Region:Middle East

Author(s):Geetanshi

Product Code:KRAC2371

Pages:91

Published On:October 2025

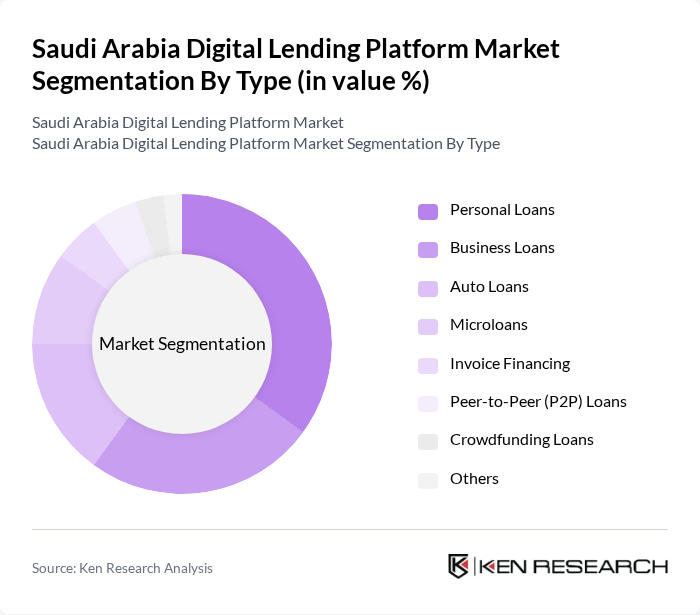

By Type:The digital lending platform market is segmented into personal loans, business loans, auto loans, microloans, invoice financing, peer-to-peer (P2P) loans, crowdfunding loans, and others. Personal loans are the most widely used due to their accessibility and flexibility for consumers. Business loans are also significant, propelled by the growth of small and medium-sized enterprises (SMEs) and increased demand for working capital. The adoption of P2P and crowdfunding platforms is rising, particularly among younger, digitally native borrowers seeking alternative financing options .

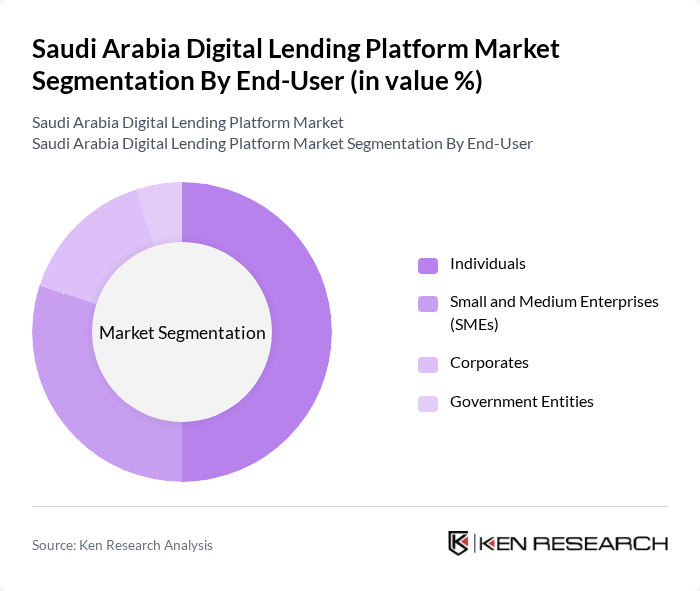

By End-User:The end-user segmentation includes individuals, small and medium enterprises (SMEs), corporates, and government entities. Individuals are the primary users, leveraging digital lending for personal finance needs. SMEs are increasingly adopting digital lending platforms for business expansion, working capital, and operational requirements, supported by government initiatives to boost SME financing. Corporates and government entities represent a smaller but growing segment as digital transformation extends across all sectors .

The Saudi Arabia Digital Lending Platform Market is characterized by a dynamic mix of regional and international players. Leading participants such as Raqamyah Crowdlending Company, Lendo Platform, Tamam Financing Company, Emkan Finance, Tamweel Aloula, Nayla Finance, Tasheel Finance, Gulf International Bank (GIB) - meem Digital Banking, Alinma Bank, Saudi National Bank (SNB), Al Rajhi Bank, Riyad Bank, STC Pay, Fintech Saudi, and Bidaya Home Finance contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital lending market in Saudi Arabia appears promising, driven by technological advancements and changing consumer behaviors. As more individuals embrace digital solutions, the integration of artificial intelligence and machine learning for credit scoring is expected to enhance lending efficiency. Additionally, the ongoing development of regulatory frameworks will likely create a more conducive environment for innovation, allowing digital lenders to offer diverse products tailored to consumer needs, thereby fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Personal Loans Business Loans Auto Loans Microloans Invoice Financing Peer-to-Peer (P2P) Loans Crowdfunding Loans Others |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Corporates Government Entities |

| By Loan Amount | Small Loans (up to SAR 10,000) Medium Loans (SAR 10,001 - SAR 50,000) Large Loans (above SAR 50,000) |

| By Loan Duration | Short-term Loans (up to 1 year) Medium-term Loans (1-3 years) Long-term Loans (above 3 years) |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales Partnerships with Financial Institutions |

| By Customer Segment | Retail Customers Business Customers Institutional Customers |

| By Geographic Reach | Urban Areas Rural Areas Nationwide |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Loan Borrowers | 100 | Individuals aged 25-45, employed professionals |

| Small Business Owners | 60 | Entrepreneurs, business managers in SMEs |

| Fintech Executives | 40 | CEOs, CTOs, and product managers from digital lending firms |

| Regulatory Authorities | 40 | Policy makers, financial regulators from SAMA |

| Potential Borrowers | 80 | Individuals interested in digital lending solutions |

The Saudi Arabia Digital Lending Platform Market is valued at approximately USD 42 billion, driven by the rapid expansion of digital financial services and government initiatives under Vision 2030 aimed at promoting a cashless economy.