Region:Middle East

Author(s):Shubham

Product Code:KRAD6707

Pages:97

Published On:December 2025

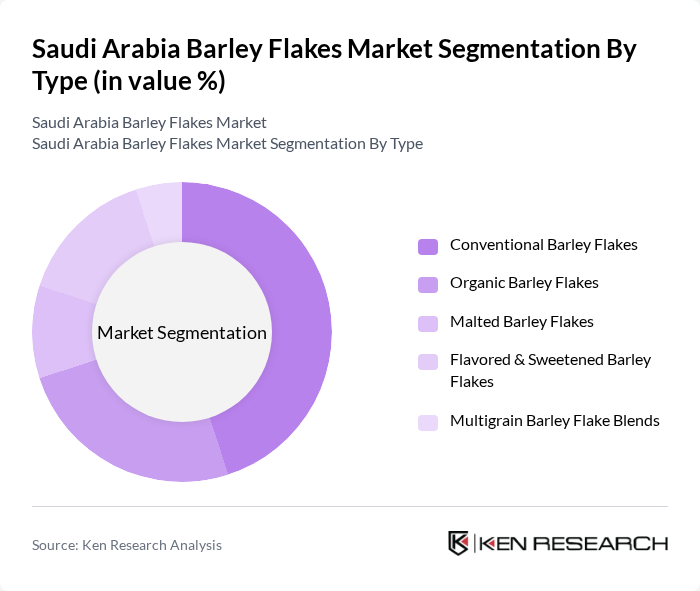

By Type:

The market is segmented into five types: Conventional Barley Flakes, Organic Barley Flakes, Malted Barley Flakes, Flavored & Sweetened Barley Flakes, and Multigrain Barley Flake Blends. Among these, Conventional Barley Flakes dominate the market due to their affordability and widespread availability. However, Organic Barley Flakes are gaining traction as health-conscious consumers increasingly prefer organic products free from synthetic chemicals. The demand for Flavored & Sweetened Barley Flakes is also on the rise, particularly among younger consumers seeking convenient and tasty breakfast options.

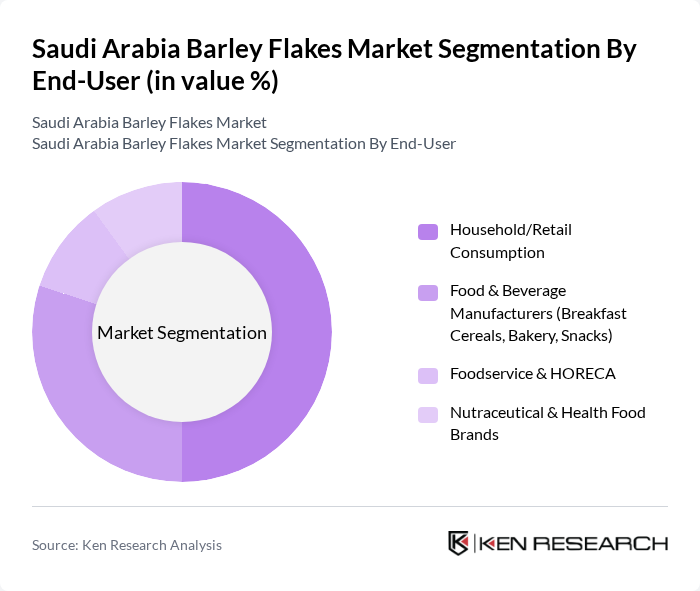

By End-User:

The end-user segmentation includes Household/Retail Consumption, Food & Beverage Manufacturers (Breakfast Cereals, Bakery, Snacks), Foodservice & HORECA, and Nutraceutical & Health Food Brands. Household/Retail Consumption is the leading segment, driven by the increasing trend of home-cooked meals and the demand for healthy breakfast options. Food & Beverage Manufacturers are also significant contributors, as they incorporate barley flakes into various products such as cereals, snacks, and health supplements to enhance nutritional value and texture.

