Malaysia Luxury Fashion & Accessories Market Overview

- The Malaysia Luxury Fashion & Accessories Market is valued at USD 760 million, based on a five-year historical analysis. This growth is primarily driven by increasing disposable incomes among affluent millennials and Gen Z, a rising middle class, and a growing appetite for luxury goods among consumers. The market has seen a significant uptick in demand for high-end fashion and accessories, reflecting changing consumer preferences towards premium products and a strong influence of digital engagement, social media, and influencer marketing on purchasing decisions. The appeal of limited-edition collections and personalized experiences is further fueling demand for luxury brands .

- Key cities such asKuala Lumpur, Penang, and Johor Bahrudominate the luxury fashion market due to their status as economic hubs and tourist destinations. Kuala Lumpur, in particular, is a focal point for luxury retail, attracting both local and international brands, while Penang and Johor Bahru benefit from cross-border shopping from neighboring countries, enhancing their market presence. The presence of established luxury malls such as Pavilion KL and Suria KLCC reinforces the dominance of these urban centers in luxury retail .

- In 2023, the Malaysian government introduced theGuidelines on Sustainable and Circular Fashion, 2023issued by the Ministry of Domestic Trade and Cost of Living. This regulation requires luxury fashion brands operating in Malaysia to incorporate eco-friendly materials, adopt sustainable production processes, and disclose environmental impact data as part of compliance. The initiative aims to reduce the environmental footprint of the fashion industry and supports Malaysia’s broader strategy to position itself as a leader in sustainable luxury fashion .

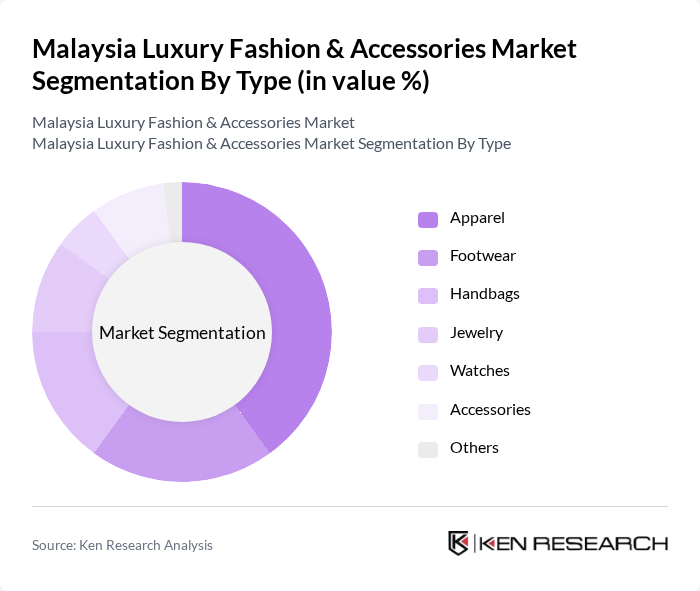

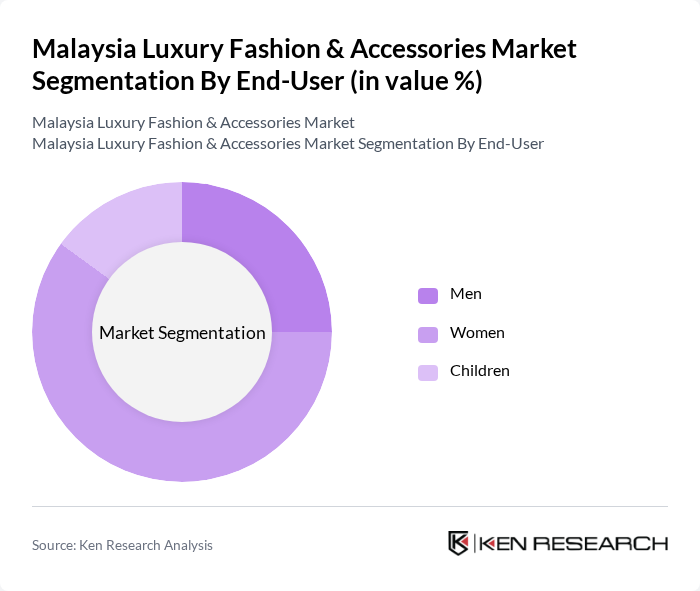

Malaysia Luxury Fashion & Accessories Market Segmentation

By Type:The luxury fashion and accessories market can be segmented into various types, including apparel, footwear, handbags, jewelry, watches, accessories, and others. Each of these segments caters to different consumer preferences and trends, with specific brands leading in each category. Theapparel segmentis particularly dominant, driven by fashion trends, established brand presence, and consistent demand for designer fashion. Thejewelry segmentis emerging as a growth leader, reflecting Malaysian consumers’ increasing preference for investment-oriented luxury purchases and international brand expansion. Accessories and footwear are also gaining traction due to the increasing importance of personal style, branding, and the influence of social media .

