Region:Middle East

Author(s):Geetanshi

Product Code:KRAA9088

Pages:81

Published On:November 2025

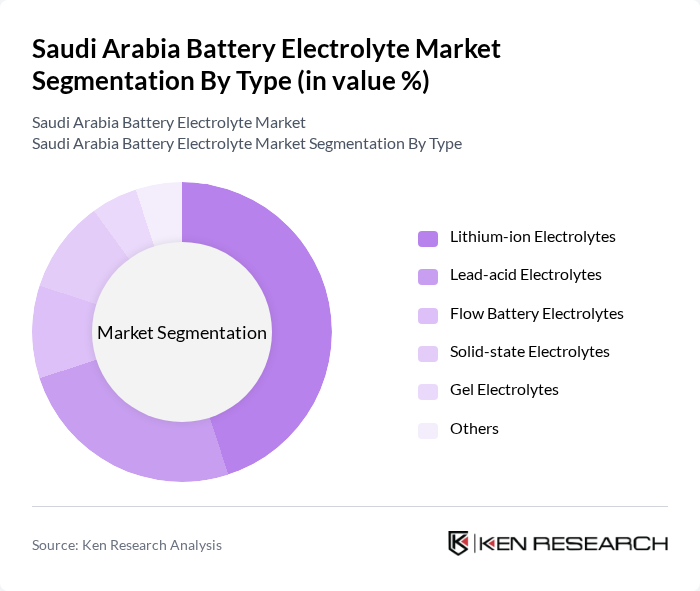

By Type:The market is segmented into various types of electrolytes, including Lithium-ion Electrolytes, Lead-acid Electrolytes, Flow Battery Electrolytes, Solid-state Electrolytes, Gel Electrolytes, and Others. Among these, Lithium-ion Electrolytes dominate the market due to their widespread application in electric vehicles and portable electronics, driven by their high energy density and efficiency. The increasing adoption of electric vehicles and renewable energy storage systems has further solidified the position of Lithium-ion Electrolytes as the leading sub-segment .

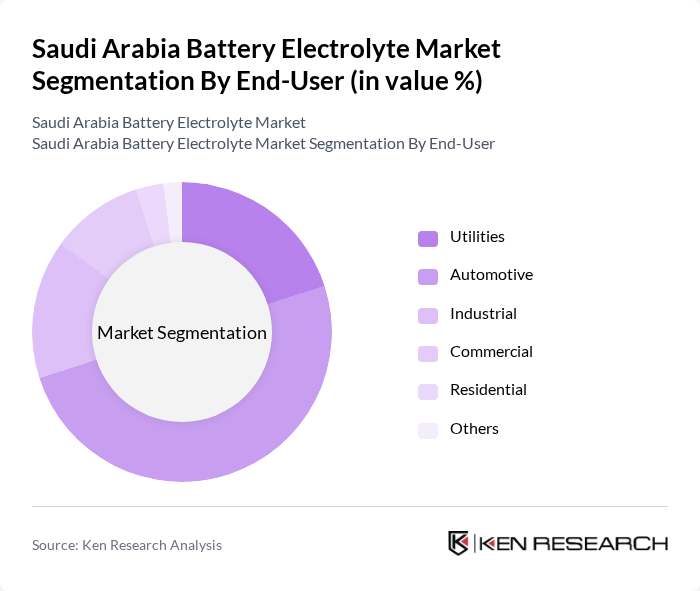

By End-User:The end-user segmentation includes Utilities, Automotive, Industrial, Commercial, Residential, and Others. The Automotive sector is the leading end-user, primarily due to the rapid growth of electric vehicle production and the increasing demand for energy storage solutions. The shift towards electric mobility and the need for efficient energy management systems in various applications have propelled the automotive sector to the forefront of the battery electrolyte market .

The Saudi Arabia Battery Electrolyte Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Advanced Petrochemical Company, EV Metals Group plc, National Industrialization Company (Tasnee), Al-Fanar Company, Al-Babtain Power & Telecommunication Co., Gulf Batteries Company Limited, Gulf Chemical Industries Co. (GCI), Al-Khodari & Sons Company, Saudi Arabian Oil Company (Saudi Aramco), Al-Rajhi Holding Group, Al-Faisaliah Group, Middle East Battery Company (MEBCO), Al-Suwaidi Industrial Services, and Saudi Electricity Company (SEC) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia battery electrolyte market appears promising, driven by the increasing adoption of electric vehicles and the expansion of renewable energy projects. As the government continues to invest in local battery production and infrastructure, the market is expected to witness significant advancements in technology and efficiency. Additionally, the focus on sustainable materials and smart grid integration will likely shape the development of innovative electrolyte solutions, enhancing overall market competitiveness and resilience.

| Segment | Sub-Segments |

|---|---|

| By Type | Lithium-ion Electrolytes Lead-acid Electrolytes Flow Battery Electrolytes Solid-state Electrolytes Gel Electrolytes Others |

| By End-User | Utilities Automotive Industrial Commercial Residential Others |

| By Application | Grid Storage Electric Vehicles Portable Electronics Renewable Energy Integration Others |

| By Distribution Channel | Direct Sales Distributors Online Retail Retail Outlets Others |

| By Geography | Riyadh (Central Region) Eastern Region (Dammam, Jubail) Western Region (Jeddah, Makkah) Southern Region Others |

| By Technology | Battery Energy Storage Systems (BESS) Hybrid Systems Advanced Electrolytes Conventional Electrolytes Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Battery Manufacturers | 60 | Production Managers, Technical Directors |

| Consumer Electronics Battery Suppliers | 50 | Product Managers, Supply Chain Analysts |

| Renewable Energy Storage Solutions | 40 | Project Managers, Energy Consultants |

| Research Institutions in Battery Technology | 40 | Research Scientists, Academic Professors |

| Government Regulatory Bodies | 20 | Policy Makers, Regulatory Affairs Specialists |

The Saudi Arabia Battery Electrolyte Market is valued at approximately USD 530 million, reflecting a significant demand for battery materials driven by the growth of electric vehicles and renewable energy storage solutions.