Region:Middle East

Author(s):Rebecca

Product Code:KRAD4364

Pages:89

Published On:December 2025

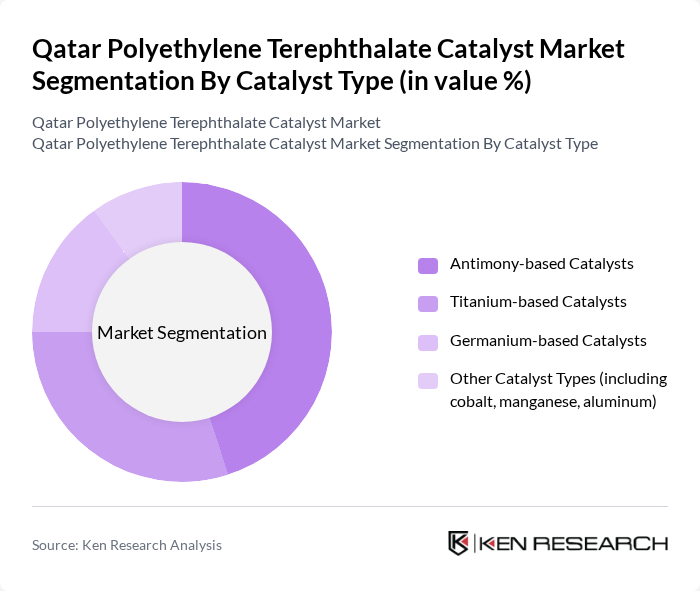

By Catalyst Type:The market is segmented into various catalyst types, including Antimony-based Catalysts, Titanium-based Catalysts, Germanium-based Catalysts, and Other Catalyst Types (including cobalt, manganese, aluminum). Antimony-based catalysts are widely used due to their effectiveness in polymerization processes, while titanium-based catalysts are gaining traction for their lower environmental impact. Germanium-based catalysts are less common but are noted for their efficiency in specific applications. Other catalyst types are utilized based on specific industry needs.

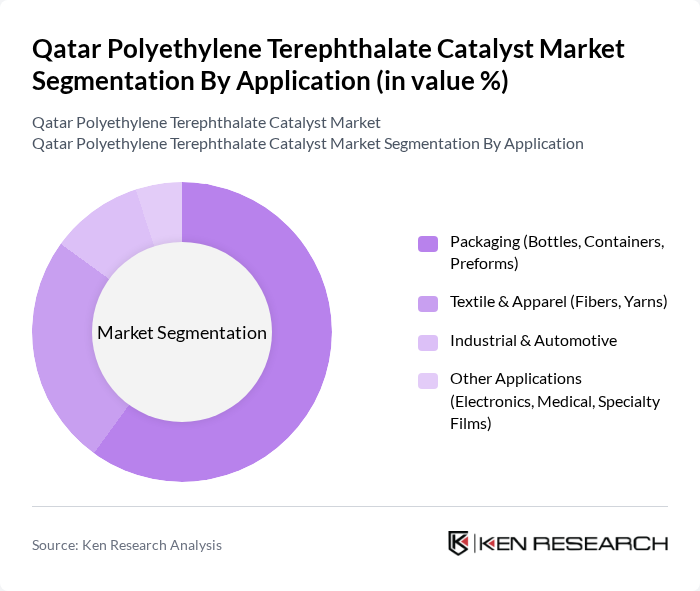

By Application:The applications of catalysts in the PET market include Packaging (Bottles, Containers, Preforms), Textile & Apparel (Fibers, Yarns), Industrial & Automotive, and Other Applications (Electronics, Medical, Specialty Films). The packaging sector is the largest consumer of PET catalysts, driven by the booming beverage industry and the increasing demand for sustainable packaging solutions. The textile sector also shows significant growth due to the rising demand for synthetic fibers.

