Region:Middle East

Author(s):Dev

Product Code:KRAC0397

Pages:90

Published On:August 2025

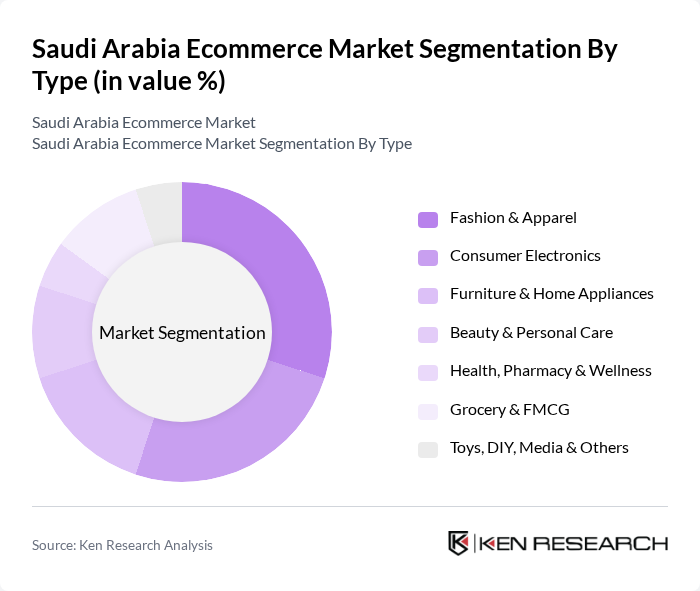

By Type:The market is segmented into various types, including Fashion & Apparel, Consumer Electronics, Furniture & Home Appliances, Beauty & Personal Care, Health, Pharmacy & Wellness, Grocery & FMCG, and Toys, DIY, Media & Others. Each of these segments caters to different consumer needs and preferences, with specific trends influencing their growth.

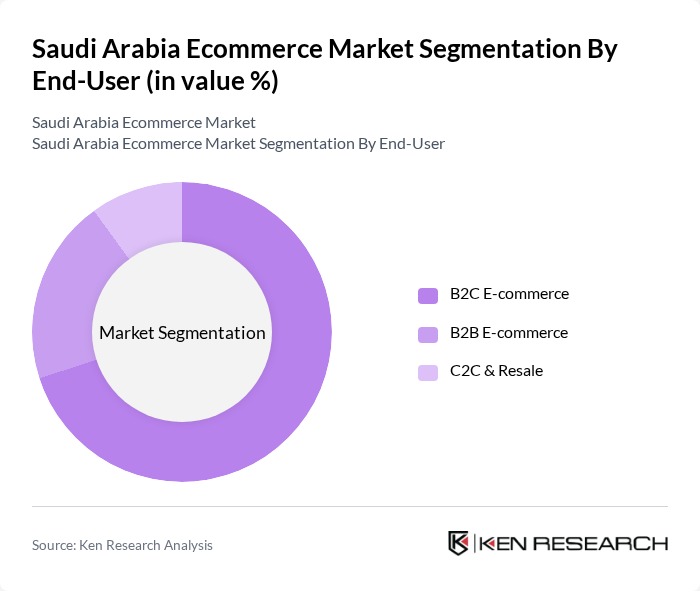

By End-User:The e-commerce market is further segmented by end-user categories, including B2C E-commerce, B2B E-commerce, and C2C & Resale. Each segment serves distinct customer bases, with B2C being the most prominent due to the growing trend of online shopping among consumers.

The Saudi Arabia Ecommerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Amazon.sa (Amazon Services LLC, formerly Souq.com), Noon, Jarir Bookstore (jarir.com), eXtra (United Electronics Company), Namshi, Ounass, Carrefour Saudi Arabia (Majid Al Futtaim Retail), Lulu Hypermarket (LuLu Group International), X-cite (X-cite by Alghanim Electronics), Nahdi Medical Company (Nahdi Online), SACO (Saudi Company for Hardware), Shein, H&M (Hennes & Mauritz), IKEA Saudi Arabia, Sephora Middle East, Centrepoint (Splash, Babyshop, Shoemart - Landmark Group), Noon Minutes & NowNow (quick commerce), HungerStation, Mrsool, STC Pay (stc bank) – as an enabling wallet for e-commerce contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabian e-commerce market appears promising, driven by technological advancements and changing consumer preferences. As digital payment solutions evolve, more consumers are likely to embrace online shopping. Additionally, the integration of artificial intelligence and machine learning will enhance personalization, improving customer experiences. The government's continued support for digital initiatives will further stimulate growth, positioning Saudi Arabia as a regional e-commerce hub, attracting both local and international players to the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fashion & Apparel Consumer Electronics Furniture & Home Appliances Beauty & Personal Care Health, Pharmacy & Wellness Grocery & FMCG Toys, DIY, Media & Others |

| By End-User | B2C E-commerce B2B E-commerce C2C & Resale |

| By Sales Channel | Retailer.com (Direct Online Stores) Marketplaces (e.g., Amazon.sa, Noon) Social Commerce (Instagram, Snapchat, TikTok) Super-apps & Aggregators (e.g., HungerStation, Mrsool) |

| By Payment Method | Cards (Visa, Mastercard, Mada) Cash on Delivery Digital Wallets (Apple Pay, STC Pay, PayPal) Buy Now Pay Later (Tamara, Tabby) |

| By Delivery Method | Standard Home Delivery Same-day/Express Delivery Click & Collect / In-store Pickup Locker & Parcel Point Pickup |

| By Customer Demographics | Age Group Gender Income Level City Tier (Riyadh/Jeddah/Dammam vs. Tier-2/3) |

| By Region | Central Region (Riyadh) Eastern Region (Dammam/Khobar/Dhahran) Western Region (Jeddah/Makkah/Medina) Southern Region Northern Region Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Electronics Purchases | 150 | Online Shoppers, Tech Enthusiasts |

| Fashion and Apparel Sales | 120 | Fashion Retailers, E-commerce Managers |

| Grocery Delivery Services | 100 | Logistics Coordinators, Grocery Retail Managers |

| Home Appliances Market | 80 | Product Managers, Supply Chain Analysts |

| Health and Beauty Products | 90 | Brand Managers, E-commerce Specialists |

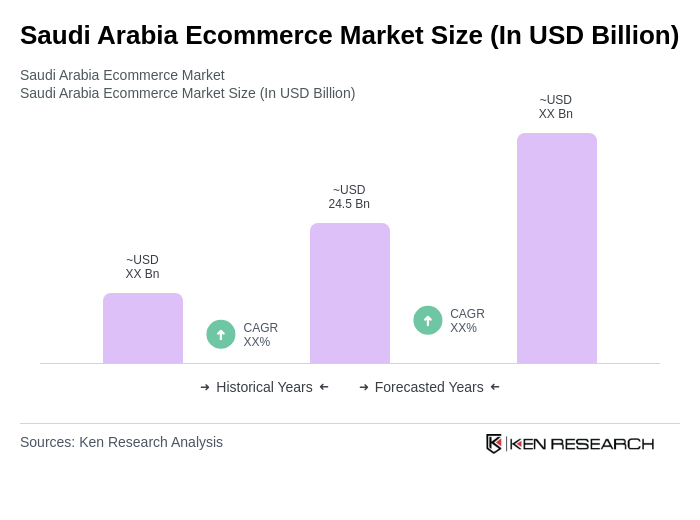

The Saudi Arabia Ecommerce Market is valued at approximately USD 24.5 billion, reflecting significant growth driven by increased online retail penetration, smartphone usage, and digital payment solutions, alongside a shift in consumer behavior towards online shopping.