Region:Middle East

Author(s):Geetanshi

Product Code:KRAC3811

Pages:86

Published On:October 2025

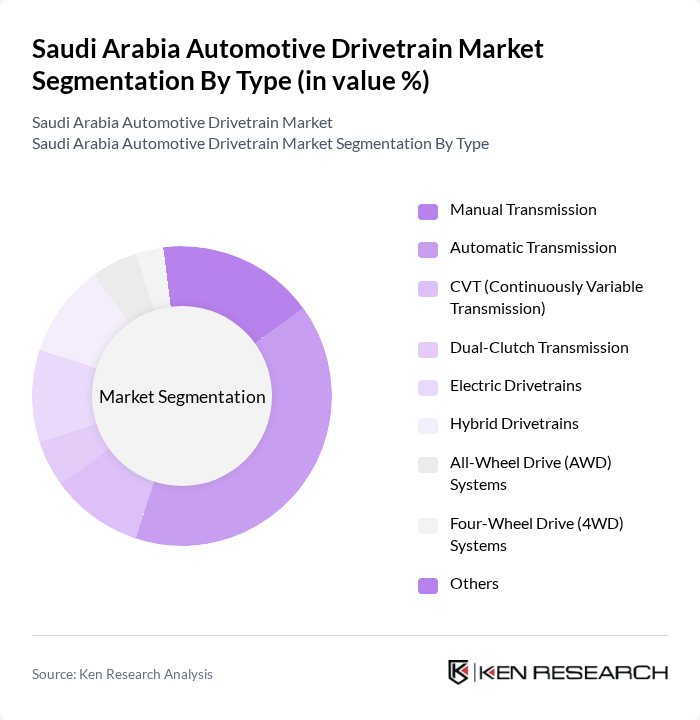

By Type:The market is segmented into various types of drivetrains, including Manual Transmission, Automatic Transmission, CVT (Continuously Variable Transmission), Dual-Clutch Transmission, Electric Drivetrains, Hybrid Drivetrains, All-Wheel Drive (AWD) Systems, Four-Wheel Drive (4WD) Systems, and Others. Among these, Automatic Transmission is the most dominant segment due to its growing popularity among consumers seeking convenience and ease of use. The increasing trend towards electric and hybrid drivetrains is also noteworthy, as consumers become more environmentally conscious.

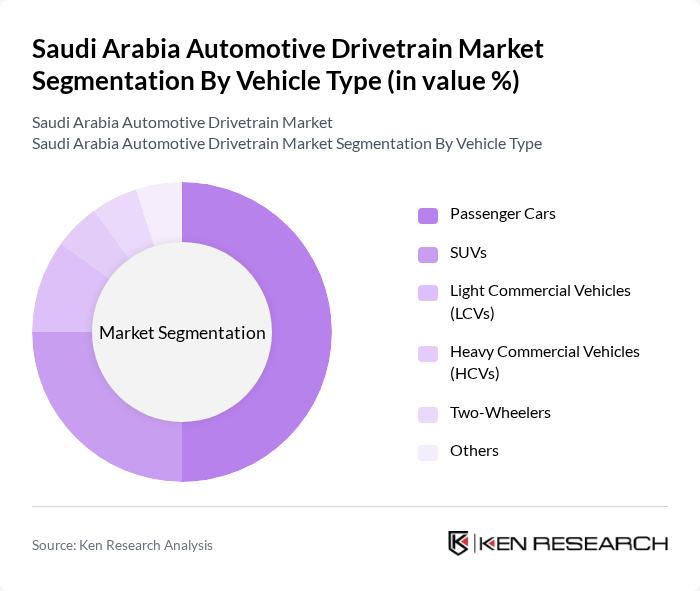

By Vehicle Type:The market is categorized into Passenger Cars, SUVs, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Two-Wheelers, and Others. The Passenger Cars segment leads the market, driven by the increasing urbanization and rising disposable incomes of consumers. SUVs are also gaining traction due to their versatility and appeal among families, while LCVs and HCVs are essential for commercial applications.

The Saudi Arabia Automotive Drivetrain Market is characterized by a dynamic mix of regional and international players. Leading participants such as Toyota Motor Corporation, Nissan Motor Co., Ltd., General Motors Company, Ford Motor Company, Hyundai Motor Company, Kia Corporation, Volkswagen AG, BMW AG, Mercedes-Benz Group AG, Honda Motor Co., Ltd., Mitsubishi Motors Corporation, Tata Motors Limited, Changan Automobile, BYD Company Limited, Geely Automobile Holdings Limited, Lucid Group, Inc., Ceer (Saudi Electric Vehicle Company), ZF Friedrichshafen AG, BorgWarner Inc., Magna International Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia automotive drivetrain market is poised for transformative growth, driven by technological advancements and a shift towards sustainable practices. As the government continues to promote local manufacturing and electric vehicle adoption, the market is expected to see increased investments in research and development. Additionally, the integration of smart technologies and automation in manufacturing processes will enhance efficiency and product quality, positioning the market favorably for future expansion and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Manual Transmission Automatic Transmission CVT (Continuously Variable Transmission) Dual-Clutch Transmission Electric Drivetrains Hybrid Drivetrains All-Wheel Drive (AWD) Systems Four-Wheel Drive (4WD) Systems Others |

| By Vehicle Type | Passenger Cars SUVs Light Commercial Vehicles (LCVs) Heavy Commercial Vehicles (HCVs) Two-Wheelers Others |

| By Component | Gearboxes Driveshafts Differentials Axles Clutches Transfer Cases Propeller Shafts Others |

| By Sales Channel | OEMs Aftermarket Online Retail Distributors Others |

| By Distribution Mode | Direct Sales Indirect Sales E-commerce Platforms Others |

| By Price Range | Budget (Below SAR 50,000) Mid-Range (SAR 50,000–120,000) Premium (SAR 120,000–150,000) Luxury (Above SAR 150,000) |

| By Application | Personal Use Commercial Use Government Use Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Passenger Vehicle Drivetrain Manufacturers | 65 | Product Managers, R&D Engineers |

| Commercial Vehicle Drivetrain Suppliers | 55 | Supply Chain Managers, Procurement Officers |

| Aftermarket Parts Distributors | 50 | Sales Managers, Operations Directors |

| Electric Vehicle Component Manufacturers | 45 | Technical Directors, Business Development Managers |

| Automotive Service Centers | 60 | Service Managers, Workshop Supervisors |

The Saudi Arabia Automotive Drivetrain Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by the demand for fuel-efficient vehicles and advancements in automotive technology.