Region:Middle East

Author(s):Dev

Product Code:KRAD7700

Pages:90

Published On:December 2025

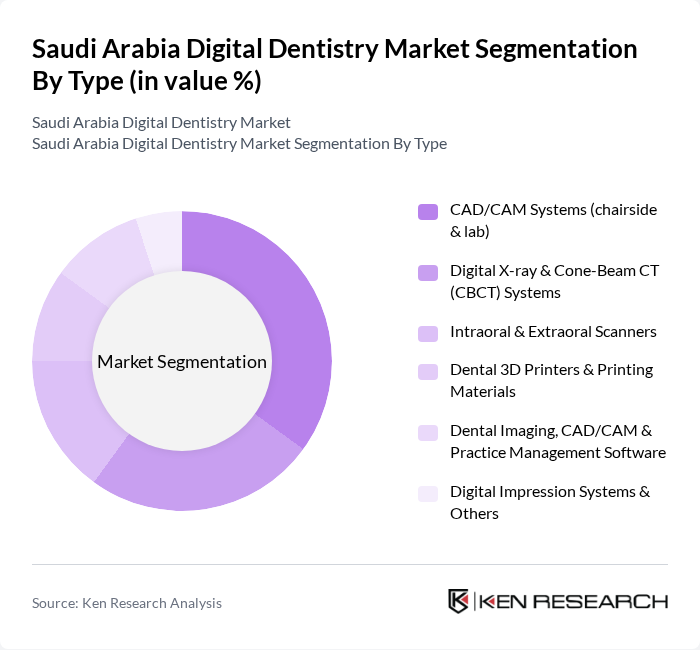

By Type:The segmentation of the market by type includes various advanced technologies that are transforming dental practices. The subsegments are CAD/CAM Systems (chairside & lab), Digital X-ray & Cone-Beam CT (CBCT) Systems, Intraoral & Extraoral Scanners, Dental 3D Printers & Printing Materials, Dental Imaging, CAD/CAM & Practice Management Software, and Digital Impression Systems & Others. Among these, CAD/CAM systems are leading due to their efficiency in producing dental restorations and prosthetics, shorter chair time, and high precision fit, which are increasingly preferred by dental professionals for same?day crowns, bridges, and implant restorations.

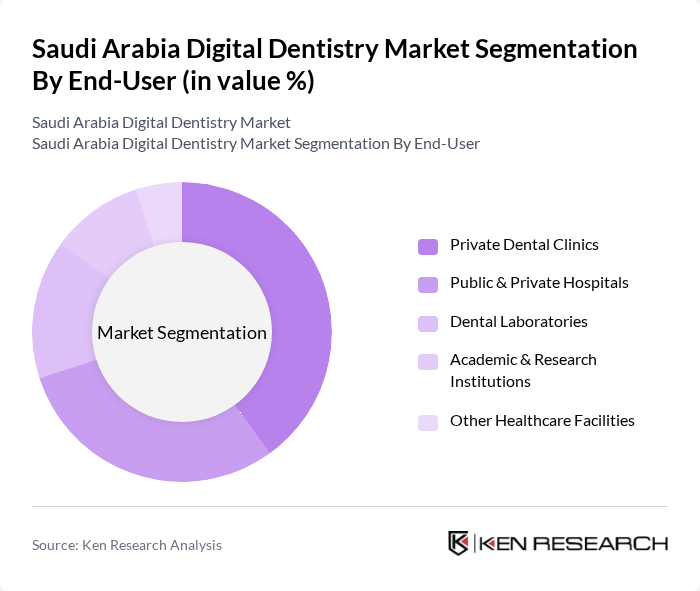

By End-User:The market is segmented by end-user, which includes Private Dental Clinics, Public & Private Hospitals, Dental Laboratories, Academic & Research Institutions, and Other Healthcare Facilities. Private dental clinics are the dominant segment, driven by the increasing number of private dental practices across urban areas, growing demand for cosmetic and implant procedures, and the faster adoption of digital workflows (CAD/CAM, digital impressions, and chairside imaging) to enhance patient experience, procedural accuracy, and operational efficiency.

The Saudi Arabia Digital Dentistry Market is characterized by a dynamic mix of regional and international players. Leading participants such as Align Technology, Inc., Dentsply Sirona Inc., 3M Company, Straumann Group, Carestream Dental LLC, Planmeca Oy, KaVo Dental GmbH, Henry Schein, Inc., Vatech Co., Ltd., GC Corporation, Nobel Biocare Services AG, Patterson Companies, Inc., Dental Wings Inc. (Straumann Group), KaVo Kerr Group (Envista Holdings Corporation), Local & Regional Players (e.g., Al Hayat Dental Supply, Arab Dental Center Trading) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital dentistry market in Saudi Arabia appears promising, driven by ongoing technological innovations and increasing consumer demand for advanced dental solutions. As the government continues to invest in healthcare infrastructure, the integration of AI and tele-dentistry is expected to enhance service delivery. Additionally, the rise of dental tourism, projected to attract over 200,000 international patients in future, will further stimulate market growth, creating a competitive landscape for dental service providers.

| Segment | Sub-Segments |

|---|---|

| By Type | CAD/CAM Systems (chairside & lab) Digital X?ray & Cone-Beam CT (CBCT) Systems Intraoral & Extraoral Scanners Dental 3D Printers & Printing Materials Dental Imaging, CAD/CAM & Practice Management Software Digital Impression Systems & Others |

| By End-User | Private Dental Clinics Public & Private Hospitals Dental Laboratories Academic & Research Institutions Other Healthcare Facilities |

| By Application | Orthodontics & Clear Aligner Therapy Prosthodontics & Implant Dentistry Oral & Maxillofacial Surgery Cosmetic & Aesthetic Dentistry Endodontics, Periodontics & Others |

| By Distribution Channel | Direct Sales by Manufacturers Local Distributors & Importers Online & E?procurement Portals Group Purchasing Organizations & Others |

| By Technology | Digital Imaging & Diagnostics CAD/CAM & Milling Technology D Printing & Additive Manufacturing Laser Dentistry & Other Emerging Digital Technologies |

| By Patient Demographics | Pediatric Patients Adult Patients Geriatric Patients Medical Tourists & Others |

| By Region | Central Region (incl. Riyadh) Eastern Region (incl. Dammam & Al Khobar) Western Region (incl. Jeddah, Makkah & Madinah) Southern & Northern Regions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Dental Clinics in Riyadh | 100 | Dentists, Clinic Managers |

| Dental Equipment Suppliers | 75 | Sales Managers, Product Specialists |

| Dental Technology Educators | 50 | University Professors, Training Coordinators |

| Public Health Officials | 40 | Health Policy Makers, Dental Health Advocates |

| Dental Associations and Organizations | 30 | Association Leaders, Research Analysts |

The Saudi Arabia Digital Dentistry Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by advanced dental technologies, increased consumer awareness, and the integration of digital solutions in dental practices.