Region:Middle East

Author(s):Rebecca

Product Code:KRAC1068

Pages:87

Published On:October 2025

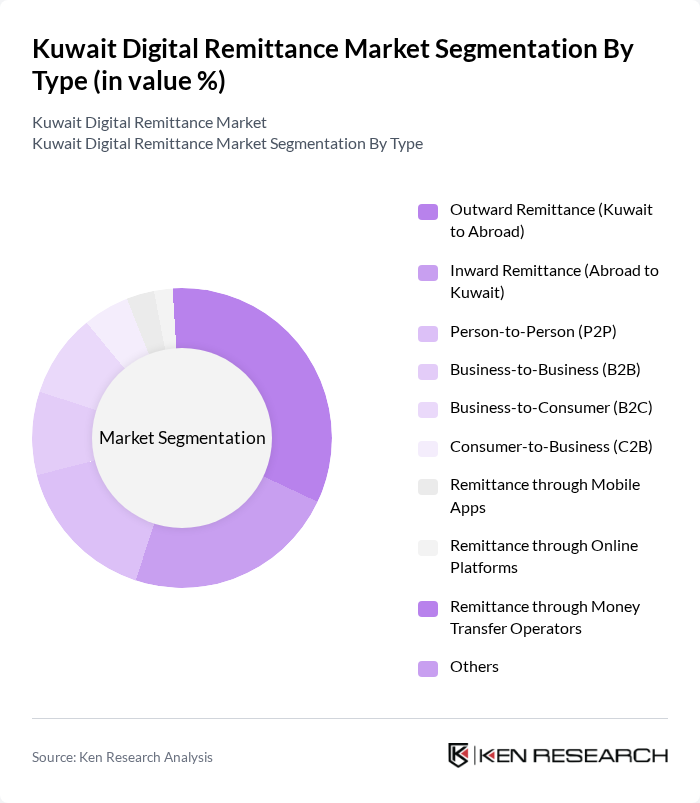

By Type:The segmentation of the market by type includes various forms of remittance services that cater to different user needs. The subsegments are as follows:

The leading subsegment in this category is Outward Remittance (Kuwait to Abroad), which accounts for a significant portion of the market. This is primarily driven by the large expatriate community in Kuwait, who regularly send money back to their home countries. The ease of use, competitive pricing, and increasing adoption of digital channels have made this option increasingly popular. Inward remittance also plays a crucial role, but the volume is lower compared to outward remittances.

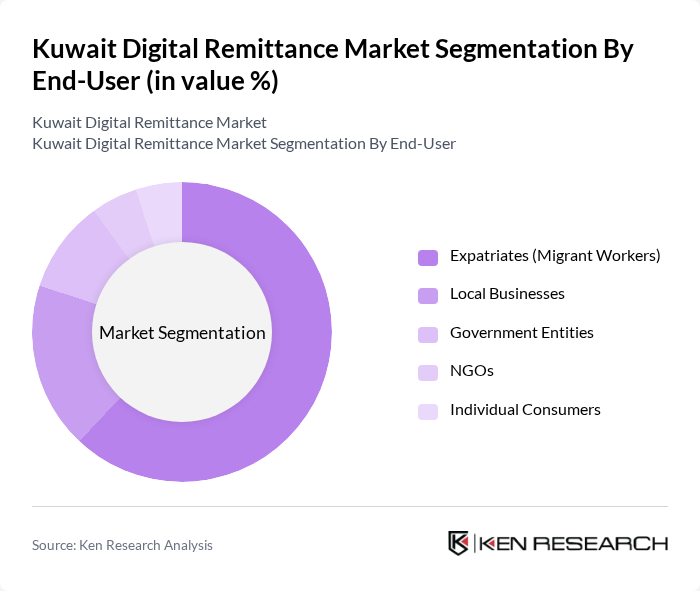

By End-User:The segmentation by end-user highlights the various groups utilizing remittance services. The subsegments include:

Expatriates (Migrant Workers) dominate the end-user segment, accounting for the majority of remittance transactions. This is due to the high number of foreign workers in Kuwait who regularly send money home to support their families. Local businesses also utilize remittance services, particularly for international transactions, but their volume is significantly lower compared to individual expatriates. The growing trend of digital remittance services, supported by government initiatives and financial inclusion efforts, has made it easier for these users to send money quickly and securely.

