Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4067

Pages:88

Published On:December 2025

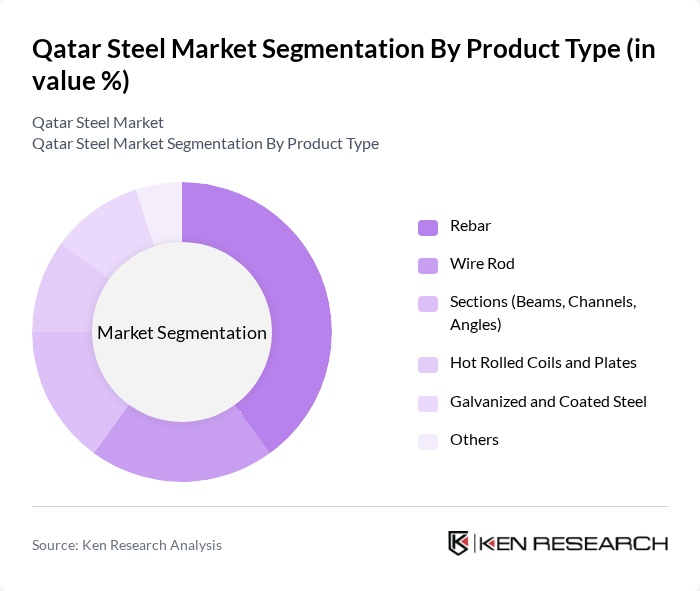

By Product Type:The product type segmentation includes various categories such as rebar, wire rod, sections, hot rolled coils and plates, galvanized and coated steel, and others. Among these, rebar is the leading sub-segment due to its extensive use in construction and infrastructure projects. The increasing demand for reinforced concrete structures has significantly boosted the consumption of rebar, making it a critical component in the steel market.

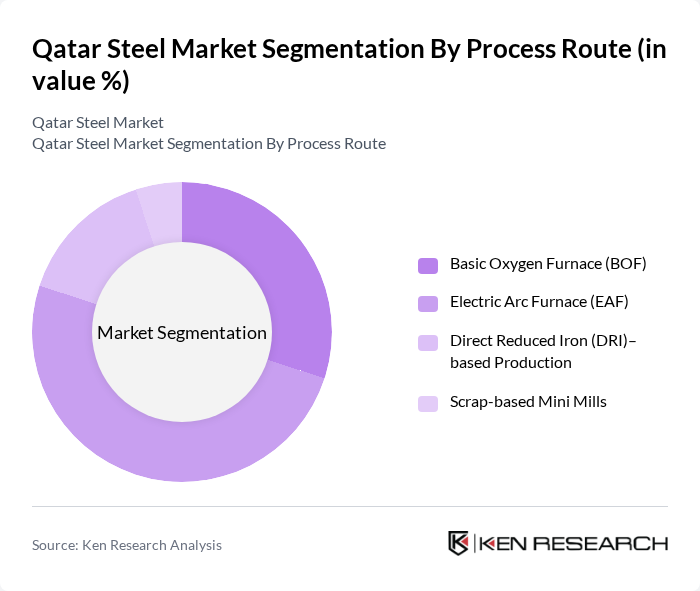

By Process Route:This segmentation includes Basic Oxygen Furnace (BOF), Electric Arc Furnace (EAF), Direct Reduced Iron (DRI)–based Production, and Scrap-based Mini Mills. The Electric Arc Furnace (EAF) process is currently the most dominant method due to its flexibility and lower environmental impact. EAF technology allows for the recycling of scrap steel, which is increasingly favored in the market as sustainability becomes a priority for manufacturers.

The Qatar Steel Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Steel Company (Industries Qatar), Qatar Steel Industries Factory, Doha Steel Company W.L.L., Qatar Reinforcement Company W.L.L. (QRC), Qatar Steel Technologies (QST), Qatar Metal Industries (QMI), Qatar Metal Coating Company W.L.L. (Q-Coat), Qatar Industrial Manufacturing Company Q.P.S.C. (Steel and Metal Subsidiaries), Qatari Investors Group Marine Services & Steel Fabrication, Qatar Engineering and Construction Company (QCon) – Steel Fabrication, United Steel Factory (Steelco), Qatar Steel Rebar and Wire Products Manufacturers (Cluster Overview), Major Imported Brand Suppliers (Saudi, UAE and Oman Mills), Key Regional Trading Houses Active in Qatar Steel Supply, Emerging Local Steel Fabricators and Service Centers contribute to innovation, geographic expansion, and service delivery in this space.

The Qatar steel market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the government emphasizes green initiatives, steel producers are likely to adopt eco-friendly production methods, enhancing their competitiveness. Additionally, the integration of digital technologies in manufacturing processes is expected to streamline operations and reduce costs. These trends will not only support local demand but also position Qatar as a key player in the regional steel market, fostering export opportunities.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Rebar Wire Rod Sections (Beams, Channels, Angles) Hot Rolled Coils and Plates Galvanized and Coated Steel Others |

| By Process Route | Basic Oxygen Furnace (BOF) Electric Arc Furnace (EAF) Direct Reduced Iron (DRI)–based Production Scrap-based Mini Mills |

| By End-Use Industry | Building and Construction Infrastructure and Civil Works Oil and Gas and Petrochemicals Industrial and Mechanical Engineering Manufacturing and Fabrication Workshops Others |

| By Application | Reinforced Concrete (Rebar) Structural Steel Frames Pipelines and Line Pipe Pre-engineered Buildings and Precast Elements Steel Mesh, Wire and Fencing Others |

| By Sales Channel | Direct Sales to Projects and EPCs Sales to Stockists and Service Centers Distributor and Dealer Network Traders and Re-exporters Others |

| By Origin | Domestically Produced Steel Imported Steel |

| By Compliance and Quality Standards | Qatar Construction Specifications (QCS) ASTM Standards BS/EN and Other International Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Sector Steel Usage | 150 | Project Managers, Procurement Officers |

| Automotive Steel Applications | 90 | Product Development Engineers, Supply Chain Managers |

| Manufacturing Steel Demand | 80 | Operations Managers, Quality Control Supervisors |

| Infrastructure Projects Steel Requirements | 120 | Infrastructure Planners, Civil Engineers |

| Steel Recycling Initiatives | 60 | Sustainability Managers, Environmental Compliance Officers |

The Qatar Steel Market is valued at approximately USD 3.0 billion, driven by significant growth in the construction sector and government investments in infrastructure and urban development projects.