Region:Africa

Author(s):Dev

Product Code:KRAA7211

Pages:85

Published On:September 2025

By Type:The luxury fashion and accessories market can be segmented into various types, including Clothing, Footwear, Handbags, Jewelry, Watches, Accessories, and Others. Each of these segments caters to different consumer preferences and trends, with Clothing and Handbags being particularly popular among consumers seeking to express their personal style and status.

The Clothing segment dominates the luxury fashion market in Nigeria, driven by a growing interest in both local and international fashion trends. Consumers are increasingly seeking unique and high-quality clothing that reflects their personal style, leading to a surge in demand for designer apparel. Handbags also hold a significant share, as they are often seen as status symbols and are favored by consumers looking to make a fashion statement. The trend towards sustainable and locally produced fashion is also influencing consumer choices, with many opting for brands that align with their values.

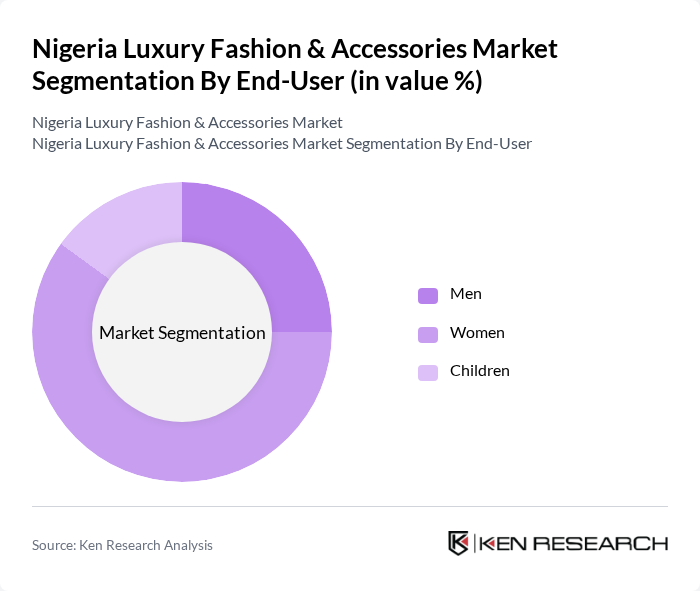

By End-User:The market can also be segmented by end-user categories, which include Men, Women, and Children. Each segment has distinct preferences and purchasing behaviors, with Women being the largest consumer group in the luxury fashion sector.

The Women segment is the most significant in the luxury fashion market, driven by a strong inclination towards fashion and accessories. Women are more likely to invest in luxury items, including clothing, handbags, and jewelry, as they seek to express their individuality and style. The Men segment is growing, particularly in categories like footwear and watches, as more men become interested in fashion and luxury brands. The Children segment, while smaller, is also gaining traction as parents increasingly seek high-quality and stylish options for their children.

The Nigeria Luxury Fashion & Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Louis Vuitton, Prada, Burberry, Versace, Dolce & Gabbana, Fendi, Chanel, Valentino, Balenciaga, Off-White, Alexander McQueen, Givenchy, Bottega Veneta, Saint Laurent contribute to innovation, geographic expansion, and service delivery in this space.

The future of Nigeria's luxury fashion and accessories market appears promising, driven by a combination of rising disposable incomes and increasing urbanization. As more consumers embrace luxury brands, the market is likely to see a surge in demand for unique, high-quality products. Additionally, the growing trend of sustainable fashion is expected to influence purchasing decisions, with consumers increasingly favoring brands that prioritize ethical practices. This evolving landscape presents opportunities for both local and international brands to innovate and expand their offerings.

| Segment | Sub-Segments |

|---|---|

| By Type | Clothing Footwear Handbags Jewelry Watches Accessories Others |

| By End-User | Men Women Children |

| By Distribution Channel | Online Retail Brick-and-Mortar Stores Luxury Boutiques Department Stores |

| By Price Range | Premium Mid-Range Affordable Luxury |

| By Material | Leather Fabric Metal Synthetic |

| By Occasion | Casual Wear Formal Wear Sportswear |

| By Brand Positioning | Established Brands Emerging Brands Niche Brands |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 150 | Affluent Consumers, Fashion Enthusiasts |

| High-End Accessories Buyers | 100 | Luxury Brand Managers, Retail Executives |

| Online Luxury Shoppers | 120 | E-commerce Managers, Digital Marketing Specialists |

| Fashion Influencers and Stylists | 80 | Fashion Bloggers, Social Media Influencers |

| Luxury Market Analysts | 60 | Market Researchers, Industry Experts |

The Nigeria Luxury Fashion & Accessories Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by rising disposable incomes and a growing middle class that increasingly seeks high-quality, fashionable products.