Region:Europe

Author(s):Shubham

Product Code:KRAB4404

Pages:85

Published On:October 2025

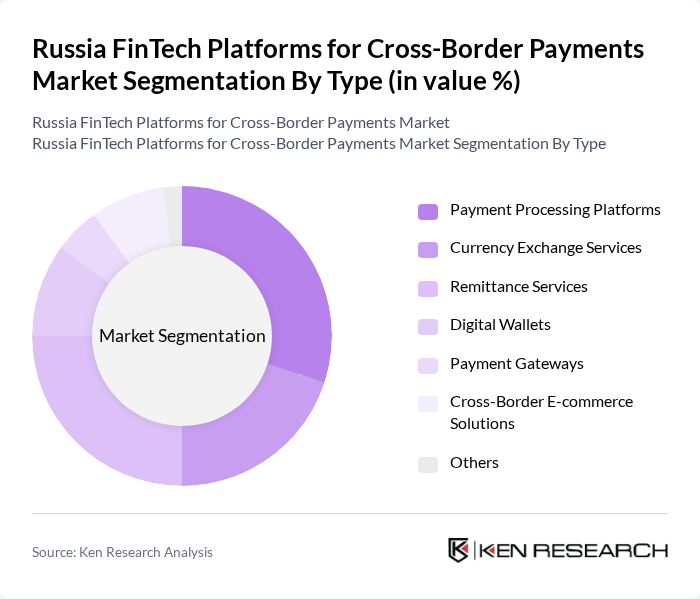

By Type:The market is segmented into various types, including Payment Processing Platforms, Currency Exchange Services, Remittance Services, Digital Wallets, Payment Gateways, Cross-Border E-commerce Solutions, and Others. Each of these segments plays a crucial role in facilitating cross-border transactions, catering to different consumer needs and preferences.

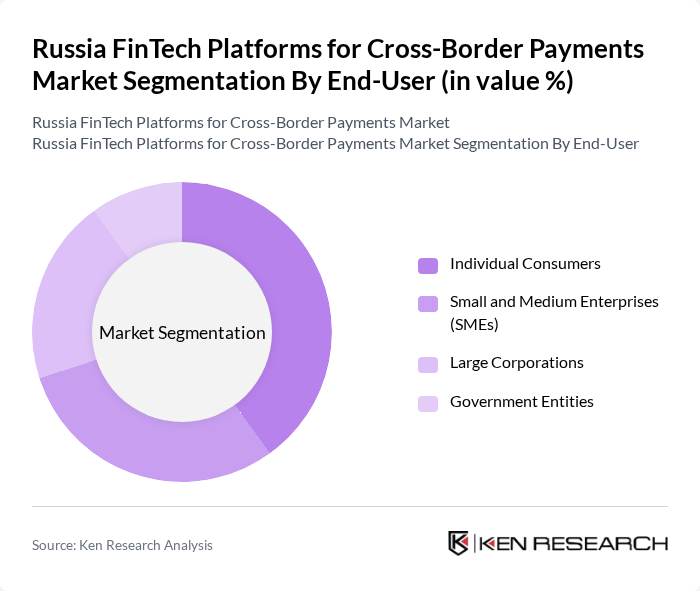

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each segment has distinct requirements and preferences for cross-border payment solutions, influencing the overall market dynamics.

The Russia FinTech Platforms for Cross-Border Payments Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tinkoff Bank, Qiwi, Yandex.Money, Sberbank, VTB Bank, WebMoney, PayMe, Raiffeisen Bank, Alfa-Bank, Rocketbank, PayPal Russia, Stripe, TransferWise, Revolut, Monzo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Russia FinTech platforms for cross-border payments market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in payment processing is expected to enhance transaction efficiency and security. Additionally, the shift towards open banking frameworks will facilitate collaboration between FinTech companies and traditional banks, fostering innovation. As digital currencies gain traction, they may also play a pivotal role in transforming cross-border payment dynamics, offering new avenues for growth and efficiency in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Payment Processing Platforms Currency Exchange Services Remittance Services Digital Wallets Payment Gateways Cross-Border E-commerce Solutions Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Payment Method | Credit/Debit Cards Bank Transfers Mobile Payments Cryptocurrencies |

| By Transaction Volume | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Geographic Reach | Domestic Transactions Regional Transactions International Transactions |

| By Compliance Level | Fully Compliant Solutions Partially Compliant Solutions Non-Compliant Solutions |

| By Customer Segment | Retail Customers Business Customers Institutional Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Wallet Usage in Cross-Border Payments | 150 | FinTech Product Managers, Digital Marketing Specialists |

| Bank Transfer Preferences Among Consumers | 100 | Retail Banking Customers, Financial Advisors |

| Cryptocurrency Adoption for International Transactions | 80 | Crypto Enthusiasts, Blockchain Developers |

| Regulatory Impact on Cross-Border Payment Solutions | 70 | Compliance Officers, Legal Advisors in FinTech |

| Consumer Experience with Cross-Border Payment Platforms | 90 | End-users, Customer Experience Managers |

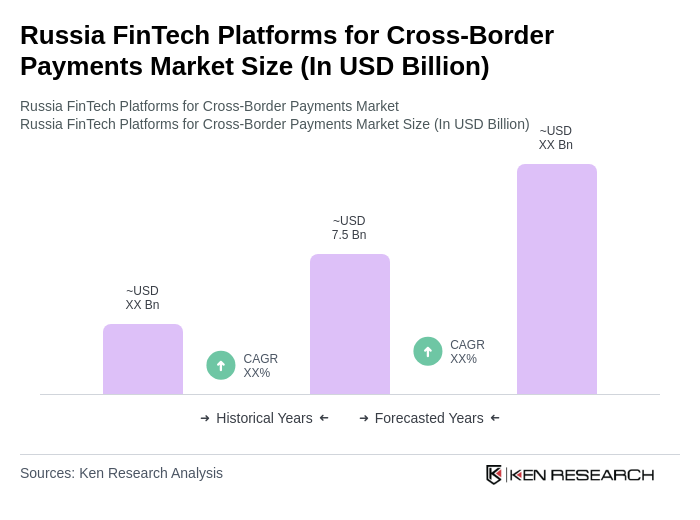

The Russia FinTech Platforms for Cross-Border Payments Market is valued at approximately USD 7.5 billion, reflecting significant growth driven by the demand for efficient and cost-effective payment solutions, as well as the rise of digital banking and e-commerce.