Region:Middle East

Author(s):Dev

Product Code:KRAC8669

Pages:91

Published On:November 2025

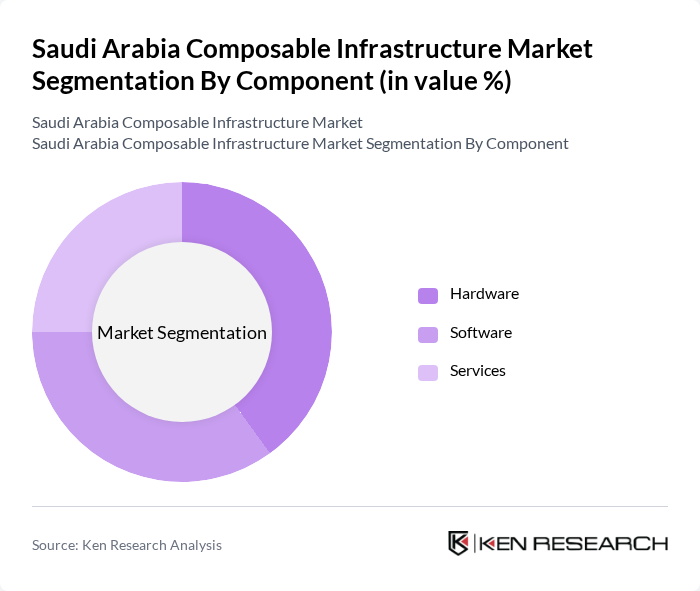

By Component:The composable infrastructure market can be segmented into three main components: Hardware, Software, and Services. Each of these components plays a crucial role in the overall infrastructure, with hardware providing the physical resources, software enabling management and orchestration, and services offering support and integration. The hardware segment remains dominant, driven by investments in high-performance servers, storage solutions, and networking equipment. The expansion of edge computing and hybrid cloud strategies is further fueling demand for robust hardware solutions that support distributed workloads and real-time data processing .

The hardware segment is currently dominating the market due to the increasing investments in physical infrastructure by enterprises looking to enhance their IT capabilities. The demand for high-performance servers, storage solutions, and networking equipment is on the rise as organizations seek to build scalable and efficient systems. Additionally, the growing trend of edge computing is further driving the need for robust hardware solutions that can support distributed workloads .

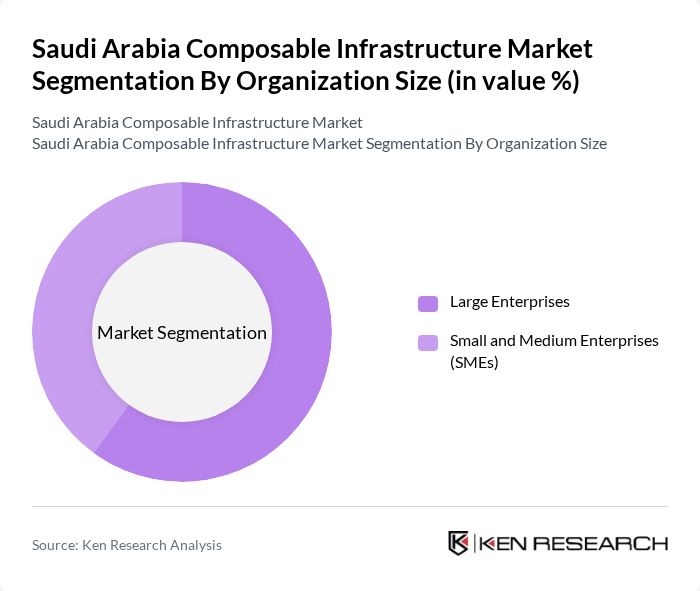

By Organization Size:The market can also be segmented based on organization size into Large Enterprises and Small and Medium Enterprises (SMEs). Each segment has distinct needs and approaches to adopting composable infrastructure solutions. Large enterprises are leading the market due to their substantial budgets and the necessity for complex IT solutions that can support their extensive operations. These organizations are more likely to invest in composable infrastructure to achieve greater flexibility and efficiency in their IT environments. In contrast, SMEs are increasingly adopting these solutions as they become more aware of the benefits of scalable and cost-effective IT infrastructure. The rising adoption among SMEs is supported by the availability of modular and cloud-based offerings, which lower entry barriers and enable cost-effective scaling .

Large enterprises are leading the market due to their substantial budgets and the necessity for complex IT solutions that can support their extensive operations. These organizations are more likely to invest in composable infrastructure to achieve greater flexibility and efficiency in their IT environments. In contrast, SMEs are increasingly adopting these solutions as they become more aware of the benefits of scalable and cost-effective IT infrastructure .

The Saudi Arabia Composable Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as HPE (Hewlett Packard Enterprise), Dell Technologies, Cisco Systems, IBM, Nutanix, VMware, Lenovo, Oracle, Fujitsu, Atos, Hitachi Vantara, Pure Storage, Arista Networks, NetApp, Huawei Technologies, Inspur Group, Supermicro (Super Micro Computer, Inc.), Saudi Business Machines (SBM), Solutions by stc, Al Moammar Information Systems (MIS) contribute to innovation, geographic expansion, and service delivery in this space .

The future of the composable infrastructure market in Saudi Arabia appears promising, driven by ongoing digital transformation efforts and increasing investments in technology. As organizations continue to embrace flexible IT solutions, the demand for composable infrastructure is expected to rise. Additionally, the integration of artificial intelligence and machine learning into infrastructure management will enhance operational efficiency. The focus on sustainability and energy efficiency will also shape future developments, encouraging businesses to adopt greener technologies and practices in their IT strategies.

| Segment | Sub-Segments |

|---|---|

| By Component | Hardware Software Services |

| By Organization Size | Large Enterprises Small and Medium Enterprises (SMEs) |

| By Deployment Model | On-Premises Cloud-Based Hybrid |

| By End-User Industry | IT & Telecom Healthcare Financial Services (BFSI) Government Manufacturing Retail Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Service Type | Consulting Services Integration Services Managed Services |

| By Pricing Model | Subscription-Based Pay-As-You-Go One-Time Payment |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Enterprise IT Infrastructure | 120 | IT Managers, CTOs, Infrastructure Architects |

| Cloud Service Providers | 60 | Product Managers, Cloud Operations Directors |

| Data Center Operations | 50 | Data Center Managers, Facility Engineers |

| SME Technology Adoption | 40 | Business Owners, IT Consultants |

| Telecommunications Infrastructure | 70 | Network Engineers, Operations Managers |

The Saudi Arabia Composable Infrastructure Market is valued at approximately USD 120 million, reflecting a significant growth driven by the demand for flexible IT infrastructure solutions and digital transformation initiatives across various sectors in the region.