Region:Middle East

Author(s):Rebecca

Product Code:KRAB7382

Pages:100

Published On:October 2025

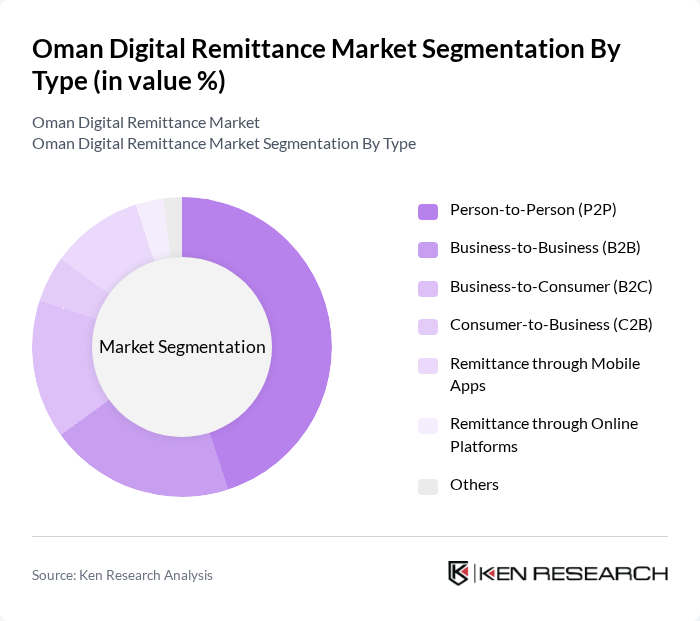

By Type:The digital remittance market can be segmented into various types, including Person-to-Person (P2P), Business-to-Business (B2B), Business-to-Consumer (B2C), Consumer-to-Business (C2B), Remittance through Mobile Apps, Remittance through Online Platforms, and Others. Among these, the Person-to-Person (P2P) segment is the most dominant, driven by the high volume of individual remittances sent by expatriates to their families and friends back home. The convenience and speed of P2P transactions make it the preferred choice for many users.

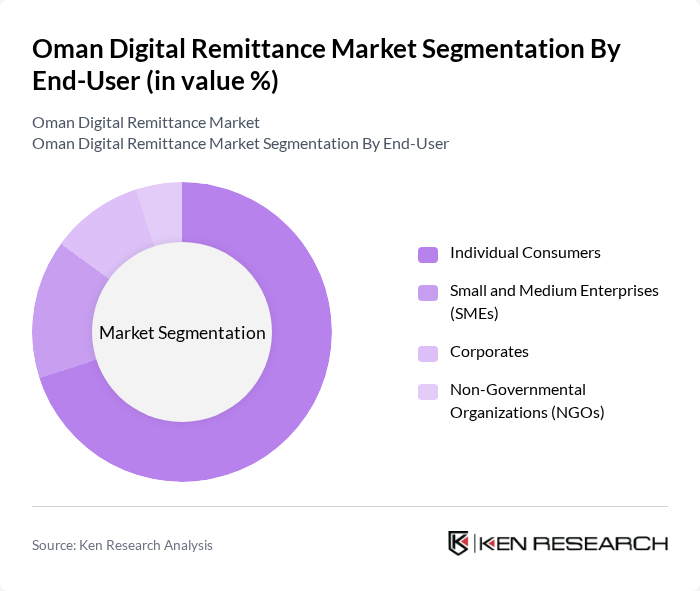

By End-User:The end-user segmentation includes Individual Consumers, Small and Medium Enterprises (SMEs), Corporates, and Non-Governmental Organizations (NGOs). The Individual Consumers segment is the largest, as it encompasses the majority of remittance transactions made by expatriates sending money to their families. This segment's growth is fueled by the increasing number of expatriates in Oman and their reliance on remittance services for financial support.

The Oman Digital Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal, TransferWise, Remitly, Xoom, WorldRemit, Ria Money Transfer, OFX, Alipay, Revolut, Skrill, Azimo, Payoneer, CashU contribute to innovation, geographic expansion, and service delivery in this space.

The Oman digital remittance market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The increasing adoption of mobile-first solutions and blockchain technology is expected to enhance transaction efficiency and security. Additionally, the focus on customer experience and personalization will likely shape service offerings, catering to the unique needs of users. As the market matures, collaboration between fintechs and traditional banks will further streamline services, fostering a more inclusive financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Person-to-Person (P2P) Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Business (C2B) Remittance through Mobile Apps Remittance through Online Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises (SMEs) Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards |

| By Transaction Size | Low-Value Transactions Medium-Value Transactions High-Value Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Geographic Reach | Domestic Remittances International Remittances |

| By Customer Segment | Expatriates Local Residents Students Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates from South Asia, Middle East, and Africa |

| Banking Sector Insights | 100 | Bank Managers, Financial Analysts |

| Fintech Adoption Trends | 80 | Product Managers, Technology Officers in Fintech |

| Regulatory Impact Assessment | 60 | Policy Makers, Regulatory Affairs Specialists |

| Local Business Perspectives | 70 | Small Business Owners, Financial Controllers |

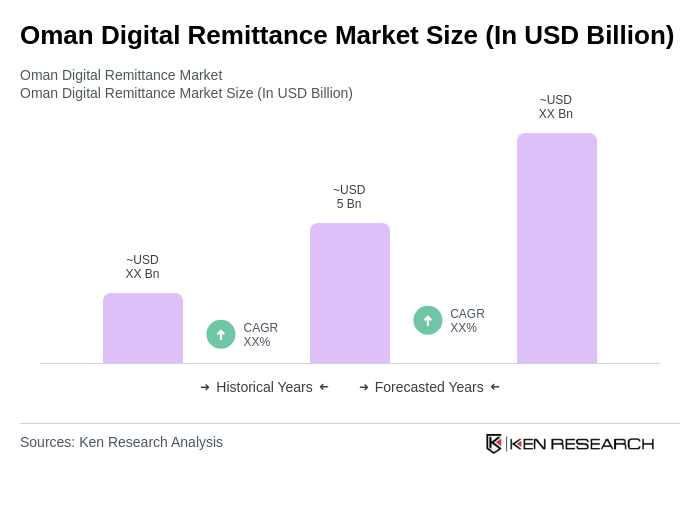

The Oman Digital Remittance Market is valued at approximately USD 5 billion, reflecting significant growth driven by the increasing expatriate population and the adoption of digital remittance services.