Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9205

Pages:88

Published On:November 2025

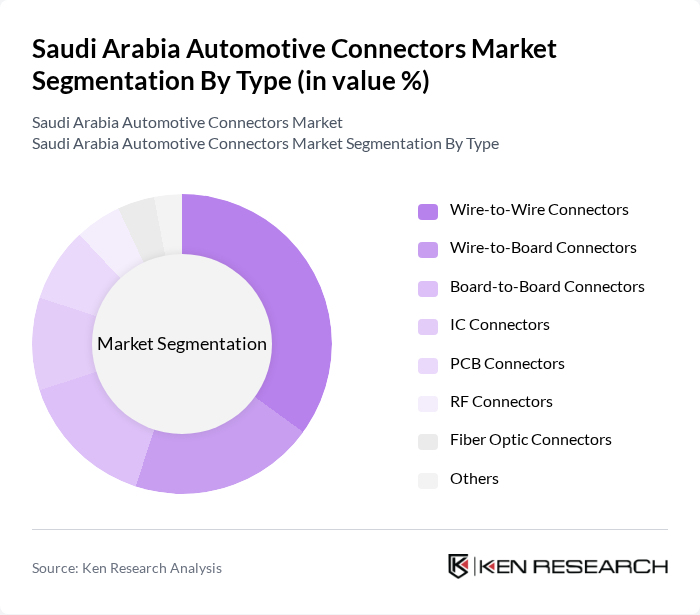

By Type:

The automotive connectors market is segmented into various types, including Wire-to-Wire Connectors, Wire-to-Board Connectors, Board-to-Board Connectors, IC Connectors, PCB Connectors, RF Connectors, Fiber Optic Connectors, and Others. Among these, Wire-to-Wire Connectors maintain a leading position due to their widespread application in connecting multiple wires within vehicles, ensuring reliable power and signal transmission. The increasing complexity of automotive electrical systems, integration of infotainment, safety, and driver-assistance technologies, and the growing trend towards electrification further bolster the demand for these connectors, making them a critical component in modern vehicles.

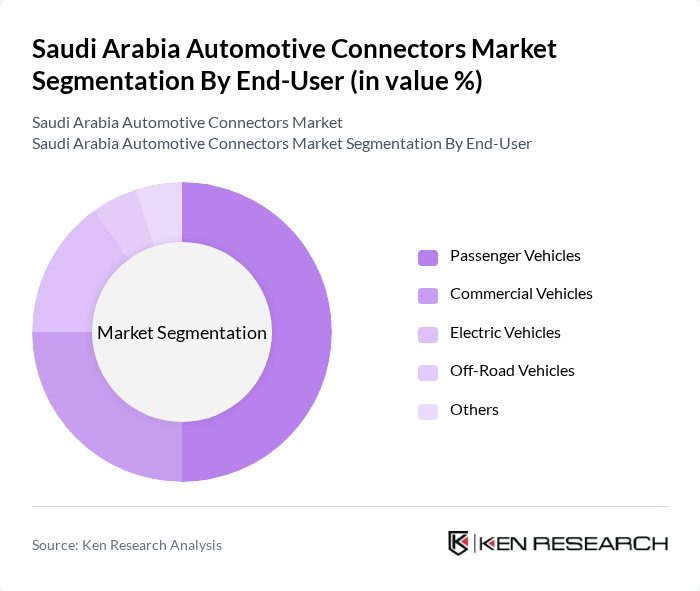

By End-User:

The end-user segmentation of the automotive connectors market includes Passenger Vehicles, Commercial Vehicles, Electric Vehicles, Off-Road Vehicles, and Others. The Passenger Vehicles segment holds the largest share, driven by the high demand for personal transportation and the increasing production of passenger cars. The growing trend towards electric and hybrid vehicles, supported by government initiatives and investments in local manufacturing, is also contributing to the expansion of this segment, as these vehicles require advanced connectors for efficient power management and connectivity.

The Saudi Arabia Automotive Connectors Market is characterized by a dynamic mix of regional and international players. Leading participants such as TE Connectivity, Aptiv (formerly Delphi Technologies), Molex, Amphenol, Yazaki Corporation, Sumitomo Electric Industries, JST Manufacturing, Hirose Electric, Rosenberger, Littelfuse, FCI Electronics (now part of Amphenol), Phoenix Contact, Harting Technology Group, 3M, Nexans, Japan Aviation Electronics Industry, Ltd. (JAE), ERNI International AG, China Auto Electronics Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the automotive connectors market in Saudi Arabia appears promising, driven by the increasing adoption of electric vehicles and advancements in automotive technology. As the government continues to support the automotive sector through initiatives and incentives, manufacturers are likely to invest in innovative connector solutions. Additionally, the integration of IoT and smart technologies in vehicles will further enhance the demand for specialized connectors, positioning the market for substantial growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Wire-to-Wire Connectors Wire-to-Board Connectors Board-to-Board Connectors IC Connectors PCB Connectors RF Connectors Fiber Optic Connectors Others |

| By End-User | Passenger Vehicles Commercial Vehicles Electric Vehicles Off-Road Vehicles Others |

| By Application | Power Distribution & Body Wiring Data Transmission & Infotainment Safety & Security Systems Powertrain Navigation & Instrumentation Others |

| By Material | Plastic Connectors Metal Connectors Hybrid Connectors Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Connector Size | Micro Connectors Mini Connectors Standard Connectors Others |

| By Technology | Conventional Connectors Smart Connectors High-Speed Connectors Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Manufacturers | 60 | Production Managers, R&D Engineers |

| Commercial Vehicle Assemblers | 50 | Supply Chain Managers, Quality Assurance Officers |

| Automotive Connector Suppliers | 40 | Sales Directors, Product Managers |

| Electric Vehicle Manufacturers | 40 | Technical Leads, Innovation Managers |

| Automotive Aftermarket Retailers | 50 | Category Managers, Procurement Specialists |

The Saudi Arabia Automotive Connectors Market is valued at approximately USD 170 million, reflecting a significant growth driven by the increasing demand for advanced automotive technologies, including electric vehicles and smart connectivity solutions.