The Saudi Arabia Barley Flakes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savola Group (Afia, Goody and related food brands), Almarai Company, Al Rabie Saudi Foods Co., Kellogg Company (including Kellanova brand presence in Saudi Arabia), Nestlé Saudi Arabia (including Nestlé breakfast cereals and health brands), General Mills (including Cheerios and other cereal brands active in KSA), Quaker (PepsiCo) – Middle East & Saudi Arabia Operations, Local and Regional Private Label Manufacturers (Modern Trade & Wholesale), Olam Agri – Grain Trading and Processing Operations in Saudi Arabia, Archer Daniels Midland (ADM) – Barley and Cereal Ingredients Supply to KSA, E.A. Juffali & Brothers – Food & FMCG Distribution Activities, Al Othaim Markets – Private Label Cereals & Grains, Panda Retail Company – Private Label Breakfast Cereals & Grains, Carrefour Saudi Arabia (Majid Al Futtaim Retail) – Private Label Cereals, Lulu Hypermarket Saudi Arabia – Imported and Private Label Barley Flakes Range contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia barley flakes market is poised for significant growth, driven by increasing health consciousness and the demand for convenient food options. As retail channels expand and e-commerce gains traction, accessibility will improve, allowing more consumers to discover barley flakes. Additionally, the trend towards organic and sustainable products is expected to shape future offerings, encouraging innovation and diversification in product lines to meet evolving consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Type | Conventional Barley Flakes Organic Barley Flakes Malted Barley Flakes Flavored & Sweetened Barley Flakes Multigrain Barley Flake Blends |

| By End-User | Household/Retail Consumption Food & Beverage Manufacturers (Breakfast Cereals, Bakery, Snacks) Foodservice & HORECA Nutraceutical & Health Food Brands |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores & Grocery Stores Online Retail & E-commerce Platforms Specialty Health & Organic Stores |

| By Packaging Type | Flexible Pouches & Bags Paperboard Boxes & Cartons Bulk/Sack Packaging (B2B) Eco-friendly & Recyclable Packaging |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Al Khobar) Southern & Northern Regions |

| By Consumer Demographics | Age Group (Children, Young Adults, Middle-aged, Seniors) Income Level (Mass, Mid, Premium) Lifestyle (Health-conscious, Weight-management, Convenience-seekers) Expat vs Local Consumers |

| By Nutritional Positioning | High Fiber / Beta-glucan Rich High Protein / Fortified Clean-label / Minimal Ingredient Functional & Fortified (Vitamins, Minerals) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences | 120 | Health-conscious Consumers, Families |

| Distribution Channel Analysis | 80 | Distributors, Wholesalers |

| Production Insights | 60 | Manufacturers, Production Managers |

| Market Trends and Innovations | 70 | Food Scientists, Product Developers |

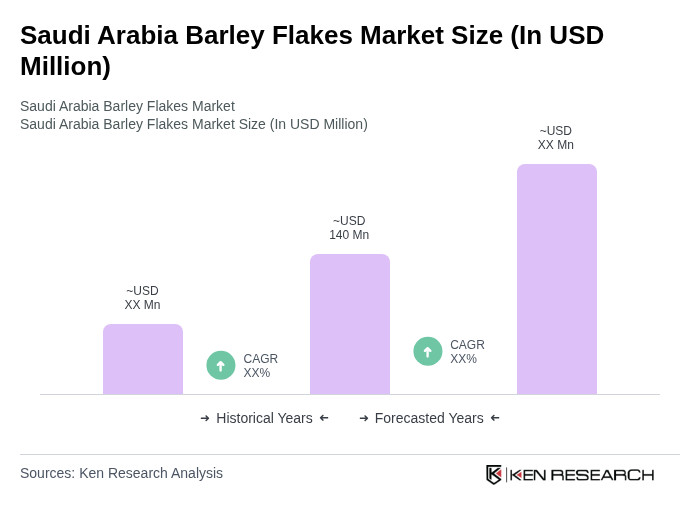

The Saudi Arabia Barley Flakes Market is valued at approximately USD 140 million, reflecting a significant growth trend driven by increasing health consciousness and demand for nutritious breakfast options among consumers.