Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8128

Pages:90

Published On:November 2025

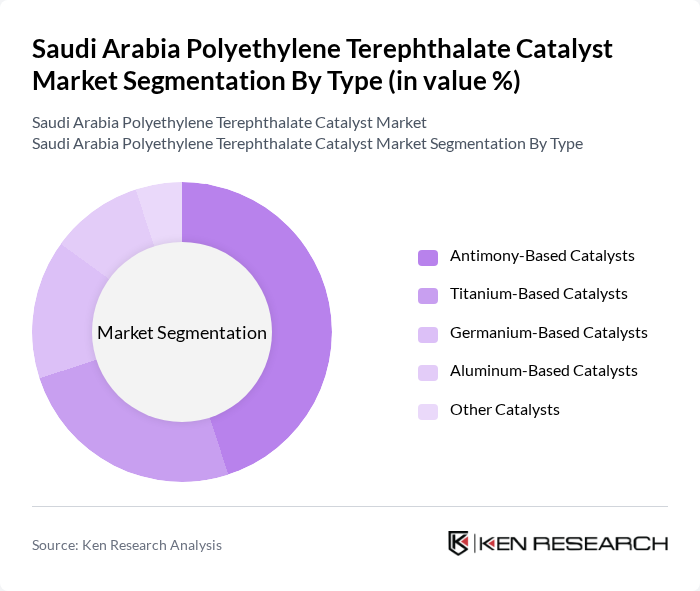

By Type:The market is segmented into Antimony-Based Catalysts, Titanium-Based Catalysts, Germanium-Based Catalysts, Aluminum-Based Catalysts, and Other Catalysts. Antimony-Based Catalysts remain the most widely used in Saudi Arabia due to their effectiveness in producing high-quality PET with excellent thermal stability and clarity. However, there is a growing shift toward titanium-based and other alternative catalysts, driven by regulatory pressure for lower toxicity and improved sustainability in PET production .

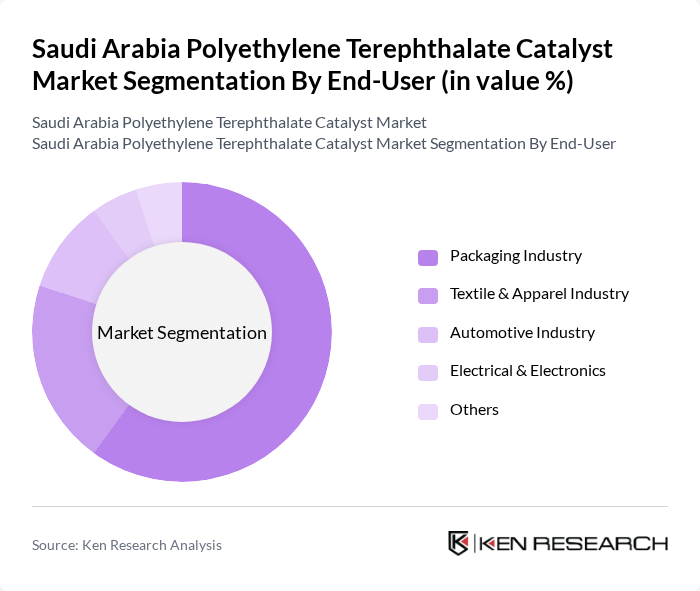

By End-User:The end-user segmentation includes Packaging, Textile & Apparel, Automotive, Electrical & Electronics, and Others. The Packaging Industry is the leading segment, accounting for the majority of PET catalyst demand, driven by the robust consumption of PET in beverage bottles and food packaging. The continued shift toward sustainable and recyclable packaging solutions further accelerates PET adoption, while the textile and apparel sector remains a key secondary market due to the widespread use of PET fibers .

The Saudi Arabia Polyethylene Terephthalate Catalyst Market is characterized by a dynamic mix of regional and international players. Leading participants such as SABIC, BASF SE, Clariant AG, Arkema S.A., W. R. Grace & Co., Albemarle Corporation, Honeywell International Inc., Indorama Ventures Public Company Limited, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Corporation, Evonik Industries AG, Tosoh Corporation, Solvay S.A., Covestro AG, KMA SA MARKETING (PTY) Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the polyethylene terephthalate catalyst market in Saudi Arabia appears promising, driven by increasing investments in sustainable practices and technological innovations. The government's commitment to diversifying the economy and enhancing local manufacturing capabilities will likely foster growth. Additionally, the rising focus on recycling and the circular economy will create new avenues for PET applications, encouraging companies to invest in advanced catalyst technologies that align with environmental goals and market demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Antimony-Based Catalysts Titanium-Based Catalysts Germanium-Based Catalysts Aluminum-Based Catalysts Other Catalysts |

| By End-User | Packaging Industry Textile & Apparel Industry Automotive Industry Electrical & Electronics Others |

| By Application | Bottles & Containers Films & Sheets Fibers & Yarns Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Region | Central Region Eastern Region Western Region Others |

| By Production Process | Batch Process Continuous Process Others |

| By Product Form | Granules Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Packaging Industry Utilization | 100 | Production Managers, Quality Control Supervisors |

| Textile Manufacturing Applications | 80 | Textile Engineers, Product Development Managers |

| Automotive Sector Adoption | 70 | Procurement Managers, R&D Managers |

| Recycling and Sustainability Initiatives | 50 | Sustainability Officers, Environmental Compliance Managers |

| Research and Development Insights | 60 | R&D Scientists, Technical Directors |

The Saudi Arabia Polyethylene Terephthalate Catalyst Market is valued at approximately USD 8 million, driven by increasing demand for PET in various applications, including packaging, beverages, and textiles, alongside the growth of the petrochemical sector.