Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7322

Pages:93

Published On:October 2025

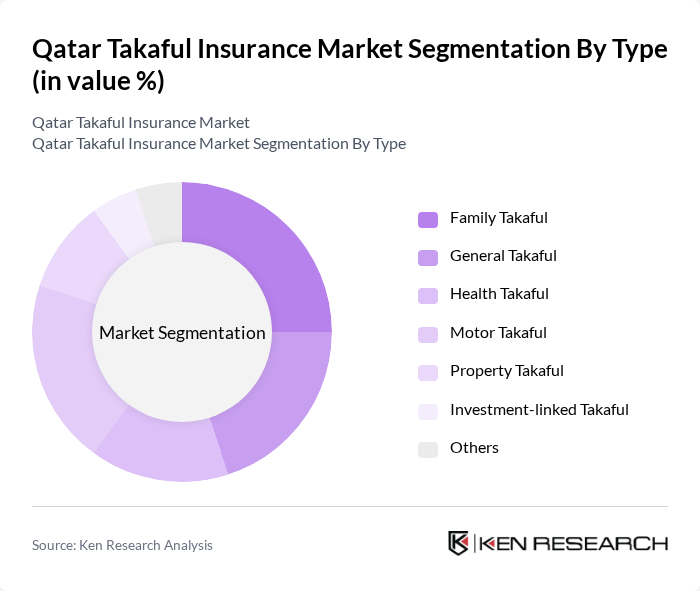

By Type:The Takaful insurance market can be segmented into various types, including Family Takaful, General Takaful, Health Takaful, Motor Takaful, Property Takaful, Investment-linked Takaful, and Others. Family Takaful is gaining traction due to the increasing focus on family protection and savings, while Health Takaful is driven by rising healthcare costs and awareness of health insurance. Motor Takaful remains popular due to the growing vehicle ownership in Qatar.

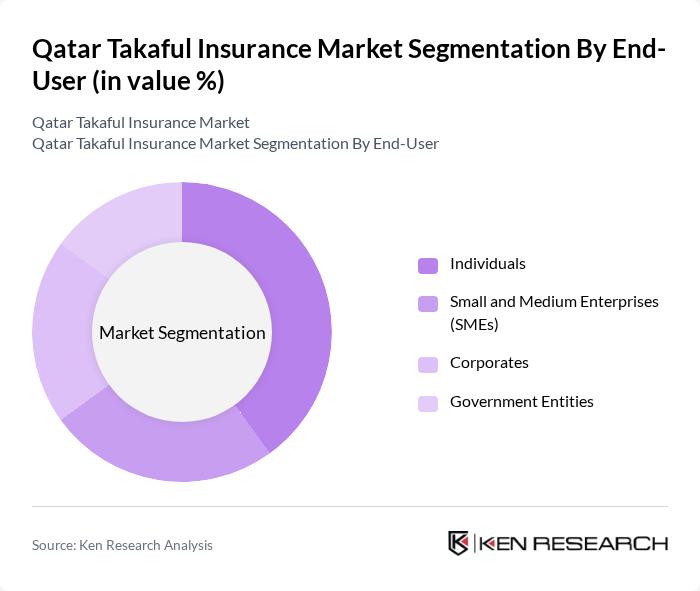

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Corporates, and Government Entities. Individuals are increasingly opting for Takaful products for personal and family protection, while SMEs are recognizing the importance of insurance in risk management. Corporates are also investing in Takaful solutions to safeguard their assets and comply with regulatory requirements.

The Qatar Takaful Insurance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar Islamic Insurance Company, Doha Takaful, Al Khaleej Takaful Insurance, Qatar General Insurance and Reinsurance Company, Qatar Insurance Company, Damaan Islamic Insurance Company, Al-Ahlia Insurance Company, Qatar Life & Medical Insurance Company, Gulf Takaful Insurance Company, Takaful Emarat, Qatar Re, Al Fardan Insurance, Al Sagr Cooperative Insurance Company, Al Hilal Takaful, Qatar National Insurance Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar Takaful insurance market appears promising, driven by increasing consumer awareness and government initiatives. As the population continues to grow, the demand for Sharia-compliant financial products is expected to rise significantly. Additionally, advancements in technology will likely enhance customer experience and operational efficiency, making Takaful products more accessible. The market is poised for transformation, with a focus on innovative solutions that cater to evolving consumer needs and preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Family Takaful General Takaful Health Takaful Motor Takaful Property Takaful Investment-linked Takaful Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Distribution Channel | Direct Sales Brokers Online Platforms Agents |

| By Product Offering | Standard Takaful Products Customized Takaful Solutions Group Takaful Policies |

| By Customer Segment | Retail Customers Corporate Clients Institutional Clients |

| By Premium Range | Low Premium Medium Premium High Premium |

| By Policy Duration | Short-term Policies Long-term Policies Renewable Policies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Individual Takaful Policyholders | 150 | Policyholders, Financial Advisors |

| Corporate Takaful Clients | 100 | Risk Managers, CFOs |

| Takaful Brokers and Agents | 80 | Insurance Brokers, Sales Agents |

| Regulatory Bodies and Associations | 50 | Regulators, Industry Analysts |

| Islamic Finance Experts | 30 | Academics, Financial Consultants |

The Qatar Takaful Insurance Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increasing awareness of Sharia-compliant financial products, rising disposable incomes, and a growing population seeking ethical investment options.