Poland Cold Chain & Food Logistics Market Overview

- The Poland Cold Chain & Food Logistics Market is valued at USD 3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing demand for fresh and frozen food products, the expansion of the food and beverage industry, and the rise in e-commerce and online grocery shopping. Additional drivers include heightened consumer awareness of food quality and safety, a surge in organic and plant-based product consumption, and the growing need for temperature-controlled logistics solutions to maintain product integrity and minimize spoilage during transit. Sustainability initiatives, such as the adoption of eco-friendly refrigeration technologies and energy-efficient operations, are also shaping market evolution, with logistics providers investing in renewable energy and advanced monitoring systems to meet consumer and regulatory expectations .

- Key cities dominating the market include Warsaw, Kraków, and Wroc?aw, primarily due to their strategic locations, robust infrastructure, and proximity to major transportation networks. These urban centers serve as critical hubs for distribution, facilitating efficient logistics operations and catering to the growing consumer demand for perishable goods. Poland’s position as a regional food hub is further strengthened by major transport corridors connecting it to Northern Europe and Central Asia, supporting both domestic and cross-border cold chain activities .

- In 2023, the Polish government implemented regulations mandating stricter temperature control standards for food transportation and storage. The key binding instrument is the “Regulation of the Minister of Agriculture and Rural Development of 21 October 2023 on the requirements for the transport and storage of foodstuffs,” which sets operational temperature thresholds for different food categories and requires logistics providers to use certified monitoring systems. Compliance is enforced through regular inspections and licensing, with specific standards for refrigerated vehicles, cold storage facilities, and traceability protocols throughout the supply chain .

Poland Cold Chain & Food Logistics Market Segmentation

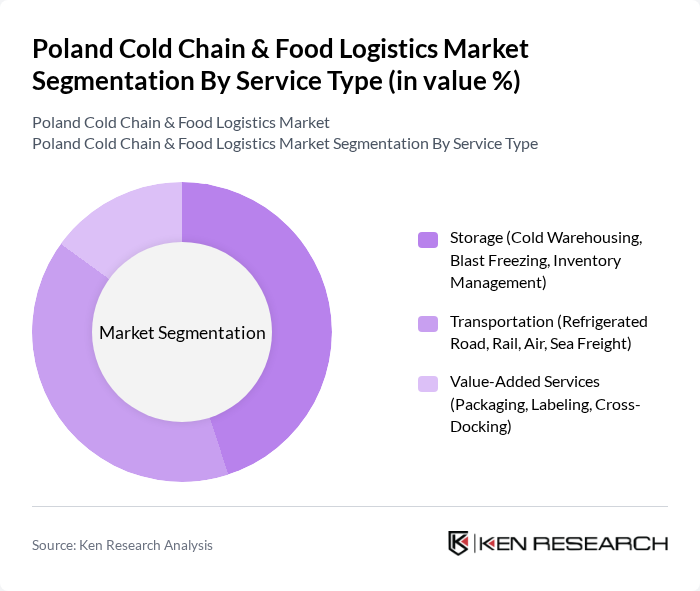

By Service Type:

The service type segmentation includes Storage, Transportation, and Value-Added Services. Among these, Storage—particularly Cold Warehousing—is the leading sub-segment, reflecting the increasing need for temperature-controlled environments to preserve food quality and extend shelf life. The expansion of e-commerce and the food & beverage sector has driven demand for efficient inventory management and blast freezing solutions. Transportation, especially refrigerated road transport, remains essential for delivering perishable goods quickly and safely, supported by Poland’s extensive road and rail infrastructure. Value-added services such as packaging, labeling, and cross-docking are gaining traction as companies seek to differentiate offerings and enhance customer experience through improved traceability and compliance with food safety standards .

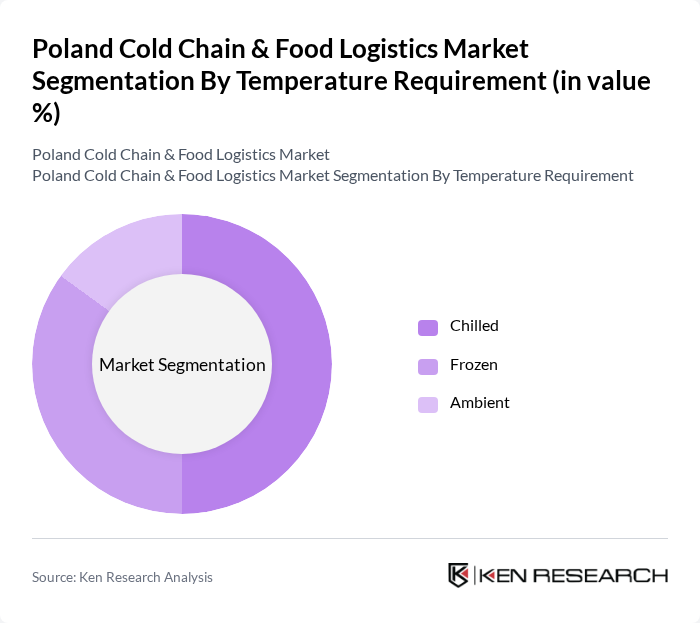

By Temperature Requirement:

