over quantity. This trend is supported by a growing awareness of sustainability, prompting brands to focus on craftsmanship and premium materials, which resonate well with the affluent consumer base.

Market Challenges

- Economic Fluctuations:Despite a strong economy, Qatar's luxury market faces challenges from global economic uncertainties. The IMF projects a GDP growth rate of approximately 1.8%, which, while positive, is subject to fluctuations in oil prices and geopolitical tensions. Such economic volatility can impact consumer confidence and spending habits, leading to potential declines in luxury goods sales. Brands must navigate these uncertainties to maintain market stability and growth.

- Intense Competition:The luxury fashion market in Qatar is characterized by fierce competition among established global brands and emerging local designers. With over 50 luxury brands operating in the region, market saturation poses a significant challenge. Companies must differentiate themselves through unique offerings and exceptional customer experiences. The competitive landscape requires continuous innovation and strategic marketing to capture the attention of discerning consumers, making it essential for brands to stay ahead of trends.

Qatar Luxury Fashion & Accessories Market Future Outlook

The future of the Qatar luxury fashion and accessories market appears promising, driven by evolving consumer preferences and technological advancements. As the market adapts to the increasing demand for online shopping, brands are expected to enhance their digital presence. Additionally, the focus on sustainability will likely shape product offerings, with more consumers seeking eco-friendly options. Collaborations with local designers may also gain traction, fostering a unique blend of global and local influences that cater to diverse consumer tastes.

Market Opportunities

- Expansion of E-commerce Platforms:The growth of e-commerce in Qatar is projected to reach $3 billion, presenting a significant opportunity for luxury brands. Enhanced online shopping experiences can attract tech-savvy consumers, allowing brands to tap into a broader audience. Investing in digital marketing and user-friendly platforms will be crucial for capturing this expanding market segment.

- Collaborations with Local Designers:Collaborating with local designers can create unique product lines that resonate with both residents and tourists. This strategy not only supports local talent but also enhances brand authenticity. As Qatar continues to promote its cultural heritage, luxury brands that embrace local artistry can differentiate themselves and appeal to consumers seeking exclusive, culturally relevant products.