Region:Middle East

Author(s):Rebecca

Product Code:KRAB5336

Pages:92

Published On:October 2025

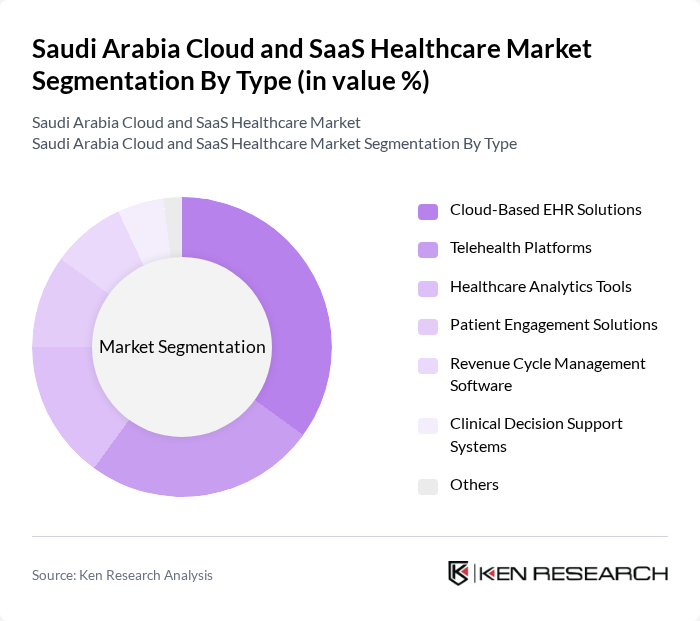

By Type:The market is segmented into various types, including Cloud-Based EHR Solutions, Telehealth Platforms, Healthcare Analytics Tools, Patient Engagement Solutions, Revenue Cycle Management Software, Clinical Decision Support Systems, and Others. Among these, Cloud-Based EHR Solutions are leading due to their ability to streamline patient data management and enhance interoperability across healthcare systems.

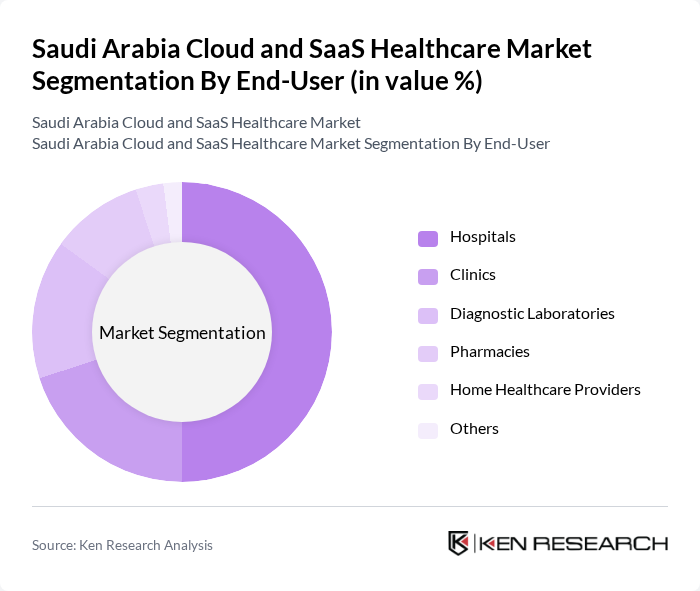

By End-User:The end-user segmentation includes Hospitals, Clinics, Diagnostic Laboratories, Pharmacies, Home Healthcare Providers, and Others. Hospitals are the dominant end-user segment, driven by the need for comprehensive healthcare solutions that improve operational efficiency and patient care.

The Saudi Arabia Cloud and SaaS Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers, Cerner Corporation, Philips Healthcare, Allscripts Healthcare Solutions, Medtronic, IBM Watson Health, Oracle Health Sciences, GE Healthcare, eClinicalWorks, NextGen Healthcare, McKesson Corporation, Infor Healthcare, Epic Systems Corporation, Zynx Health, and Health Catalyst contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia Cloud and SaaS healthcare market appears promising, driven by ongoing digital transformation initiatives and increasing healthcare investments. As telehealth services expand, healthcare providers are likely to adopt more integrated solutions that enhance patient engagement and streamline operations. Furthermore, the integration of AI and machine learning technologies is expected to revolutionize data analytics, improving decision-making processes and patient outcomes across the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Cloud-Based EHR Solutions Telehealth Platforms Healthcare Analytics Tools Patient Engagement Solutions Revenue Cycle Management Software Clinical Decision Support Systems Others |

| By End-User | Hospitals Clinics Diagnostic Laboratories Pharmacies Home Healthcare Providers Others |

| By Application | Patient Management Data Management Billing and Revenue Management Compliance Management Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud |

| By Pricing Model | Subscription-Based Pay-Per-Use Licensing |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Policy Support | Government Grants Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital IT Infrastructure | 100 | IT Managers, Chief Information Officers |

| Healthcare SaaS Adoption | 80 | Healthcare Administrators, Procurement Officers |

| Telemedicine Solutions | 70 | Telehealth Coordinators, Medical Directors |

| Data Security in Healthcare | 60 | Compliance Officers, Data Protection Managers |

| Patient Management Systems | 90 | Clinical Managers, Operations Directors |

The Saudi Arabia Cloud and SaaS Healthcare Market is valued at approximately USD 1.2 billion, driven by the increasing adoption of digital health solutions and government initiatives aimed at enhancing healthcare infrastructure and patient management systems.