Region:Asia

Author(s):Geetanshi

Product Code:KRAB1645

Pages:100

Published On:October 2025

By Type:The luxury fashion and accessories market can be segmented into various types, including apparel, footwear, handbags, jewelry, watches, accessories, fragrances, and others. Among these, apparel and handbags are particularly dominant due to their high consumer demand and the influence of fashion trends. The growing inclination towards branded clothing and stylish handbags reflects the evolving lifestyle and status aspirations of Filipino consumers. Filipino consumers show strong preference for fashionable clothing items (53% of luxury purchases) and there is increasing demand for locally inspired luxury products that incorporate indigenous materials and traditional Filipino craftsmanship.

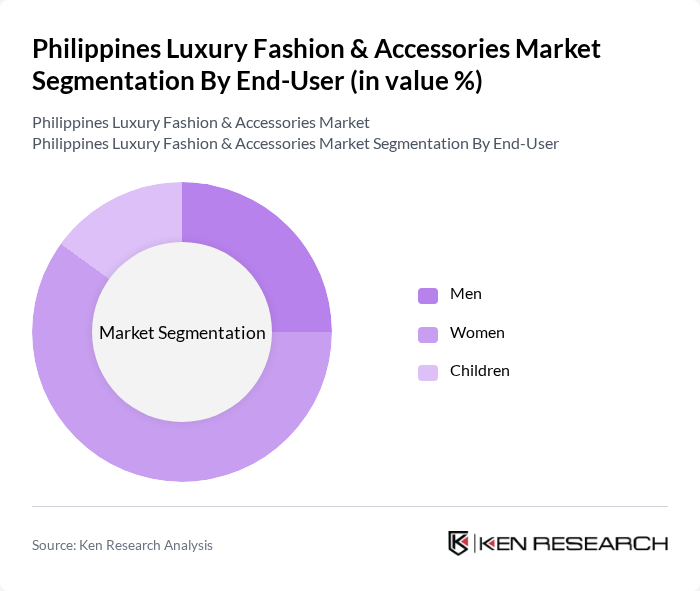

By End-User:The market can also be segmented by end-user demographics, including men, women, and children. Women represent the largest segment, driven by their higher spending on fashion and accessories. The increasing focus on personal style and the influence of social media have led to a surge in demand for luxury items among female consumers, making them the primary target for luxury brands. Consumer behavior analysis shows that 74% of Filipino consumers purchase luxury goods for self-consumption, while product longevity (58%), unique designs (53%), and superior product quality (56%) are the primary motivating factors for luxury purchases.

The Philippines Luxury Fashion & Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton Malletier, Gucci, Chanel, Prada, Hermès, Burberry, Versace, Salvatore Ferragamo, Michael Kors, Bvlgari, Fendi, Valentino, Dolce & Gabbana, Balenciaga, Tory Burch contribute to innovation, geographic expansion, and service delivery in this space.

The future of the luxury fashion and accessories market in the Philippines appears promising, driven by a combination of rising disposable incomes and a growing middle class. As consumers increasingly prioritize quality and brand authenticity, luxury brands that adapt to local preferences and invest in sustainable practices are likely to gain a competitive edge. Furthermore, the integration of technology in retail, such as augmented reality and personalized shopping experiences, will enhance consumer engagement and drive sales in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Handbags Jewelry Watches Accessories Fragrances Others |

| By End-User | Men Women Children |

| By Sales Channel | Online Retail Offline Retail Luxury Department Stores Specialty Stores Luxury Boutiques |

| By Price Range | Premium High-End Ultra-Luxury |

| By Brand Origin | Local Brands International Brands |

| By Consumer Demographics | Age Group Income Level Lifestyle Preferences |

| By Occasion | Casual Wear Formal Wear Special Events Everyday Use |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 120 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Buyers | 100 | Luxury Brand Loyalists, Trendsetters |

| Footwear Market Insights | 80 | Shoe Retail Managers, Fashion Bloggers |

| Online Luxury Shopping Behavior | 120 | eCommerce Shoppers, Digital Marketing Experts |

| Luxury Fashion Event Attendees | 70 | Event Organizers, VIP Guests |

The Philippines Luxury Fashion & Accessories Market is valued at approximately USD 2.7 billion, driven by rising disposable incomes, a growing middle class, and increased consumer interest in luxury goods.