Region:Africa

Author(s):Geetanshi

Product Code:KRAB5723

Pages:96

Published On:October 2025

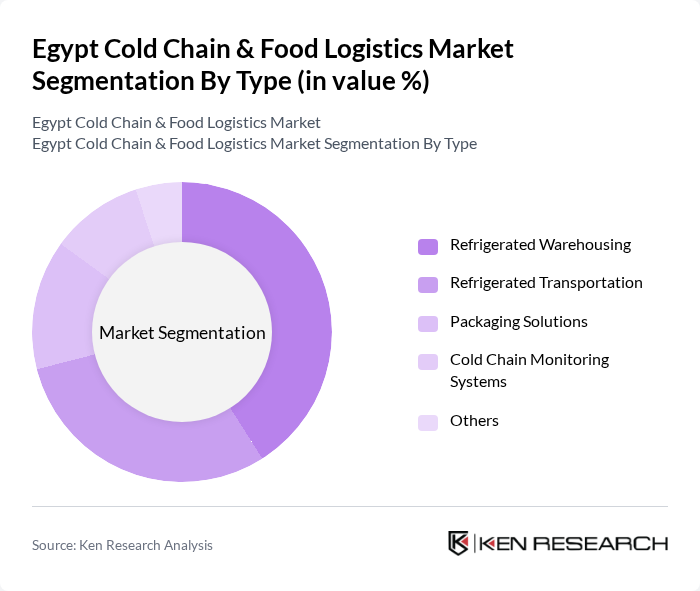

By Type:The market is segmented into various types, including Refrigerated Warehousing, Refrigerated Transportation, Packaging Solutions, Cold Chain Monitoring Systems, and Others. Among these,Refrigerated Warehousingis the leading sub-segment, driven by the increasing demand for storage of perishable goods and the need for efficient inventory management. The growth of e-commerce, online grocery, and the food delivery sector has also contributed to the rising need for refrigerated warehousing solutions. The adoption of IoT-based monitoring and automation is further enhancing operational efficiency in this segment .

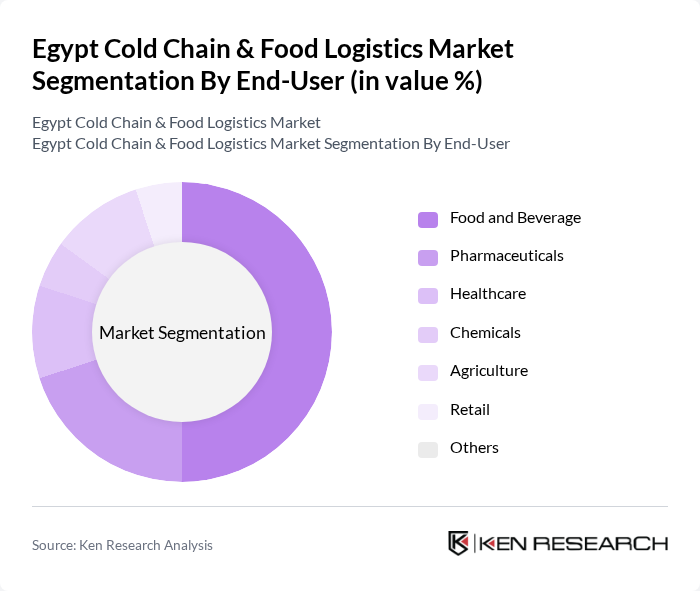

By End-User:The end-user segmentation includes Food and Beverage, Pharmaceuticals, Healthcare, Chemicals, Agriculture, Retail, and Others. TheFood and Beveragesector dominates this market segment, driven by the increasing consumption of perishable products and the growing trend of online grocery shopping. The demand for fresh produce, frozen foods, and ready-to-eat meals has significantly influenced the growth of cold chain logistics in this sector. The pharmaceutical and healthcare segments are also expanding rapidly due to vaccine and biologics distribution requirements .

The Egypt Cold Chain & Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Agility Egypt, DB Schenker Egypt, Nile Cold Stores, YCH Logistics Egypt, Transmar, Egyptian German Cold Chain, Maersk Egypt, DHL Egypt, Kuehne + Nagel Egypt, Cold Box Egypt, Multi Fruit Egypt, Green Food Hub, Lineage Logistics, Americold Logistics, United Group for Cold Storage contribute to innovation, geographic expansion, and service delivery in this space.

The future of Egypt's cold chain and food logistics market appears promising, driven by technological advancements and increased investment in infrastructure. As the government continues to prioritize food security, the establishment of new cold storage facilities and the integration of IoT technologies will enhance operational efficiency. Additionally, the growing emphasis on sustainability practices will likely shape logistics strategies, encouraging companies to adopt eco-friendly solutions while meeting consumer demands for quality and safety in food products.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Warehousing Refrigerated Transportation Packaging Solutions Cold Chain Monitoring Systems Others |

| By End-User | Food and Beverage Pharmaceuticals Healthcare Chemicals Agriculture Retail Others |

| By Distribution Mode | Direct Distribution Third-Party Logistics (3PL) E-commerce Platforms Others |

| By Application | Meat & Poultry Fish & Seafood Dairy Products Fresh Produce Frozen Foods Pharmaceuticals Others |

| By Sales Channel | Online Sales Offline Retail Wholesale Distribution Others |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Grants |

| By Policy Support | Subsidies for Cold Chain Infrastructure Tax Exemptions for Logistics Companies Regulatory Support for Food Safety Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Storage Facilities | 100 | Facility Managers, Operations Directors |

| Food Distribution Companies | 80 | Logistics Coordinators, Supply Chain Managers |

| Agricultural Producers | 70 | Farm Managers, Supply Chain Analysts |

| Retail Food Outlets | 50 | Store Managers, Procurement Officers |

| Food Safety Regulators | 40 | Compliance Officers, Regulatory Affairs Managers |

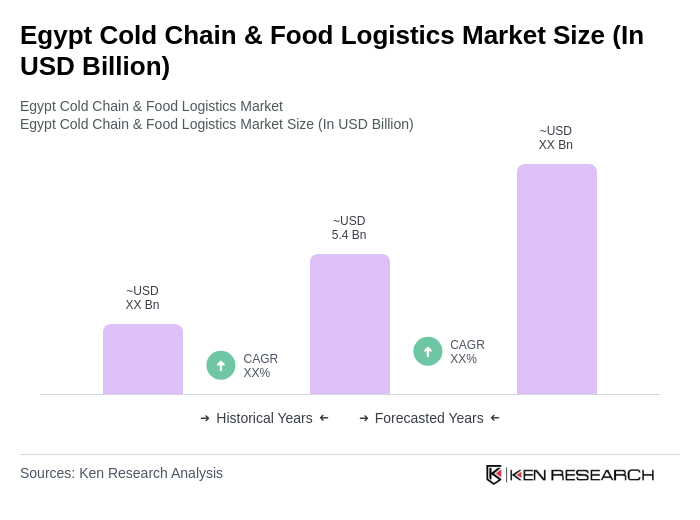

The Egypt Cold Chain & Food Logistics Market is valued at approximately USD 5.4 billion, driven by the increasing demand for perishable goods, advancements in refrigeration technology, and the growth of the food and beverage sector.