The Qatar Polyethylene Terephthalate Catalyst Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, Indorama Ventures Public Company Limited, BASF SE, Clariant AG, W. R. Grace & Co., Arkema S.A., Albemarle Corporation, LyondellBasell Industries N.V., Eastman Chemical Company, Chowgule Group (PET Catalyst Business), Reliance Industries Limited, QatarEnergy (Petrochemicals), Qatar Petrochemical Company (QAPCO), Qatar Chemical Company Ltd. (Q-Chem), Other Specialized PET Catalyst and Additive Suppliers Active in Qatar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar polyethylene terephthalate catalyst market appears promising, driven by increasing investments in sustainable practices and technological advancements. As the demand for PET continues to rise, particularly in packaging and automotive applications, the market is expected to adapt by integrating innovative catalyst solutions. Additionally, the focus on recycling and biodegradable materials will likely create new avenues for growth, positioning Qatar as a key player in the global catalyst landscape in the future.

| Segment | Sub-Segments |

|---|---|

| By Catalyst Type | Antimony-based Catalysts Titanium-based Catalysts Germanium-based Catalysts Other Catalyst Types (including cobalt, manganese, aluminum) |

| By Application | Packaging (Bottles, Containers, Preforms) Textile & Apparel (Fibers, Yarns) Industrial & Automotive Other Applications (Electronics, Medical, Specialty Films) |

| By Process | Virgin PET Polymerization rPET / Chemical Recycling (Depolymerization & Repolymerization) Solid-state Polymerization (SSP) Others |

| By End-Use Industry | Food & Beverage Packaging Personal Care & Household Products Textiles and Industrial Yarn Electronics & Electrical Others |

| By Sales Channel | Direct Sales to PET Producers Sales via Chemical Distributors Key Account / Contract-based Supply Others |

| By Import Source Region | Asia-Pacific Suppliers Europe-based Suppliers Middle East & Africa Suppliers Others |

| By Regulatory & Sustainability Profile | Food-contact Approved Catalysts Low-Antimony / Heavy-Metal-Reduced Catalysts Recycled-content / Circular Economy-aligned Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Polyethylene Terephthalate Production | 110 | Production Managers, Plant Engineers |

| Catalyst Supply Chain Management | 90 | Procurement Officers, Supply Chain Analysts |

| End-User Applications in Packaging | 80 | Product Managers, Marketing Directors |

| Research and Development in Catalyst Technologies | 70 | R&D Scientists, Technical Directors |

| Regulatory Compliance and Sustainability Initiatives | 60 | Compliance Officers, Sustainability Managers |

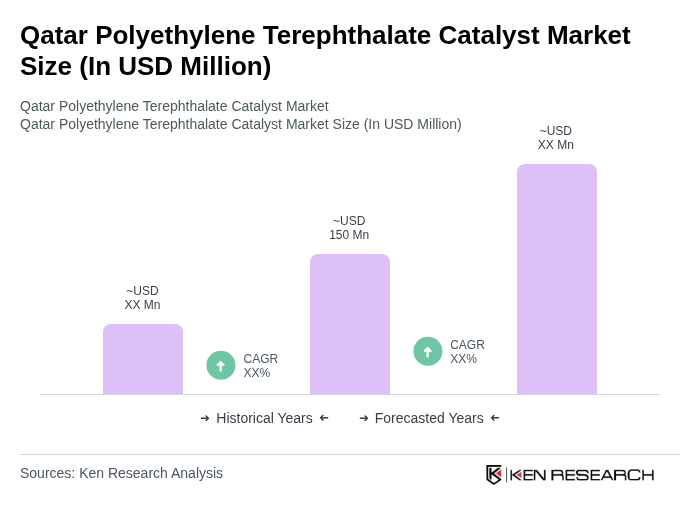

The Qatar Polyethylene Terephthalate Catalyst Market is valued at approximately USD 150 million, reflecting a five-year historical analysis. This valuation is driven by the increasing demand for polyethylene terephthalate (PET) in various applications, particularly in packaging and textiles.