The Kuwait Digital Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, PayPal/Xoom, Wise (formerly TransferWise), Remitly, WorldRemit, Ria Money Transfer, Al Mulla Exchange, Al Ansari Exchange, Lulu Exchange, UAE Exchange, OFX, Payoneer, Skrill, City Exchange Co., Kuwait Finance House (KFH), Boubyan Bank, Gulf Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait digital remittance market appears promising, driven by technological advancements and evolving consumer preferences. As the expatriate population continues to grow, the demand for efficient and secure remittance solutions will likely increase. Additionally, the integration of blockchain technology and the rise of peer-to-peer services are expected to reshape the landscape, enhancing transaction speed and reducing costs. Providers that prioritize user experience and security will be well-positioned to capture market share in this dynamic environment.

| Segment | Sub-Segments |

|---|---|

| By Type | Outward Remittance (Kuwait to Abroad) Inward Remittance (Abroad to Kuwait) Person-to-Person (P2P) Business-to-Business (B2B) Business-to-Consumer (B2C) Consumer-to-Business (C2B) Remittance through Mobile Apps Remittance through Online Platforms Remittance through Money Transfer Operators Others |

| By End-User | Expatriates (Migrant Workers) Local Businesses Government Entities NGOs Individual Consumers |

| By Payment Method | Bank Transfers Mobile Wallets Cash Pickup Prepaid Cards Debit/Credit Cards |

| By Transaction Size | Small Transactions ( |

| By Frequency of Transactions | Daily Weekly Monthly Quarterly |

| By Geographic Reach | Domestic Remittances International Remittances |

| By Customer Segment | Individual Customers Corporate Customers Institutional Customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates from South Asia, Middle East, and Africa |

| Banking Sector Insights | 80 | Bank Managers, Financial Analysts |

| Digital Remittance Platforms | 60 | Product Managers, Marketing Directors |

| Regulatory Impact Assessment | 40 | Policy Makers, Compliance Officers |

| Consumer Preferences in Remittance | 90 | End-users of remittance services, Financial Advisors |

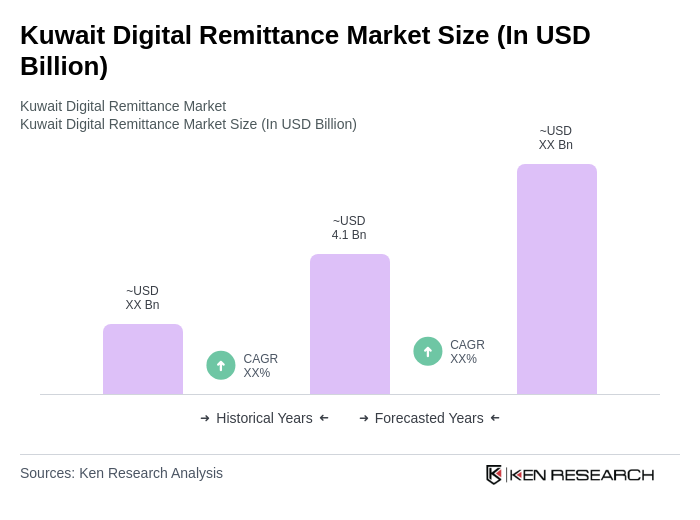

The Kuwait Digital Remittance Market is valued at approximately USD 4.1 billion, driven by the growing expatriate population and the increasing adoption of digital remittance services. This market is expected to continue expanding as more users seek convenient money transfer options.