This segmentation includes Chilled, Frozen, and Ambient temperature requirements. The Chilled segment is currently the dominant sub-segment, driven by high demand for fresh produce, dairy products, and ready-to-eat meals. Consumers increasingly prefer fresh items, necessitating efficient chilled logistics solutions and advanced monitoring technologies. The Frozen segment is also significant, particularly for meat, seafood, and processed foods, as it ensures longer shelf life and quality preservation. Ambient logistics, while essential for less perishable goods, holds a smaller market share due to the predominance of fresh and frozen food consumption .

Poland Cold Chain & Food Logistics Market Competitive Landscape

The Poland Cold Chain & Food Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DB Schenker, Kuehne + Nagel, DSV, Raben Group, Frigo Logistics, Fresh Logistics Polska, No Limit, Rohlig SUUS Logistics, NewCold, PAGO Logistics, Greenyard Logistics Poland, DHL Supply Chain, Geodis, FM Logistic, and ?abka Polska (as a major cold chain end-user with logistics operations) contribute to innovation, geographic expansion, and service delivery in this space.

Poland Cold Chain & Food Logistics Market Industry Analysis

Growth Drivers

- Increasing Demand for Fresh and Frozen Food:The Polish food market is projected to reach approximately PLN 300 billion, driven by a growing consumer preference for fresh and frozen products. The demand for fresh produce has surged by 15% over the past three years, reflecting a shift towards healthier eating habits. Additionally, frozen food sales have increased by 10% annually, indicating a robust market for cold chain logistics to ensure product quality and safety during transportation and storage.

- Expansion of E-commerce in Food Delivery:The e-commerce food delivery sector in Poland is expected to grow to PLN 10 billion, fueled by changing consumer behaviors and increased online shopping. The number of online grocery shoppers has risen to 5 million, representing a 25% increase from 2021. This trend necessitates efficient cold chain logistics to maintain the integrity of perishable goods, creating significant opportunities for logistics providers to enhance their service offerings.

- Technological Advancements in Refrigeration:The cold chain logistics sector is witnessing a technological revolution, with investments in advanced refrigeration technologies projected to exceed PLN 1 billion. Innovations such as IoT-enabled temperature monitoring systems and energy-efficient refrigeration units are becoming standard. These advancements not only improve operational efficiency but also reduce energy consumption by up to 30%, aligning with sustainability goals and enhancing the overall competitiveness of the cold chain market.

Market Challenges

- High Initial Investment Costs:Establishing a robust cold chain infrastructure requires significant capital investment, estimated at around PLN 2 billion for new facilities and equipment. This high entry barrier can deter new players from entering the market, limiting competition and innovation. Existing companies also face challenges in upgrading their systems to meet modern standards, which can strain financial resources and impact profitability.

- Regulatory Compliance Complexity:The cold chain logistics sector in Poland is subject to stringent regulations, including EU food safety standards and environmental laws. Compliance costs can reach up to PLN 500 million annually for major players, as they must invest in training, certifications, and technology upgrades. Navigating this complex regulatory landscape poses a significant challenge, particularly for smaller companies that may lack the resources to ensure compliance.

Poland Cold Chain & Food Logistics Market Future Outlook

The future of the cold chain and food logistics market in Poland appears promising, driven by increasing consumer demand for fresh and organic products. As e-commerce continues to expand, logistics providers will need to adapt by implementing advanced technologies and sustainable practices. The integration of IoT and automation will enhance operational efficiency, while government support for infrastructure development will further bolster the sector. Overall, the market is poised for significant growth, with opportunities for innovation and collaboration.

Market Opportunities

- Growth in Organic Food Sector:The organic food market in Poland is projected to reach PLN 10 billion, driven by rising health consciousness among consumers. This growth presents a unique opportunity for cold chain logistics providers to specialize in the transportation and storage of organic products, ensuring compliance with stringent quality standards and enhancing market competitiveness.

- Development of Smart Cold Chain Solutions:The increasing adoption of smart technologies in logistics is expected to create a market worth PLN 1.5 billion. Companies that invest in smart cold chain solutions, such as real-time tracking and automated inventory management, can significantly improve efficiency and reduce waste, positioning themselves as leaders in the evolving market landscape.