Region:Middle East

Author(s):Dev

Product Code:KRAC0361

Pages:94

Published On:August 2025

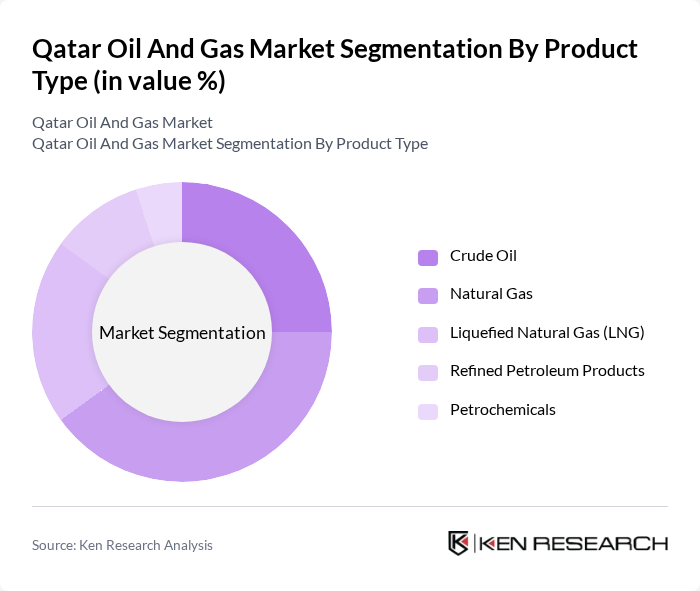

By Product Type:The product type segmentation includes crude oil, natural gas, liquefied natural gas (LNG), refined petroleum products, and petrochemicals. Among these,natural gasremains the leading subsegment due to Qatar's significant reserves and its role as a primary energy source for both domestic consumption and international exports. The increasing global demand for cleaner energy sources, especially LNG, has further solidified natural gas's position in the market, with Qatar recognized as one of the world's largest LNG exporters.

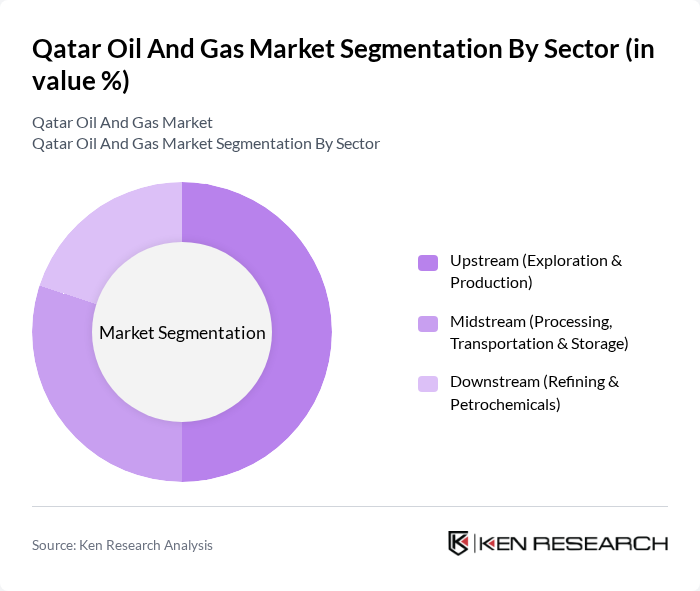

By Sector:The sector segmentation encompasses upstream (exploration & production), midstream (processing, transportation & storage), and downstream (refining & petrochemicals). Theupstream sectoris the most dominant, driven by Qatar's extensive exploration activities and production capabilities. The focus on maximizing output from existing fields, such as Al-Shaheen and North Field, and exploring new reserves has positioned this sector as the backbone of the oil and gas industry in Qatar. Midstream activities are increasingly important due to ongoing investments in LNG processing and export infrastructure, while downstream growth is supported by expansion in petrochemicals and refining.

The Qatar Oil and Gas Market is characterized by a dynamic mix of regional and international players. Leading participants such as QatarEnergy, Qatargas, Ras Laffan Liquefied Natural Gas Company Ltd. (RasGas), TotalEnergies SE, ExxonMobil Qatar Inc., Shell Qatar, Occidental Petroleum of Qatar Ltd., ConocoPhillips Qatar, Eni S.p.A., Petronas Qatar, Chevron Qatar Energy, BP Qatar, Woodside Energy Qatar, Mitsubishi Corporation Qatar, JGC Corporation Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar oil and gas market appears promising, driven by ongoing investments in technology and infrastructure. The integration of renewable energy sources is expected to complement traditional oil and gas operations, enhancing sustainability. Additionally, the expansion of LNG exports to meet global demand, particularly in Asia, will likely position Qatar as a pivotal player in the energy transition. Continued focus on local content development will also foster economic growth and job creation in the sector.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Crude Oil Natural Gas Liquefied Natural Gas (LNG) Refined Petroleum Products Petrochemicals |

| By Sector | Upstream (Exploration & Production) Midstream (Processing, Transportation & Storage) Downstream (Refining & Petrochemicals) |

| By End-Use Industry | Power Generation Industrial Residential and Commercial Transportation Others |

| By Location of Deployment | Onshore Offshore |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Upstream Oil Production | 60 | Exploration Managers, Production Engineers |

| Midstream Transportation and Storage | 50 | Logistics Coordinators, Operations Managers |

| Downstream Refining and Distribution | 55 | Refinery Managers, Supply Chain Analysts |

| Natural Gas Sector | 45 | Gas Plant Operators, Regulatory Affairs Specialists |

| Renewable Energy Initiatives | 40 | Sustainability Managers, Project Developers |

The Qatar Oil and Gas Market is valued at approximately USD 50 billion, driven by the country's extensive natural gas reserves and increasing energy demand both domestically and internationally.