Region:Middle East

Author(s):Rebecca

Product Code:KRAB2854

Pages:100

Published On:October 2025

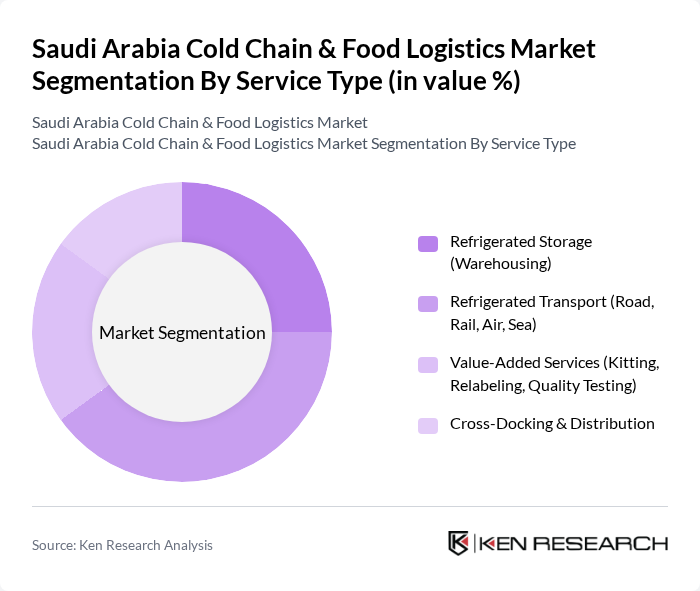

By Service Type:The service type segmentation includes Refrigerated Storage (Warehousing), Refrigerated Transport (Road, Rail, Air, Sea), Value-Added Services (Kitting, Relabeling, Quality Testing), and Cross-Docking & Distribution. Refrigerated Transport is currently the leading subsegment, driven by the growing need for efficient and timely movement of perishable goods across the country. The surge in e-commerce and online grocery platforms has intensified demand for reliable refrigerated transport, while warehousing and value-added services are also expanding as supply chains become more complex and quality-focused .

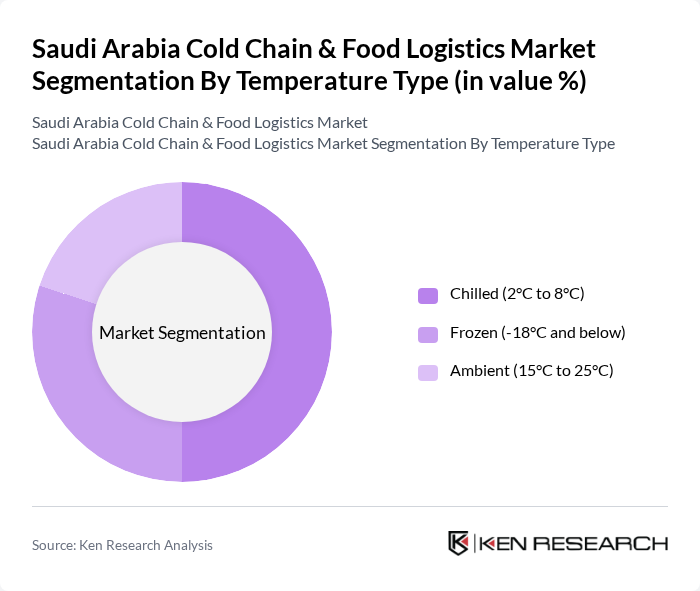

By Temperature Type:The temperature type segmentation includes Chilled (2°C to 8°C), Frozen (-18°C and below), and Ambient (15°C to 25°C). The Chilled segment remains the most dominant, reflecting the high demand for fresh produce, dairy, and ready-to-eat foods that require strict temperature control. The expansion of modern retail formats and consumer preference for fresh food options continue to drive growth in this segment .

The Saudi Arabia Cold Chain & Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al-Faisaliah Group, Al-Watania Poultry, Gulf Warehousing Company, Agility Logistics, Naqel Express, Almajdouie Logistics, Al Othaim Holding, Al-Safi Danone, United Food Industries Corporation, Al-Babtain Group, Bahri (National Shipping Company of Saudi Arabia), Arabian Agricultural Services Company (ARASCO), Almarfa Medical, and Tamer Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain and food logistics market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer awareness regarding food safety. The integration of automation and IoT technologies is expected to enhance operational efficiency, reducing waste and improving tracking capabilities. Additionally, the government's commitment to food security will likely lead to further investments in infrastructure, fostering a more resilient supply chain that can adapt to changing market demands and consumer preferences.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Refrigerated Storage (Warehousing) Refrigerated Transport (Road, Rail, Air, Sea) Value-Added Services (Kitting, Relabeling, Quality Testing) Cross-Docking & Distribution |

| By Temperature Type | Chilled (2°C to 8°C) Frozen (-18°C and below) Ambient (15°C to 25°C) |

| By End-User Industry | Food & Beverage (Dairy, Meat, Seafood, Fruits & Vegetables, Bakery) Pharmaceuticals & Healthcare Retail & E-commerce Chemicals Others |

| By Distribution Mode | Road Transport Rail Transport Air Transport Sea Transport |

| By Application | Dairy Products Meat and Seafood Fruits and Vegetables Pharmaceuticals Bakery & Confectionery Others |

| By Sales Channel | Direct Sales Online Sales Distributors Third-Party Logistics (3PL) |

| By Price Range | Budget Mid-Range Premium |

| By Policy Support | Subsidies Tax Exemptions Grants |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 60 | Facility Managers, Operations Directors |

| Food Distribution Networks | 50 | Logistics Coordinators, Supply Chain Managers |

| Retail Food Outlets | 40 | Store Managers, Procurement Officers |

| Agricultural Producers | 40 | Farm Managers, Supply Chain Analysts |

| Food Safety Regulators | 40 | Compliance Officers, Quality Assurance Managers |

The Saudi Arabia Cold Chain & Food Logistics Market is valued at approximately USD 3.9 billion, driven by the increasing demand for perishable goods and advancements in cold storage technology and logistics infrastructure.