By End-User:The market can also be segmented by end-user demographics, including men, women, and children.Womenrepresent the largest consumer group in the luxury fashion market, driven by a strong inclination towards fashion and accessories.Menare increasingly participating in luxury purchases, particularly in categories like watches and apparel, while thechildren’s segmentis growing due to rising disposable incomes and parents’ willingness to invest in luxury items for their children. The growing influence of Gen Z and millennial consumers is reshaping demand across all end-user segments .

Malaysia Luxury Fashion & Accessories Market Competitive Landscape

The Malaysia Luxury Fashion & Accessories Market is characterized by a dynamic mix of regional and international players. Leading participants such as Louis Vuitton, Gucci, Chanel, Prada, Hermès, Burberry, Dior, Fendi, Versace, Valentino, Bvlgari, Salvatore Ferragamo, Tiffany & Co., Montblanc, Coach contribute to innovation, geographic expansion, and service delivery in this space.

Malaysia Luxury Fashion & Accessories Market Industry Analysis

Growth Drivers

- Rising Disposable Income:The average disposable income in Malaysia is projected to reach approximately MYR 3,000 per month in future, reflecting a 5% increase from previous periods. This rise in income enables consumers to allocate more funds towards luxury fashion and accessories, driving demand. As the middle class expands, with over 40% of households earning above MYR 5,000 monthly, the luxury market is poised for significant growth, supported by increased purchasing power and consumer confidence.

- Increasing Urbanization:Urbanization in Malaysia is expected to reach 78% in future, with over 25 million people living in urban areas. This demographic shift leads to a higher concentration of affluent consumers who are more inclined to purchase luxury goods. Urban centers like Kuala Lumpur are becoming hubs for luxury retail, with over 50 new luxury brands entering the market in the past year, catering to the growing urban population's demand for high-end fashion and accessories.

- Expansion of E-commerce Platforms:The e-commerce sector in Malaysia is projected to grow to MYR 30 billion in future, driven by increased internet penetration, which is expected to reach 90%. This growth facilitates access to luxury fashion and accessories, allowing consumers to shop conveniently online. Major platforms like Lazada and Shopee are expanding their luxury segments, with a reported 40% increase in luxury product listings, enhancing consumer choice and driving market growth.

Market Challenges

- Economic Uncertainty:Malaysia's GDP growth is forecasted to slow to 4.3% in future due to global economic headwinds and inflationary pressures. This uncertainty can lead to reduced consumer spending on luxury items, as households prioritize essential goods over discretionary purchases. The luxury fashion market may face challenges as consumers become more cautious, impacting overall sales and brand performance in the sector.

- Intense Competition:The luxury fashion market in Malaysia is characterized by fierce competition, with over 200 international brands vying for market share. This saturation leads to aggressive pricing strategies and marketing campaigns, making it challenging for new entrants and established brands to differentiate themselves. As a result, profit margins may be squeezed, and brands must innovate continuously to maintain their competitive edge in this crowded marketplace.

Malaysia Luxury Fashion & Accessories Market Future Outlook

The future of the Malaysia luxury fashion and accessories market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, brands that adopt eco-friendly practices are likely to attract a growing segment of conscious consumers. Additionally, the integration of augmented reality and virtual fitting rooms in e-commerce platforms is expected to enhance the shopping experience, making luxury products more accessible and appealing to a tech-savvy audience.

Market Opportunities

- Sustainable Fashion Trends:The demand for sustainable luxury fashion is on the rise, with a projected market value of MYR 5 billion in future. Brands that focus on eco-friendly materials and ethical production practices can tap into this growing consumer base, enhancing brand loyalty and attracting environmentally conscious shoppers.

- Collaborations with Local Designers:Collaborating with local designers presents a unique opportunity for luxury brands to differentiate themselves. By integrating local culture and craftsmanship, brands can create exclusive collections that resonate with Malaysian consumers, potentially increasing sales by 15% as they appeal to national pride and support for local talent.