Region:Middle East

Author(s):Rebecca

Product Code:KRAB5317

Pages:98

Published On:October 2025

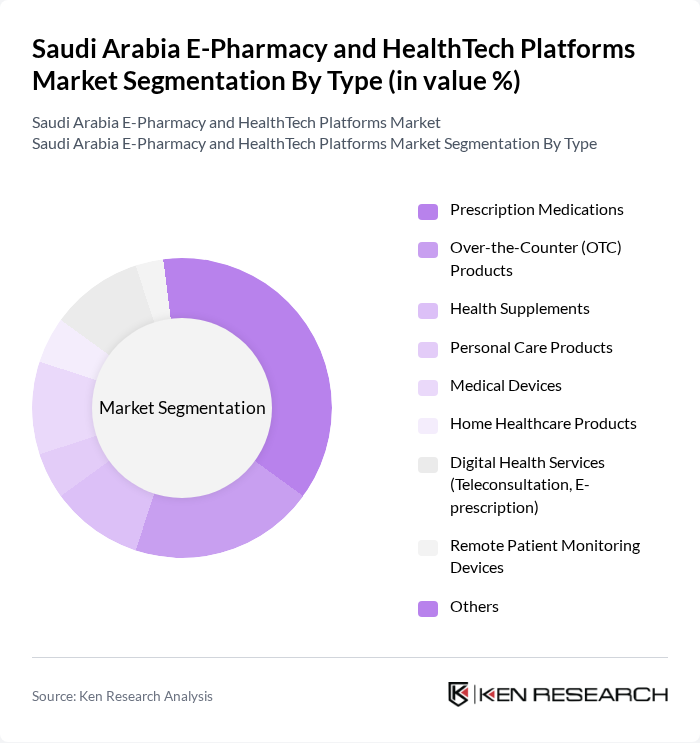

By Type:The market is segmented into various types, including Prescription Medications, Over-the-Counter (OTC) Products, Health Supplements, Personal Care Products, Medical Devices, Home Healthcare Products, Digital Health Services (Teleconsultation, E-prescription), Remote Patient Monitoring Devices, and Others. Among these, Prescription Medications and Digital Health Services are particularly prominent due to the increasing reliance on telehealth solutions, the growing need for convenient access to medications, and the integration of AI-driven prescription management and teleconsultation platforms .

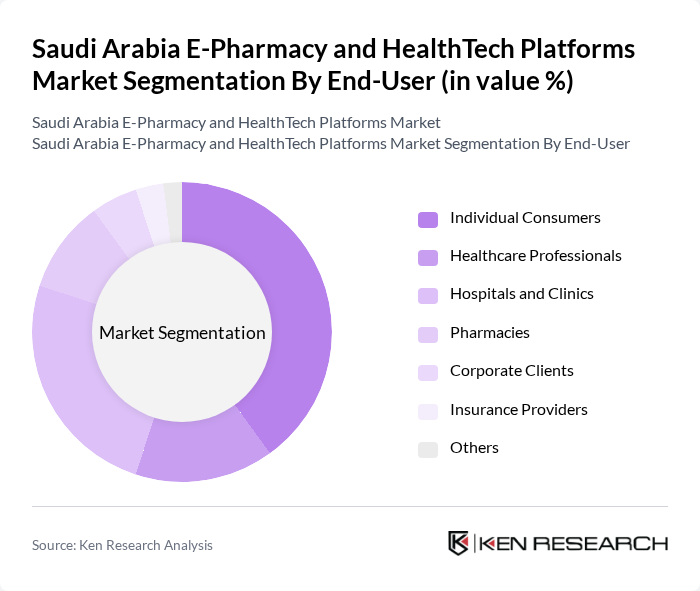

By End-User:The end-user segmentation includes Individual Consumers, Healthcare Professionals, Hospitals and Clinics, Pharmacies, Corporate Clients, Insurance Providers, and Others. Individual Consumers and Hospitals and Clinics are the leading segments, driven by the increasing demand for home healthcare solutions, the need for efficient patient management systems, and the growing adoption of digital platforms by both patients and healthcare providers .

The Saudi Arabia E-Pharmacy and HealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Nahdi Medical Company, White Pharmacy (Wasfaty/WhitePharmacy.com), Tabib (Tabib.sa), Sehaty (Ministry of Health Platform), Altibbi, Vezeeta, Sihatech, Cura, Aster Pharmacy, Al-Dawaa Pharmacies, Nabataty, Mawid (Ministry of Health Platform), Yodawy, Dawatech, Tibbiyah Holding contribute to innovation, geographic expansion, and service delivery in this space.

The future of the e-pharmacy and HealthTech platforms in Saudi Arabia appears promising, driven by technological advancements and increasing consumer acceptance. The integration of artificial intelligence and machine learning is expected to enhance personalized healthcare services, improving patient outcomes. Additionally, the expansion of telehealth services will likely continue, providing greater access to healthcare professionals. As regulatory frameworks evolve, they will support innovation while ensuring consumer safety, paving the way for a more robust digital health ecosystem in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Prescription Medications Over-the-Counter (OTC) Products Health Supplements Personal Care Products Medical Devices Home Healthcare Products Digital Health Services (Teleconsultation, E-prescription) Remote Patient Monitoring Devices Others |

| By End-User | Individual Consumers Healthcare Professionals Hospitals and Clinics Pharmacies Corporate Clients Insurance Providers Others |

| By Sales Channel | Direct Online Sales (Web Portals) Third-Party Marketplaces Mobile Applications Subscription Services Telemedicine Platforms Others |

| By Distribution Mode | Home Delivery Click and Collect Pharmacy Pickup Locker Delivery Others |

| By Customer Demographics | Age Group (Children, Adults, Seniors) Gender Income Level Urban vs. Rural Others |

| By Product Category | Chronic Disease Management Acute Care Products Preventive Care Products Wellness and Lifestyle Products Others |

| By Price Range | Budget Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| E-Pharmacy User Experience | 100 | Regular E-Pharmacy Users, First-time Users |

| Healthcare Professional Insights | 80 | Pharmacists, General Practitioners, Specialists |

| HealthTech Adoption Trends | 60 | HealthTech Entrepreneurs, Investors, Industry Analysts |

| Consumer Attitudes Towards E-Pharmacy | 90 | General Consumers, Health-Conscious Individuals |

| Regulatory Impact Assessment | 40 | Regulatory Officials, Compliance Officers |

The Saudi Arabia E-Pharmacy and HealthTech Platforms Market is valued at approximately USD 970 million, driven by the increasing adoption of digital health solutions and government initiatives aimed at enhancing healthcare accessibility and efficiency.