Region:Middle East

Author(s):Geetanshi

Product Code:KRAB2713

Pages:95

Published On:October 2025

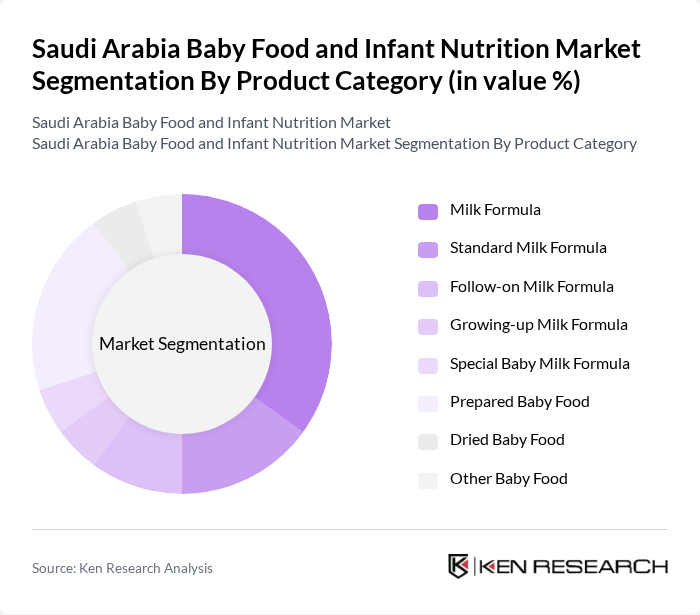

By Product Category:The product category segmentation encompasses a variety of baby food products tailored to different nutritional needs and parental preferences. The market is primarily driven by demand for milk formulas, which are essential for infant nutrition, followed by prepared and dried baby foods. The trend towards organic products is increasingly significant, as parents seek healthier and safer options for their children .

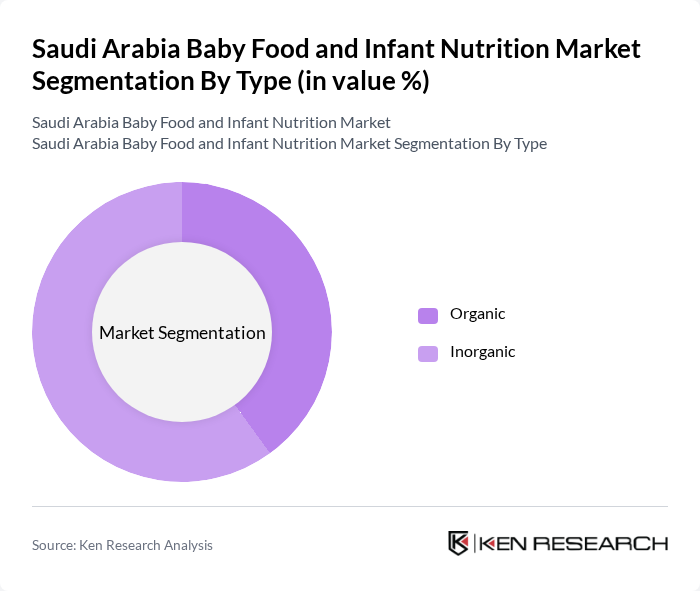

By Type:The type segmentation differentiates between organic and inorganic baby food products. Organic baby food is increasingly favored by health-conscious parents who prioritize natural ingredients and sustainability. Inorganic products remain popular due to their affordability and widespread availability. The market is witnessing a gradual shift towards organic options, driven by rising consumer awareness of health and nutrition .

The Saudi Arabia Baby Food and Infant Nutrition Market features a dynamic mix of regional and international players. Leading participants such as Nestlé S.A., Danone S.A., Abbott Laboratories, Mead Johnson Nutrition Company, Hero Group, FrieslandCampina, Hain Celestial Group, Perrigo Company plc, Bledina (part of Danone), Bellamy's Organic, Earth's Best (part of Hain Celestial), Nutricia (part of Danone), Baby Gourmet Foods Inc., Plum Organics (part of Campbell Soup Company), Little Spoon, Almarai Company, Nuralac (Nutridar), Similac (Abbott), Kendamil, Hipp GmbH & Co. Vertrieb KG contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia baby food and infant nutrition market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As parents increasingly seek convenience and quality, the demand for ready-to-eat and organic products is expected to rise. Additionally, the integration of digital platforms for marketing and sales will enhance brand visibility and consumer engagement, fostering a more competitive landscape. Companies that adapt to these trends will likely capture a larger share of the growing market.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Milk Formula Standard Milk Formula Follow-on Milk Formula Growing-up Milk Formula Special Baby Milk Formula Prepared Baby Food Dried Baby Food Other Baby Food |

| By Type | Organic Inorganic |

| By Age Group | 6 months 12 months 24 months Others |

| By Distribution Channel | Hypermarkets Supermarkets Specialty Stores Convenience Stores Online Retail Others |

| By Packaging Type | Jars Pouches Tetra packs Cans Others |

| By Price Range | Economy Mid-range Premium Others |

| By Nutritional Content | High protein Low sugar Fortified Others |

| By Brand Type | National brands Private labels Imported brands Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Baby Food Sales | 150 | Store Managers, Category Buyers |

| Healthcare Professional Insights | 100 | Pediatricians, Nutritionists |

| Parental Purchasing Behavior | 150 | Parents of infants aged 0-24 months |

| Market Trends in Organic Baby Food | 80 | Health-Conscious Parents, Organic Product Retailers |

| Consumer Attitudes Towards Baby Food Brands | 120 | Caregivers, Childcare Providers |

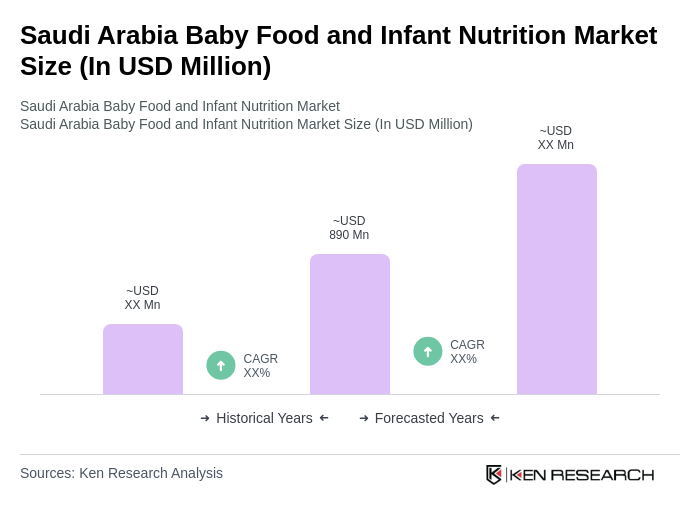

The Saudi Arabia Baby Food and Infant Nutrition Market is valued at approximately USD 890 million, reflecting a significant growth trend driven by rising birth rates, increasing disposable incomes, and heightened awareness of infant nutrition among parents.