Region:Middle East

Author(s):Geetanshi

Product Code:KRAB7346

Pages:81

Published On:October 2025

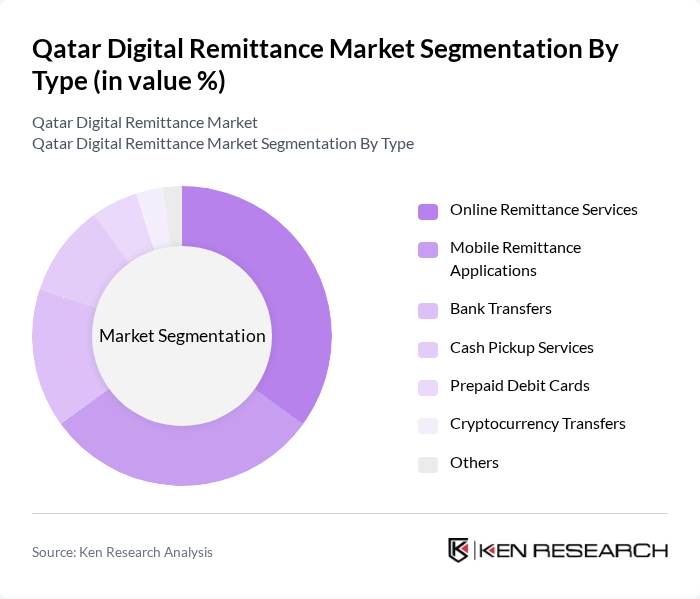

By Type:The segmentation by type includes various methods of remittance services such as online remittance services, mobile remittance applications, bank transfers, cash pickup services, prepaid debit cards, cryptocurrency transfers, and others. Each of these sub-segments caters to different consumer preferences and technological advancements, with online remittance services and mobile applications leading the market due to their convenience and accessibility.

By End-User:The end-user segmentation includes individual consumers, small businesses, corporates, and non-governmental organizations (NGOs). Individual consumers dominate the market as they frequently send remittances to support families and relatives abroad. Small businesses and NGOs also contribute significantly, utilizing remittance services for operational needs and humanitarian efforts.

The Qatar Digital Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, TransferWise, Xoom (a PayPal service), Remitly, WorldRemit, Ria Money Transfer, Payoneer, Alipay, Revolut, Skrill, OFX, Azimo, Payza, Wise contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar digital remittance market appears promising, driven by technological advancements and evolving consumer preferences. The increasing integration of artificial intelligence in customer service is expected to enhance user experience, while the rise of blockchain technology could revolutionize transaction security and efficiency. Additionally, as the expatriate population continues to grow, demand for seamless remittance solutions will likely increase, prompting service providers to innovate and adapt to meet these changing needs effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Online Remittance Services Mobile Remittance Applications Bank Transfers Cash Pickup Services Prepaid Debit Cards Cryptocurrency Transfers Others |

| By End-User | Individual Consumers Small Businesses Corporates Non-Governmental Organizations (NGOs) |

| By Payment Method | Bank Transfers Credit/Debit Cards E-Wallets Cash Payments |

| By Destination Country | India Nepal Philippines Bangladesh |

| By Transaction Size | Small Transactions Medium Transactions Large Transactions |

| By Frequency of Transactions | Daily Transactions Weekly Transactions Monthly Transactions |

| By Customer Segment | Expatriates Local Residents Businesses Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates from South Asia, Africa, and the Philippines |

| Service Provider Insights | 100 | Managers from remittance companies and banks |

| Regulatory Impact Assessment | 50 | Policy Makers, Financial Regulators |

| Consumer Preferences in Remittance Services | 80 | End-users of remittance services, including families receiving funds |

| Market Trends and Innovations | 70 | Industry Analysts, Financial Technology Experts |

The Qatar Digital Remittance Market is valued at approximately USD 7.5 billion, driven by a significant expatriate population that relies on digital services to send money home efficiently and conveniently.