Region:Middle East

Author(s):Rebecca

Product Code:KRAB0847

Pages:81

Published On:December 2025

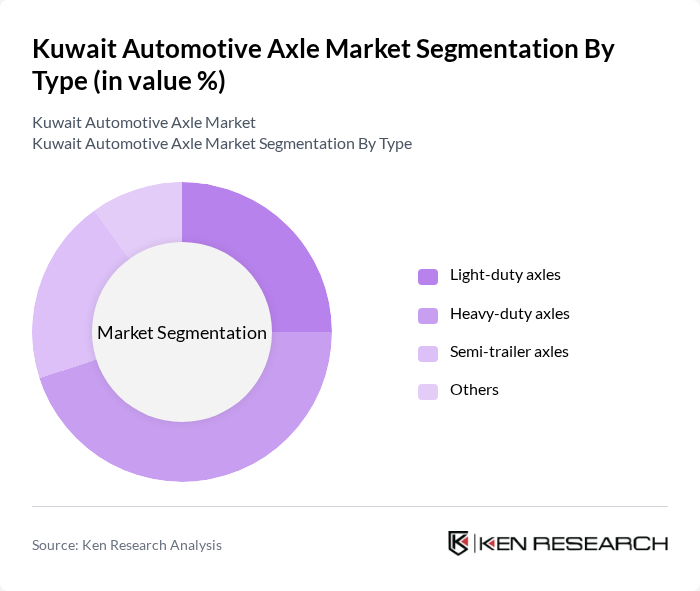

By Type:

The market is segmented into light-duty axles, heavy-duty axles, semi-trailer axles, and others. Among these, heavy-duty axles dominate the market due to the increasing demand for commercial vehicles and construction machinery. The growth in logistics and transportation sectors has led to a higher requirement for robust axle systems that can withstand heavy loads and harsh operating conditions. This trend is further supported by the expansion of infrastructure projects across Kuwait, which necessitates the use of heavy-duty vehicles.

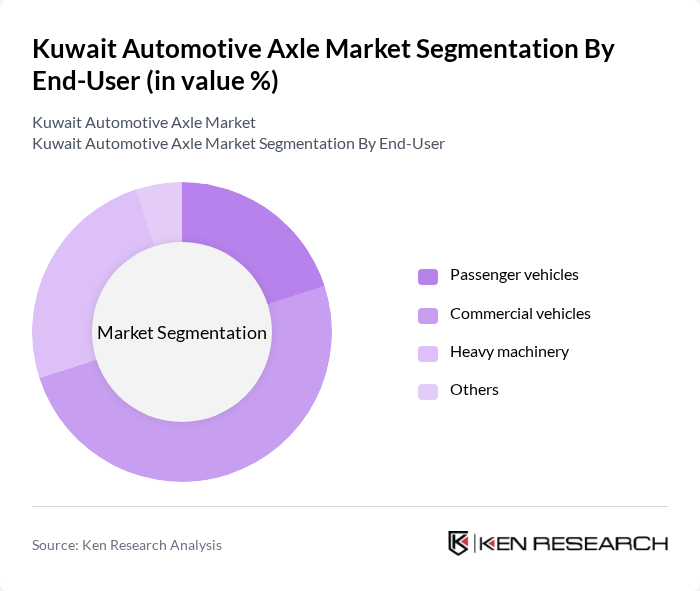

By End-User:

This segmentation includes passenger vehicles, commercial vehicles, heavy machinery, and others. The commercial vehicles segment is the largest, driven by the increasing demand for freight transport and logistics services. The rise in e-commerce and trade activities has led to a surge in the number of commercial vehicles on the road, thereby boosting the demand for axles. Additionally, the heavy machinery segment is also witnessing growth due to ongoing construction projects in the region.

The Kuwait Automotive Axle Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait Automotive Industries Company, Al-Mansour Automotive Company, Alghanim Industries, Al-Futtaim Group, Al-Jazeera Automotive, Al-Muhaidib Group, Al-Sayer Group, Al-Mazaya Holding, Al-Babtain Group, Al-Khaldi Group, Al-Qatami Group, Al-Mansour Automotive, Al-Muhanna Group, Al-Sabhan Group, Al-Hamra Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait automotive axle market appears promising, driven by trends such as the increasing adoption of electric vehicles (EVs) and advancements in remanufacturing technologies. As the government supports EV infrastructure and sustainability initiatives, the demand for specialized axles tailored for electric vehicles is likely to grow. Additionally, the integration of digital platforms in automotive retail will enhance the sourcing and distribution of axle components, further stimulating market activity and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Light-duty axles Heavy-duty axles Semi-trailer axles Others |

| By End-User | Passenger vehicles Commercial vehicles Heavy machinery Others |

| By Vehicle Type | Trucks Buses SUVs Others |

| By Material | Steel Aluminum Composite materials Others |

| By Application | On-road vehicles Off-road vehicles Industrial applications Others |

| By Distribution Channel | Direct sales Distributors Online sales Others |

| By Region | Central Kuwait Northern Kuwait Southern Kuwait Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OEM Axle Manufacturers | 60 | Production Managers, Quality Assurance Heads |

| Aftermarket Suppliers | 50 | Sales Directors, Product Managers |

| Automotive Component Distributors | 40 | Logistics Coordinators, Inventory Managers |

| Regulatory Bodies | 40 | Policy Analysts, Compliance Officers |

| Automotive Industry Experts | 40 | Consultants, Market Analysts |

The Kuwait Automotive Axle Market is valued at approximately USD 4.2 billion, driven by steady consumption in heavy vehicles and aftermarket demand, supported by expanding logistics and construction vehicle fleets.