Region:Middle East

Author(s):Shubham

Product Code:KRAC4285

Pages:89

Published On:October 2025

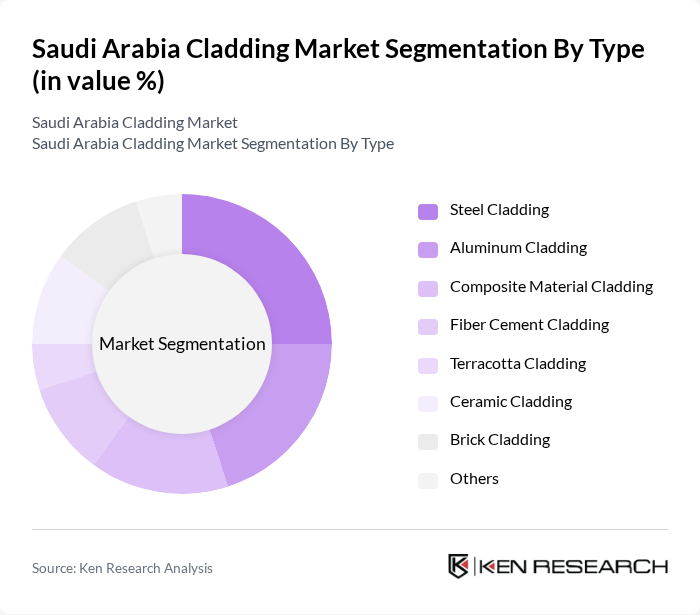

By Type:The segmentation by type includes various materials used for cladding, which are essential for both aesthetic and functional purposes in construction. The subsegments include Steel Cladding, Aluminum Cladding, Composite Material Cladding, Fiber Cement Cladding, Terracotta Cladding, Ceramic Cladding, Brick Cladding, and Others. Each type offers unique benefits, such as durability, insulation, and design flexibility, catering to different consumer preferences and project requirements .

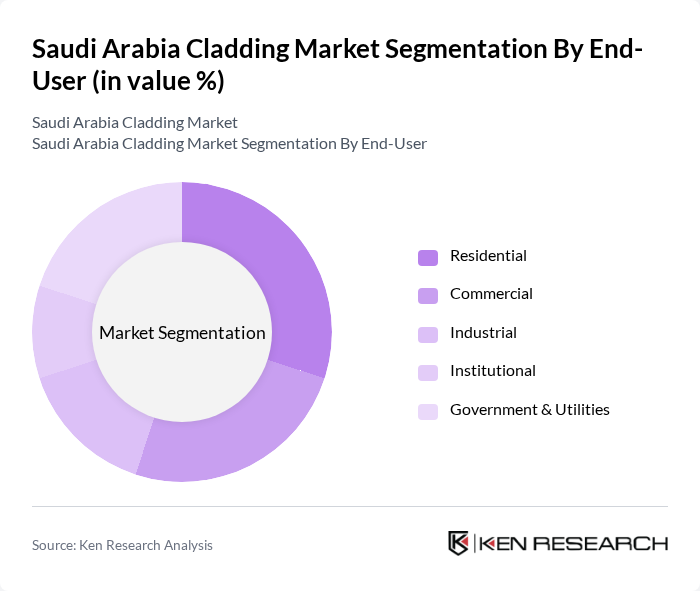

By End-User:The segmentation by end-user includes various sectors that utilize cladding materials, such as Residential, Commercial, Industrial, Institutional, and Government & Utilities. Each sector has distinct requirements and preferences for cladding materials, influenced by factors like building codes, aesthetic considerations, and functional needs .

The Saudi Arabia Cladding Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Ceramics Company, Al Abbar Group, Al-Fouzan Trading & General Construction Co., Al Jazeera Paints Company, Saudi Building Materials Company (SBMC), Al Kifah Holding Company, Al Rajhi Construction, Middle East Insulation LLC, Kingspan Group PLC, SFS Group AG, Cladding Corp, Carea Facade, Al Yamama Company, Al Bawani Co. Ltd., Al Zamil Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia cladding market is poised for significant transformation as urbanization and government initiatives drive demand for innovative building solutions. With a focus on sustainability and energy efficiency, the market is likely to see increased adoption of eco-friendly materials and smart technologies. As the construction sector expands, particularly in mega-projects, the integration of advanced cladding solutions will become essential. This evolution will not only enhance building aesthetics but also contribute to the overall sustainability goals outlined in Vision 2030.

| Segment | Sub-Segments |

|---|---|

| By Type | Steel Cladding Aluminum Cladding Composite Material Cladding Fiber Cement Cladding Terracotta Cladding Ceramic Cladding Brick Cladding Others |

| By End-User | Residential Commercial Industrial Institutional Government & Utilities |

| By Application | New Construction Renovation Facade Improvement |

| By Distribution Channel | Direct Sales Distributors Online Sales |

| By Material Source | Domestic Suppliers International Suppliers |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants for Sustainable Practices |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Commercial Building Cladding | 45 | Architects, Project Managers |

| Residential Cladding Solutions | 40 | Home Builders, Contractors |

| Industrial Facility Cladding | 35 | Facility Managers, Procurement Officers |

| Cladding Material Suppliers | 42 | Sales Managers, Product Development Managers |

| Sustainable Cladding Innovations | 38 | R&D Managers, Sustainability Consultants |

The Saudi Arabia Cladding Market is valued at approximately USD 3.5 billion, driven by factors such as rapid urbanization, a booming construction sector, and increasing demand for energy-efficient and sustainable building materials.