Region:Middle East

Author(s):Shubham

Product Code:KRAC4338

Pages:92

Published On:October 2025

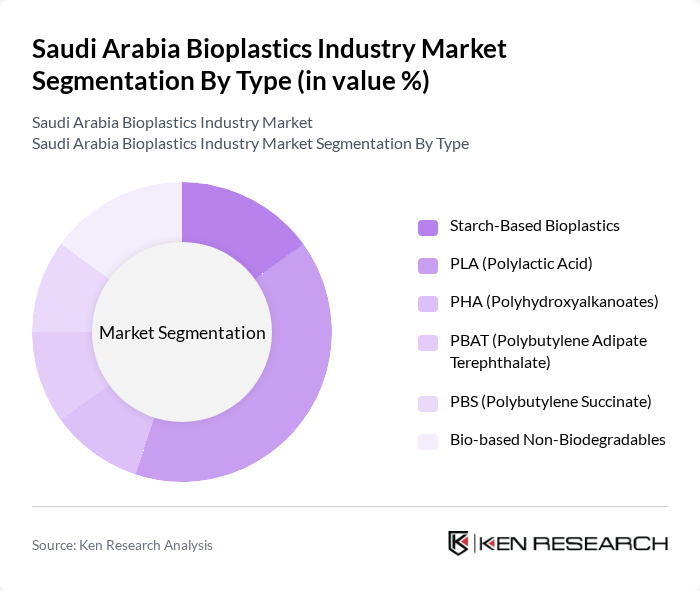

By Type:The bioplastics market in Saudi Arabia is segmented into various types, including Starch-Based Bioplastics, PLA (Polylactic Acid), PHA (Polyhydroxyalkanoates), PBAT (Polybutylene Adipate Terephthalate), PBS (Polybutylene Succinate), and Bio-based Non-Biodegradables. Among these, PLA is currently the leading subsegment due to its versatility and widespread application in packaging and consumer goods. The increasing consumer preference for eco-friendly products is driving the demand for PLA, making it a dominant player in the market.

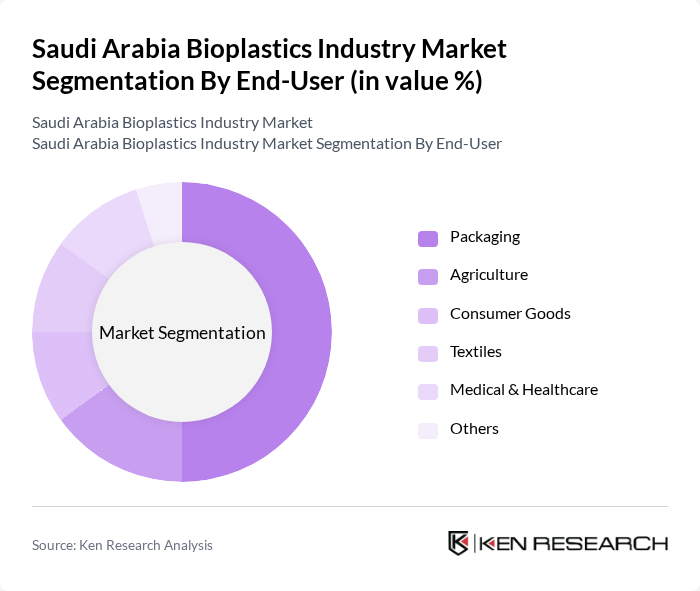

By End-User:The end-user segmentation of the bioplastics market includes Packaging, Agriculture, Consumer Goods, Textiles, Medical & Healthcare, and Others. The Packaging segment is the most significant contributor, driven by the increasing demand for sustainable packaging solutions in the food and beverage industry. As consumers become more environmentally conscious, companies are shifting towards bioplastics to meet regulatory requirements and consumer preferences.

The Saudi Arabia Bioplastics Industry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Plastus, BASF SE, NatureWorks LLC, Novamont S.p.A., Braskem S.A., Total Corbion PLA, Mitsubishi Chemical Corporation, Danimer Scientific, FKuR Kunststoff GmbH, Cardia Bioplastics contribute to innovation, geographic expansion, and service delivery in this space.

The future of the bioplastics industry in Saudi Arabia appears promising, driven by increasing environmental awareness and supportive government policies. As consumer preferences shift towards sustainable products, the demand for bioplastics is expected to rise. Innovations in biopolymer development and enhanced production technologies will likely reduce costs, making bioplastics more competitive. Additionally, collaboration between industry players and research institutions will foster advancements, ensuring that the market adapts to evolving consumer needs and regulatory frameworks.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch-Based Bioplastics PLA (Polylactic Acid) PHA (Polyhydroxyalkanoates) PBAT (Polybutylene Adipate Terephthalate) PBS (Polybutylene Succinate) Bio-based Non-Biodegradables |

| By End-User | Packaging Agriculture Consumer Goods Textiles Medical & Healthcare Others |

| By Application | Food Packaging Disposable Cutlery & Tableware Agricultural Films Flexible Packaging Others |

| By Distribution Channel | Direct Sales to Manufacturers Distributors & Wholesalers Online Retail Platforms Retail Stores Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Mecca) Southern Region Northern Region |

| By Price Range | Low Price (Budget Segment) Mid Price (Standard Segment) High Price (Premium Segment) |

| By Policy Support | Government Subsidies Tax Exemptions & Incentives Research Grants & R&D Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bioplastics Manufacturers | 60 | Production Managers, Operations Directors |

| Packaging Industry Stakeholders | 50 | Product Development Managers, Sustainability Officers |

| Agricultural Bioplastics Users | 40 | Agronomists, Farm Managers |

| Consumer Goods Companies | 45 | Brand Managers, Supply Chain Coordinators |

| Regulatory Bodies and NGOs | 40 | Policy Makers, Environmental Analysts |

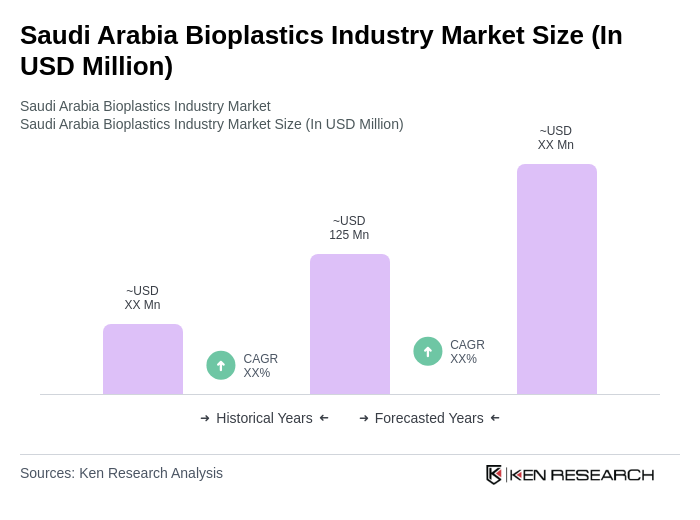

The Saudi Arabia Bioplastics Industry Market is valued at approximately USD 125 million, reflecting a five-year historical analysis. This growth is attributed to increasing environmental awareness and demand for biodegradable products across various sectors.