Region:Middle East

Author(s):Rebecca

Product Code:KRAB7780

Pages:82

Published On:October 2025

By Type:The market is segmented into various types, including Predictive Analytics, Machine Learning Models, Natural Language Processing, Computer Vision, and Others. Among these, Predictive Analytics is gaining traction due to its ability to analyze vast datasets and predict outcomes, which is crucial in drug discovery. Machine Learning Models are also significant, as they enhance the accuracy of drug development processes. The demand for Natural Language Processing is increasing as it aids in processing unstructured data from research papers and clinical trials.

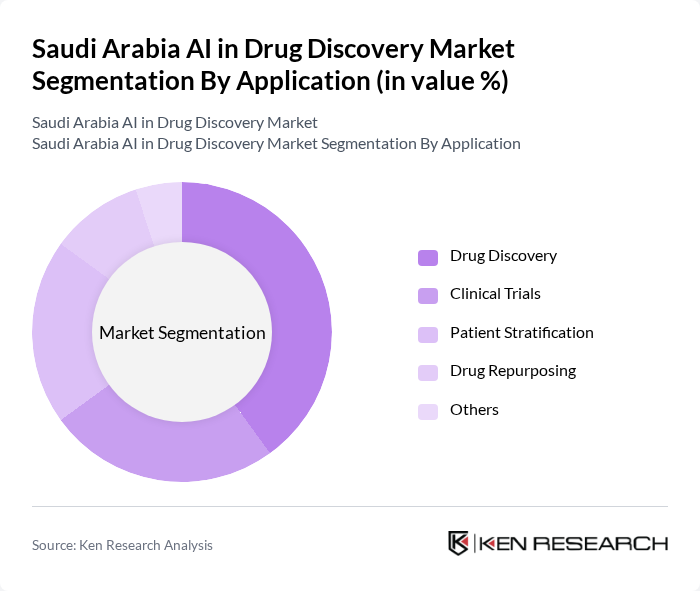

By Application:The applications of AI in drug discovery include Drug Discovery, Clinical Trials, Patient Stratification, Drug Repurposing, and Others. Drug Discovery is the leading application, as it directly impacts the development of new medications. Clinical Trials are also significant, as AI helps in optimizing trial designs and patient recruitment. Patient Stratification is gaining importance for personalized medicine, while Drug Repurposing is increasingly utilized to find new uses for existing drugs.

The Saudi Arabia AI in Drug Discovery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Novartis AG, Roche Holding AG, Pfizer Inc., AstraZeneca PLC, Merck & Co., Inc., GSK (GlaxoSmithKline) PLC, Sanofi S.A., Johnson & Johnson, Amgen Inc., AbbVie Inc., Eli Lilly and Company, Bayer AG, Biogen Inc., Takeda Pharmaceutical Company Limited, Siemens Healthineers contribute to innovation, geographic expansion, and service delivery in this space.

The future of AI in drug discovery in Saudi Arabia appears promising, driven by ongoing advancements in technology and increasing collaboration between public and private sectors. As the government continues to invest in healthcare innovation, the integration of AI is expected to enhance drug development processes significantly. Moreover, the focus on personalized medicine and real-world evidence will likely shape research priorities, leading to more effective treatments. The collaboration with international research institutions will further bolster the capabilities of local firms, fostering a vibrant ecosystem for AI-driven drug discovery.

| Segment | Sub-Segments |

|---|---|

| By Type | Predictive Analytics Machine Learning Models Natural Language Processing Computer Vision Others |

| By Application | Drug Discovery Clinical Trials Patient Stratification Drug Repurposing Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Research Institutions Healthcare Providers Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Investment Source | Government Funding Private Equity Venture Capital Corporate Investments Others |

| By Policy Support | Subsidies for AI Research Tax Incentives for AI Startups Grants for Healthcare Innovation Regulatory Support for AI Integration Others |

| By Technology | Cloud Computing On-Premise Solutions Hybrid Models AI Software Platforms Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Pharmaceutical R&D Departments | 100 | R&D Directors, AI Specialists |

| Biotechnology Firms Utilizing AI | 80 | Product Development Managers, Data Scientists |

| Healthcare Professionals Involved in Drug Trials | 70 | Clinical Researchers, Pharmacologists |

| Regulatory Bodies and Policy Makers | 50 | Regulatory Affairs Managers, Health Policy Analysts |

| Investors in Pharmaceutical Technologies | 60 | Venture Capitalists, Investment Analysts |

The Saudi Arabia AI in Drug Discovery Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by advancements in AI technologies and increased investments in healthcare innovation.