Region:Middle East

Author(s):Rebecca

Product Code:KRAB2941

Pages:95

Published On:October 2025

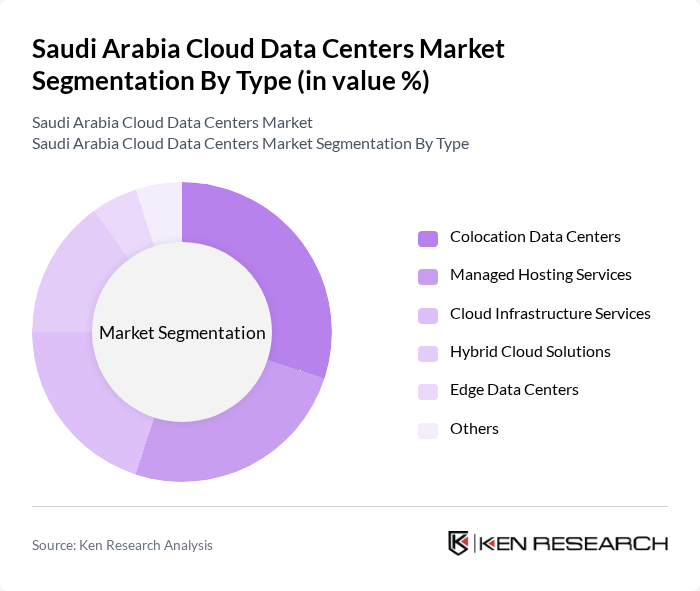

By Type:The market is segmented into various types, including Colocation Data Centers, Managed Hosting Services, Cloud Infrastructure Services, Hybrid Cloud Solutions, Edge Data Centers, and Others. Each of these segments caters to different customer needs and preferences, with specific advantages that appeal to various industries.

The Colocation Data Centers segment is currently leading the market due to the increasing demand for secure and scalable data storage solutions. Businesses are opting for colocation services to reduce costs associated with building and maintaining their own data centers. This trend is particularly prevalent among SMEs and large enterprises looking to enhance their IT infrastructure without significant capital investment. Managed Hosting Services also show strong growth, driven by the need for businesses to outsource their IT operations to focus on core activities.

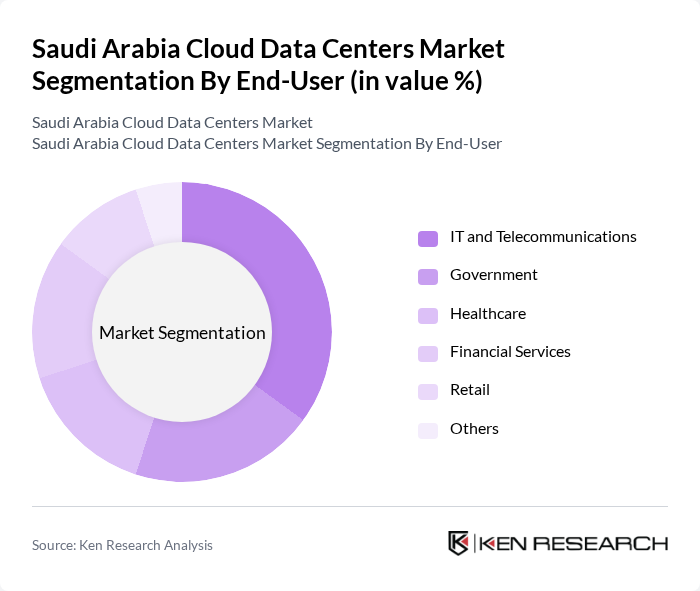

By End-User:The market is segmented by end-users, including IT and Telecommunications, Government, Healthcare, Financial Services, Retail, and Others. Each sector has unique requirements and challenges that drive the adoption of cloud data center services.

The IT and Telecommunications sector is the largest end-user of cloud data center services, driven by the need for high-speed connectivity and data processing capabilities. This sector's rapid growth is fueled by the increasing demand for cloud-based applications and services. The Government sector is also a significant contributor, as public institutions are increasingly adopting cloud solutions to enhance service delivery and operational efficiency. The Healthcare and Financial Services sectors are growing rapidly as they seek secure and compliant data storage solutions.

The Saudi Arabia Cloud Data Centers Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Cloud, Mobily, Zain KSA, Oracle Cloud, Microsoft Azure, Amazon Web Services (AWS), IBM Cloud, Alibaba Cloud, Gulf Data Hub, NTT Communications, Equinix, DigitalOcean, Rackspace Technology, VIRTUS Data Centres, Khazna Data Centers contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia cloud data centers market appears promising, driven by ongoing digital transformation and government initiatives. By future, the market is expected to witness a significant shift towards hybrid cloud solutions, as businesses seek flexibility and scalability. Additionally, the emphasis on sustainability will likely lead to increased investments in energy-efficient technologies, aligning with global trends. As the demand for data sovereignty grows, local data centers will play a crucial role in meeting regulatory requirements and enhancing consumer trust.

| Segment | Sub-Segments |

|---|---|

| By Type | Colocation Data Centers Managed Hosting Services Cloud Infrastructure Services Hybrid Cloud Solutions Edge Data Centers Others |

| By End-User | IT and Telecommunications Government Healthcare Financial Services Retail Others |

| By Application | Data Storage and Backup Disaster Recovery Big Data Analytics Application Hosting Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Tax Incentives Subsidies for Infrastructure Development Regulatory Support for Green Initiatives Others |

| By Service Model | Infrastructure as a Service (IaaS) Platform as a Service (PaaS) Software as a Service (SaaS) Others |

| By Deployment Model | Public Cloud Private Cloud Hybrid Cloud Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise Cloud Adoption | 150 | IT Managers, CTOs, CIOs |

| Data Center Operations | 100 | Data Center Managers, Operations Directors |

| Cloud Security Solutions | 80 | Security Analysts, Compliance Officers |

| SME Cloud Utilization | 70 | Business Owners, IT Consultants |

| Public Sector Cloud Initiatives | 60 | Government IT Officials, Policy Makers |

The Saudi Arabia Cloud Data Centers Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by digital transformation, e-commerce expansion, and government initiatives aimed at fostering a knowledge-based economy.