Region:Asia

Author(s):Geetanshi

Product Code:KRAB2844

Pages:91

Published On:October 2025

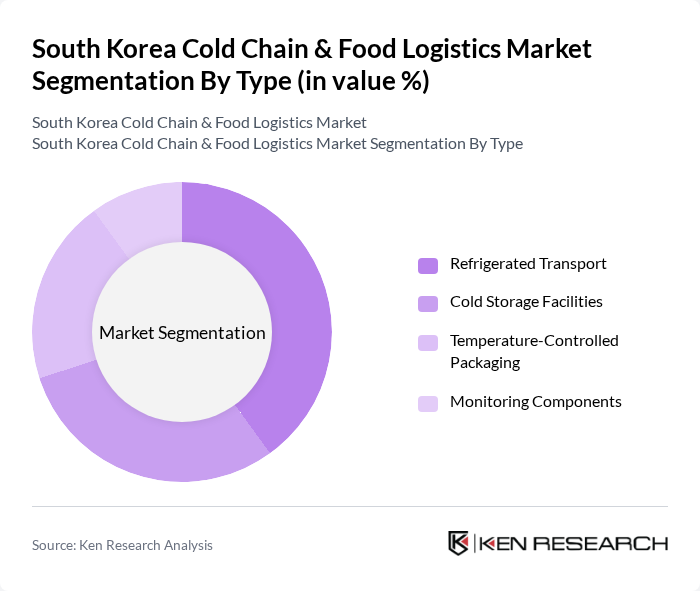

By Type:The market is segmented into Refrigerated Transport, Cold Storage Facilities, Temperature-Controlled Packaging, and Monitoring Components. Refrigerated Transport leads the market, driven by the surge in e-commerce food deliveries and pharmaceutical shipments requiring strict temperature control. Cold Storage Facilities are expanding rapidly, supported by government grants and private investment in urban and rural warehousing. Temperature-Controlled Packaging is increasingly adopted for meal kits, seafood, and processed foods, while Monitoring Components (IoT sensors, real-time trackers) are now standard for regulatory compliance and operational efficiency .

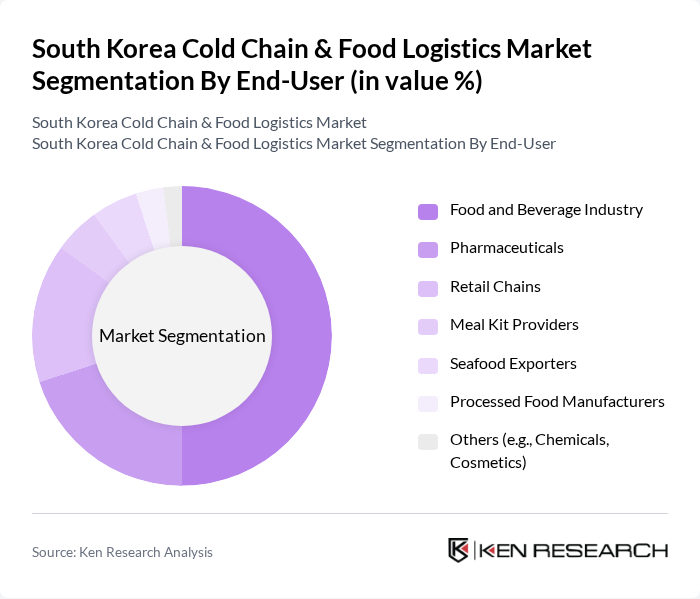

By End-User:The end-user segmentation includes the Food and Beverage Industry, Pharmaceuticals, Retail Chains, Meal Kit Providers, Seafood Exporters, Processed Food Manufacturers, and Others. The Food and Beverage Industry accounts for the largest share, driven by consumer demand for fresh and frozen products and the expansion of online grocery platforms. Pharmaceuticals represent a fast-growing segment due to increased vaccine and biologics logistics, while Retail Chains and Meal Kit Providers are leveraging cold chain solutions for differentiated service and product quality. Seafood Exporters and Processed Food Manufacturers require specialized cold chain capabilities for export compliance and shelf-life extension .

The South Korea Cold Chain & Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as CJ Logistics, Lotte Global Logistics, Hanjin Transportation, Hyundai Glovis, SK Networks, Daewoo Logistics, GS Global, Samsung C&T Corporation, KCTC, Dongbu Express, Hanil Express, Kwangdong Pharmaceutical, SML Logistics, Koryo Logistics, TSK Logistics, Dongwon Loex, Sebang Co., Ltd., Korea Express, Korea Integrated Freight Terminal (KIFT), LS Networks contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean cold chain and food logistics market is poised for significant transformation, driven by technological advancements and evolving consumer preferences. The integration of IoT technologies is expected to enhance tracking and monitoring capabilities, improving operational efficiency. Additionally, the focus on sustainable practices will likely lead to increased investments in eco-friendly packaging and energy-efficient refrigeration systems, aligning with global sustainability trends. As the market adapts to these changes, it will create new avenues for growth and innovation in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Cold Storage Facilities Temperature-Controlled Packaging Monitoring Components |

| By End-User | Food and Beverage Industry Pharmaceuticals Retail Chains Meal Kit Providers Seafood Exporters Processed Food Manufacturers Others (e.g., Chemicals, Cosmetics) |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Dairy Products Meat and Seafood Fruits and Vegetables Biologics & Vaccines Others |

| By Sales Channel | Online Sales Offline Sales Wholesale Distribution Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food Distribution Logistics | 100 | Logistics Managers, Supply Chain Analysts |

| Cold Storage Facilities | 60 | Facility Managers, Operations Directors |

| Agricultural Supply Chain | 50 | Farmers, Agribusiness Executives |

| Pharmaceutical Cold Chain | 40 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Retail Food Logistics | 45 | Retail Operations Managers, Procurement Officers |

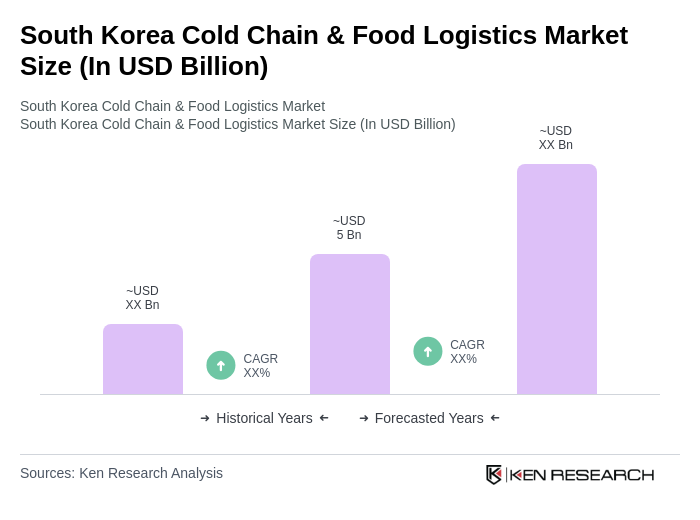

The South Korea Cold Chain & Food Logistics Market is valued at approximately USD 5 billion, driven by increasing demand for perishable goods, pharmaceutical logistics, and the growth of e-commerce requiring temperature-controlled delivery solutions.