Region:Middle East

Author(s):Rebecca

Product Code:KRAC1141

Pages:87

Published On:October 2025

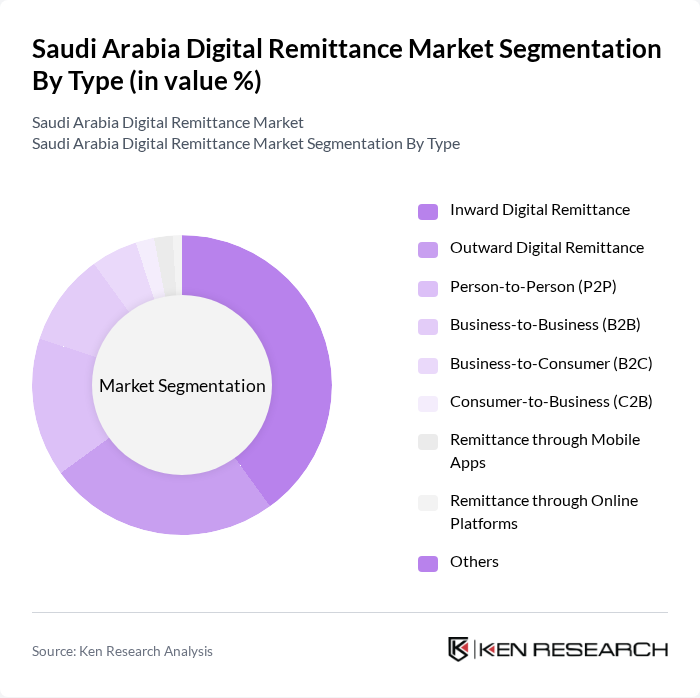

By Type:The digital remittance market can be segmented into various types, including Inward Digital Remittance, Outward Digital Remittance, Person-to-Person (P2P), Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Business (C2B), Remittance through Mobile Apps, Remittance through Online Platforms, and Others. Each of these segments caters to different consumer needs and preferences, reflecting the diverse landscape of remittance services. Outward digital remittance is the largest segment by revenue, while inward digital remittance is the fastest growing.

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Large Corporations, and Non-Governmental Organizations (NGOs). Each of these segments plays a crucial role in the overall dynamics of the digital remittance market, with varying needs and transaction volumes.

The Saudi Arabia Digital Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, Wise (formerly TransferWise), Remitly, Xoom (a PayPal Service), Al Rajhi Bank (Tahweel Al Rajhi, urpay), National Commercial Bank (NCB) / SNB QuickPay, Saudi Post (Enjaz), STC Pay, Alinma Bank, Bank Aljazira (Fawri), Saudi Awwal Bank (SAB), Arab National Bank (TeleMoney), Banque Saudi Fransi, Amwal, Tiqmo, Mada contribute to innovation, geographic expansion, and service delivery in this space.

The future of the digital remittance market in Saudi Arabia appears promising, driven by technological advancements and increasing consumer demand for seamless transactions. As mobile wallet adoption continues to rise, service providers are likely to enhance their offerings, focusing on user experience and transaction speed. Additionally, partnerships with local banks will facilitate broader access to financial services, further integrating digital remittance solutions into everyday financial activities, thus fostering market growth and innovation.

| Segment | Sub-Segments |

|---|---|

| By Type | Inward Digital Remittance Outward Digital Remittance Person-to-Person (P2P) Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Business (C2B) Remittance through Mobile Apps Remittance through Online Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Large Corporations Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Source of Funds | Salaries Business Revenues Personal Savings |

| By Policy Support | Government Subsidies Tax Incentives Regulatory Support |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 120 | Expatriates from South Asia, Africa, and the Philippines |

| Service Provider Insights | 85 | Executives from remittance companies and banks |

| Regulatory Impact Assessment | 65 | Policy Makers, Financial Regulators |

| Digital Remittance Adoption | 100 | Tech-savvy expatriates and younger demographics |

| Market Trends and Forecasting | 75 | Financial Analysts, Economists, Market Researchers |

The Saudi Arabia Digital Remittance Market is valued at approximately USD 655 million, driven by the increasing number of expatriates and their reliance on digital channels for remitting money back home.