Region:Middle East

Author(s):Rebecca

Product Code:KRAE2845

Pages:97

Published On:February 2026

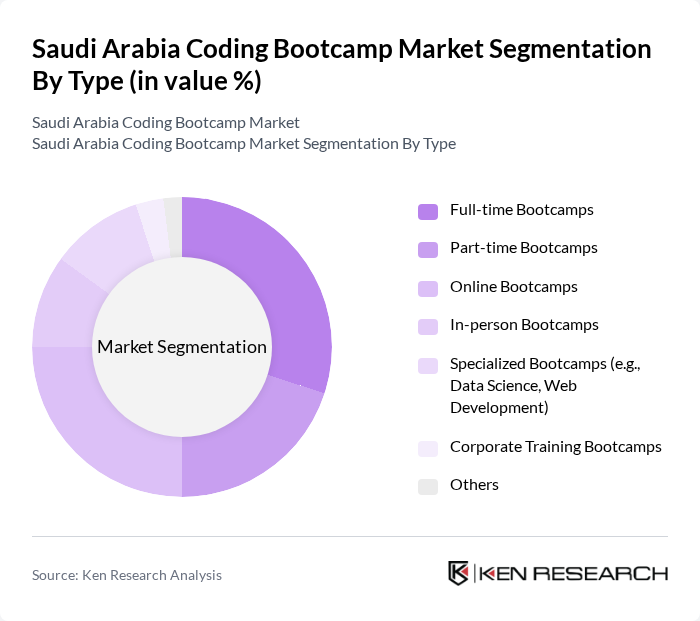

By Type:The coding bootcamp market can be segmented into various types, including Full-time Bootcamps, Part-time Bootcamps, Online Bootcamps, In-person Bootcamps, Specialized Bootcamps (e.g., Data Science, Web Development), Corporate Training Bootcamps, and Others. Each of these sub-segments caters to different learner needs and preferences, contributing to the overall market dynamics.

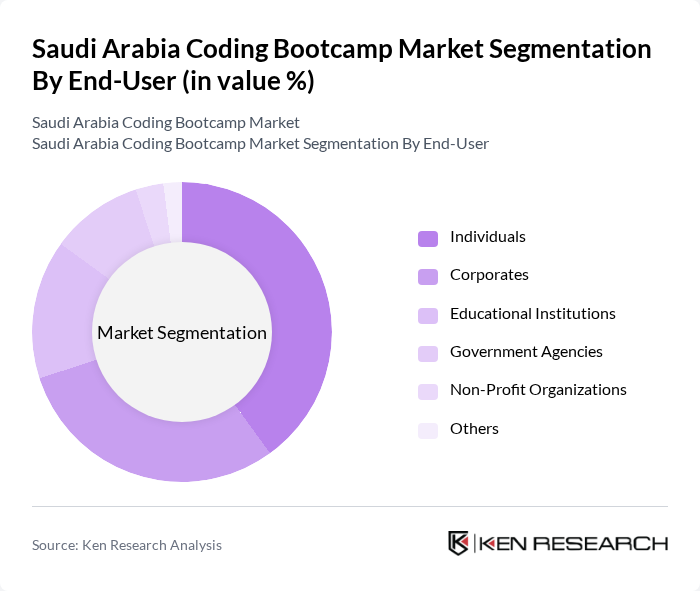

By End-User:The end-user segmentation includes Individuals, Corporates, Educational Institutions, Government Agencies, Non-Profit Organizations, and Others. Each segment represents a unique demand for coding bootcamps, driven by the need for skill development in various sectors.

The Saudi Arabia Coding Bootcamp Market is characterized by a dynamic mix of regional and international players. Leading participants such as Le Wagon, General Assembly, Ironhack, Codecademy, Thinkful, Flatiron School, Udacity, Coursera, Skillshare, Coding Dojo, Tech Elevator, Springboard, CareerFoundry, Nucamp, and BrainStation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the coding bootcamp market in Saudi Arabia appears promising, driven by increasing digitalization and a growing emphasis on tech skills. As the government continues to invest in educational reforms and digital initiatives, bootcamps are likely to play a crucial role in bridging the skills gap. Additionally, the integration of hybrid learning models and partnerships with tech companies will enhance the relevance and accessibility of coding education, positioning bootcamps as vital contributors to the Kingdom's workforce development.

| Segment | Sub-Segments |

|---|---|

| By Type | Full-time Bootcamps Part-time Bootcamps Online Bootcamps In-person Bootcamps Specialized Bootcamps (e.g., Data Science, Web Development) Corporate Training Bootcamps Others |

| By End-User | Individuals Corporates Educational Institutions Government Agencies Non-Profit Organizations Others |

| By Delivery Mode | Online Learning In-Person Learning Hybrid Learning Corporate Training Sessions Bootcamp Partnerships with Universities Others |

| By Duration | Short-term Bootcamps (less than 3 months) Medium-term Bootcamps (3-6 months) Long-term Bootcamps (6 months and above) Intensive Bootcamps Others |

| By Certification Type | Accredited Certifications Non-accredited Certifications Industry-recognized Certifications Bootcamp-specific Certifications Others |

| By Target Audience | Beginners Intermediate Learners Advanced Learners Career Changers Others |

| By Geographic Focus | Urban Areas Rural Areas Specific Regions (e.g., Riyadh, Jeddah) Nationwide Programs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Current Coding Bootcamp Students | 150 | Students enrolled in various coding bootcamps |

| Recent Graduates of Bootcamps | 100 | Graduates who completed bootcamps within the last 2 years |

| Industry Employers | 80 | HR Managers and Tech Leads from companies hiring bootcamp graduates |

| Potential Bootcamp Students | 120 | Individuals interested in tech careers, aged 18-35 |

| Educational Institutions | 50 | Administrators and educators from universities and colleges |

The Saudi Arabia Coding Bootcamp Market is valued at approximately USD 150 million, reflecting significant growth driven by the increasing demand for skilled tech professionals and the government's initiatives to enhance digital skills across various sectors.