Region:Middle East

Author(s):Shubham

Product Code:KRAD3699

Pages:92

Published On:November 2025

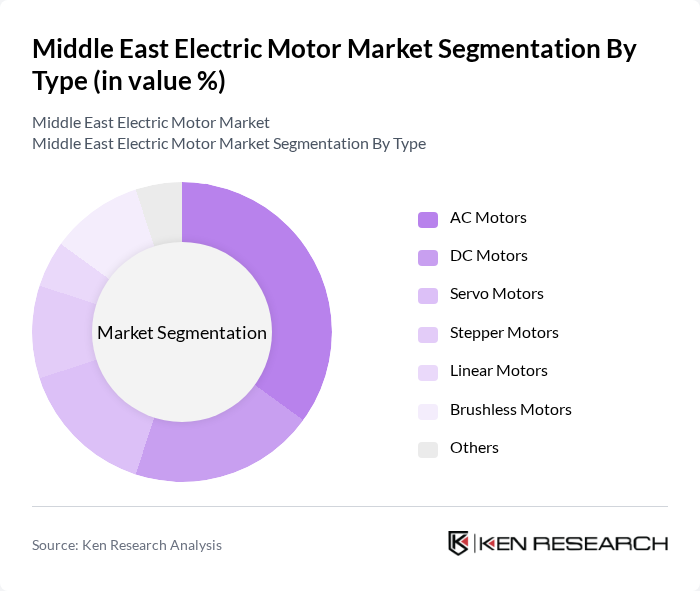

By Type:The electric motor market can be segmented into various types, including AC Motors, DC Motors, Servo Motors, Stepper Motors, Linear Motors, Brushless Motors, and Others. Each type serves distinct applications and industries, with varying levels of demand based on efficiency, performance, and technological advancements.

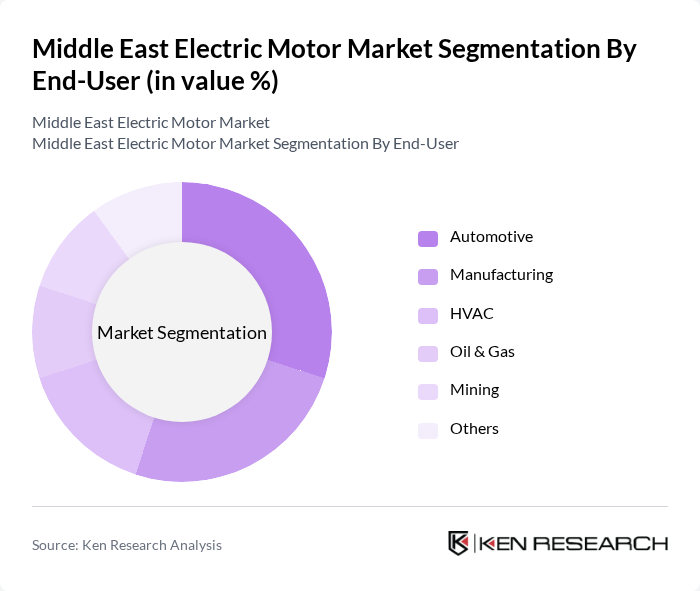

By End-User:The electric motor market is segmented by end-user industries, including Automotive, Manufacturing, HVAC, Oil & Gas, Mining, and Others. Each sector has unique requirements and applications for electric motors, influencing the overall market dynamics and growth trends.

The Middle East Electric Motor Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens AG, ABB Ltd., Schneider Electric, General Electric, Nidec Corporation, WEG Industries, Regal Beloit Corporation, Mitsubishi Electric, Rockwell Automation, Emerson Electric Co., Yaskawa Electric Corporation, Danfoss A/S, Baldor Electric Company, Toshiba Corporation, Hitachi Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East electric motor market appears promising, driven by a combination of technological advancements and increasing regulatory support for energy efficiency. As industries continue to embrace automation and smart technologies, the integration of IoT in electric motors is expected to enhance operational efficiencies. Furthermore, the ongoing push for sustainable energy solutions will likely lead to increased investments in electric motor technologies, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | AC Motors DC Motors Servo Motors Stepper Motors Linear Motors Brushless Motors Others |

| By End-User | Automotive Manufacturing HVAC Oil & Gas Mining Others |

| By Application | Pumps Fans Compressors Conveyors Robotics Others |

| By Voltage | Low Voltage Medium Voltage High Voltage Others |

| By Region | GCC Countries Levant Region North Africa Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Others |

| By Industry Standards | ISO Standards IEC Standards NEMA Standards Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Industrial Electric Motors | 150 | Manufacturing Managers, Production Engineers |

| Commercial Electric Motors | 100 | Facility Managers, Operations Directors |

| Residential Electric Motors | 80 | Home Appliance Manufacturers, Retail Buyers |

| Electric Motor Distributors | 70 | Sales Managers, Distribution Network Coordinators |

| Electric Motor Repair Services | 60 | Service Technicians, Repair Shop Owners |

The Middle East Electric Motor Market is valued at approximately USD 3.5 billion, driven by the increasing demand for energy-efficient solutions and the expansion of manufacturing and automotive sectors across the region.