Region:Middle East

Author(s):Shubham

Product Code:KRAD5347

Pages:84

Published On:December 2025

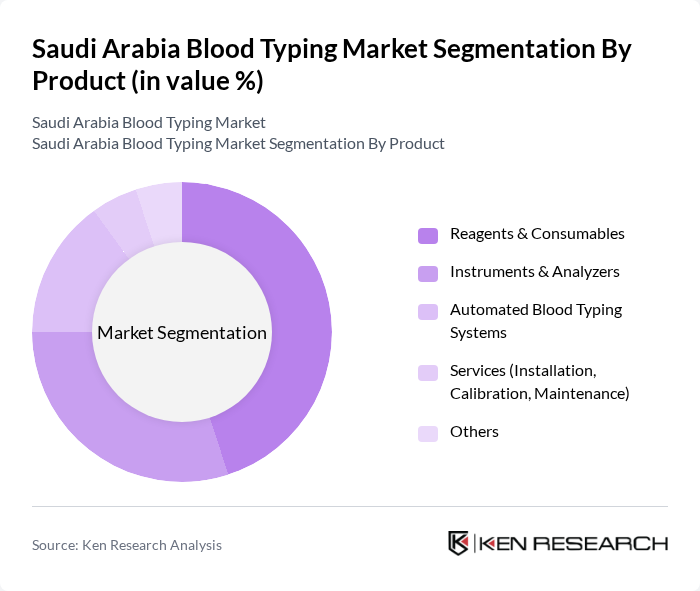

By Product:The market is segmented into various products including reagents & consumables, instruments & analyzers, automated blood typing systems, services (installation, calibration, maintenance), and others. Among these, reagents & consumables are the most significant due to their essential role in routine serology and confirmatory blood typing procedures, and this category accounts for the largest revenue share in Saudi Arabia. The increasing demand for accurate and rapid blood typing tests in emergency care, surgery, oncology, and prenatal testing, along with a shift toward gel cards, microplates, and molecular kits, drives the growth of this subsegment as healthcare providers seek reliable and automated solutions to enhance patient care and laboratory efficiency.

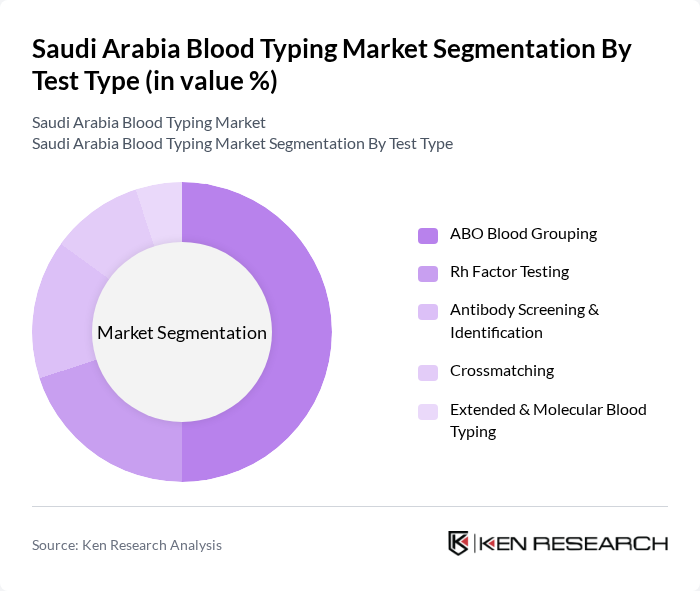

By Test Type:The market is further segmented by test types, including ABO blood grouping, Rh factor testing, antibody screening & identification, crossmatching, and extended & molecular blood typing. ABO blood grouping is the leading subsegment, driven by its fundamental importance in transfusion medicine and its use in virtually all donor and recipient compatibility assessments. The widespread use of this test in hospitals, trauma centers, and blood banks ensures its dominance in the market, as it is critical for safe blood transfusions, surgical procedures, organ transplantation, and obstetric care, while Rh factor testing and antibody screening are also gaining importance with rising high?risk pregnancies and complex transfusion cases.

The Saudi Arabia Blood Typing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Danaher Corporation (Beckman Coulter), Bio-Rad Laboratories, Inc., Grifols, S.A., Thermo Fisher Scientific Inc., Merck KGaA (MilliporeSigma), Quotient Limited, Ortho Clinical Diagnostics (QuidelOrtho Corporation), Abbott Laboratories, Siemens Healthineers AG, F. Hoffmann-La Roche Ltd, Seegene Inc., Sysmex Corporation, Beckman Coulter Saudi Arabia / Local Distributor Partners, Bio-Rad Saudi Arabia / Local Distributor Partners, Grifols Saudi Arabia / Local Distributor Partners contribute to innovation, geographic expansion, and service delivery in this space, particularly through serology reagents, gel-card systems, automated analyzers, and molecular typing platforms adopted by Saudi blood banks and hospital laboratories.

The future of the blood typing market in Saudi Arabia appears promising, driven by ongoing advancements in technology and increasing healthcare investments. As the government continues to enhance healthcare infrastructure, the integration of automated systems and AI in blood typing processes is expected to improve efficiency and accuracy. Additionally, the rising focus on personalized medicine will likely create new avenues for blood typing applications, further solidifying the market's growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product | Reagents & Consumables Instruments & Analyzers Automated Blood Typing Systems Services (Installation, Calibration, Maintenance) Others |

| By Test Type | ABO Blood Grouping Rh Factor Testing Antibody Screening & Identification Crossmatching Extended & Molecular Blood Typing |

| By Technology | Serology-based Testing (Tube, Slide, Card) Gel Card Technology Microplate & Column Agglutination Molecular / NAT-based Blood Typing Point-of-care Blood Typing Devices |

| By End-User | Public Hospitals Private Hospitals & Clinics Blood Banks & Transfusion Centers Diagnostic & Reference Laboratories Research & Academic Institutes |

| By Application | Blood Transfusion & Blood Bank Screening Organ & Stem Cell Transplantation Prenatal & Neonatal Testing Surgical & Emergency Medicine Others |

| By Region | Central Region (Riyadh, Qassim) Western Region (Makkah, Jeddah, Madinah) Eastern Region (Dammam, Al Khobar, Al Ahsa) Southern Region (Asir, Jizan, Najran) Northern Region (Tabuk, Hail, Al Jouf) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Blood Banks | 120 | Blood Bank Managers, Transfusion Medicine Specialists |

| Private Clinics | 80 | General Practitioners, Laboratory Technicians |

| Blood Donation Organizations | 45 | Program Coordinators, Outreach Managers |

| Healthcare Regulatory Bodies | 40 | Policy Makers, Health Inspectors |

| Medical Equipment Suppliers | 50 | Sales Managers, Product Specialists |

The Saudi Arabia Blood Typing Market is valued at approximately USD 15 million, reflecting a five-year historical analysis. This growth is driven by the increasing prevalence of blood-related disorders and advancements in blood typing technologies.