Region:Middle East

Author(s):Shubham

Product Code:KRAA8936

Pages:92

Published On:November 2025

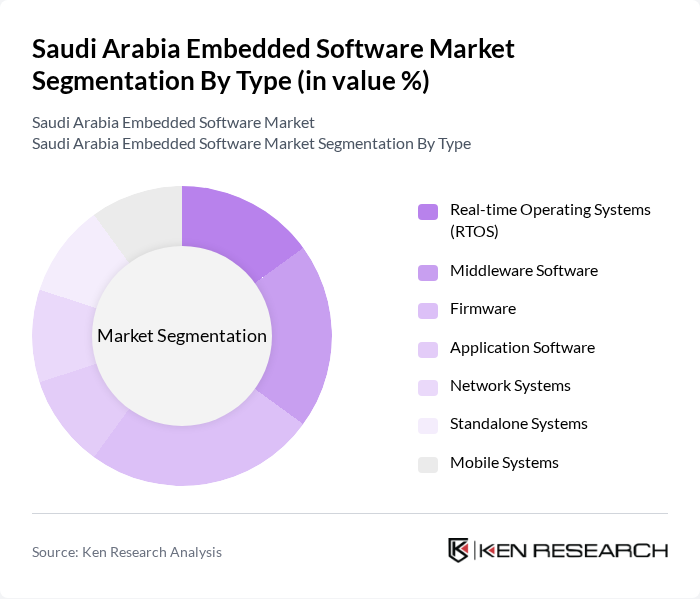

By Type:The embedded software market can be segmented into various types, including Real-time Operating Systems (RTOS), Middleware Software, Firmware, Application Software, Network Systems, Standalone Systems, and Mobile Systems. Each of these sub-segments plays a crucial role in the overall market, catering to different applications and industries.

TheFirmwaresub-segment is currently dominating the market due to its essential role in the functionality of embedded systems across various applications, including automotive, consumer electronics, and industrial automation. The increasing complexity of devices and the need for efficient performance have led to a higher demand for firmware solutions. Additionally, the trend towards IoT and smart devices has further accelerated the need for robust firmware, making it a critical component in the embedded software landscape.

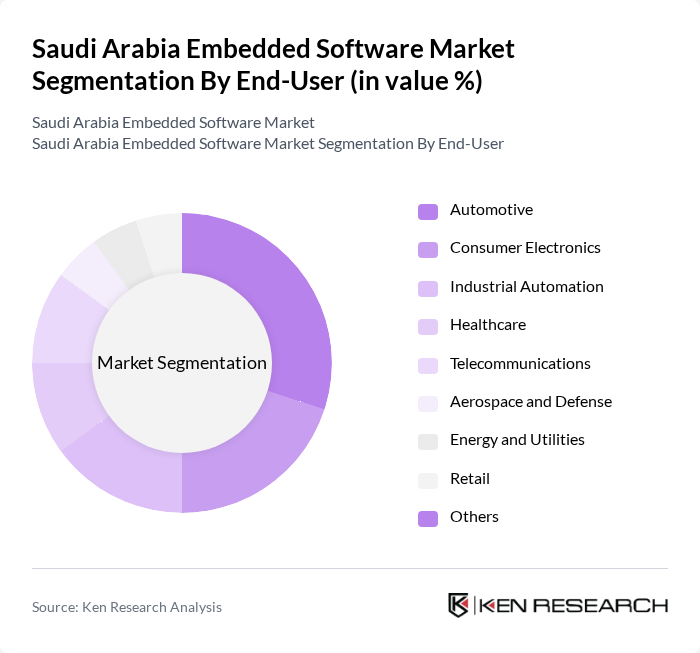

By End-User:The embedded software market is segmented by end-user industries, including Automotive, Consumer Electronics, Industrial Automation, Healthcare, Telecommunications, Aerospace and Defense, Energy and Utilities, Retail, and Others. Each sector has unique requirements and applications for embedded software, driving the demand in various ways.

TheAutomotivesector is the leading end-user of embedded software, driven by the increasing integration of advanced technologies such as autonomous driving, infotainment systems, and vehicle-to-everything (V2X) communication. The demand for safety features and enhanced user experiences in vehicles has led to a surge in the adoption of embedded software solutions, making it a pivotal area for growth in the market.

The Saudi Arabia Embedded Software Market is characterized by a dynamic mix of regional and international players. Leading participants such as STC Solutions, Advanced Electronics Company (AEC), Al-Falak Electronic Equipment & Supplies, Elm Company, Solutions by STC, Mobily, Saudi Business Machines (SBM), Zain KSA, Thales Group Saudi Arabia, Schneider Electric Saudi Arabia, Siemens Saudi Arabia, IBM Saudi Arabia, Lean Technologies, Tamkeen Technologies, Al-Babtain Group, Obeikan Investment Group, Al-Faisaliah Group, Al-Jazira Capital contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia embedded software market appears promising, driven by ongoing government support and technological advancements. As the Kingdom continues to invest in smart city initiatives and digital transformation, the demand for innovative embedded solutions is expected to rise. Furthermore, the integration of AI and machine learning into embedded systems will enhance functionality and efficiency, positioning the market for significant growth. Companies that adapt to these trends will likely thrive in this evolving landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Real-time Operating Systems (RTOS) Middleware Software Firmware Application Software Network Systems Standalone Systems Mobile Systems |

| By End-User | Automotive Consumer Electronics Industrial Automation Healthcare Telecommunications Aerospace and Defense Energy and Utilities Retail Others |

| By Industry Vertical | Automotive & Mobility Consumer Electronics Industrial Automation & Manufacturing Telecommunications Healthcare & Medical Devices Aerospace and Defense Energy and Utilities Retail & E-commerce Others |

| By Deployment Model | On-Premises Cloud-Based Hybrid Edge Deployment Others |

| By Region | Central Region Eastern Region Western Region Southern Region |

| By Application | Automotive Control Systems Home Automation Medical Devices Industrial Control Systems Smart Grid & Energy Management Telecommunications Infrastructure Consumer Electronics Devices Others |

| By Investment Source | Private Investments Government Funding Venture Capital Public-Private Partnerships Foreign Direct Investment (FDI) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Embedded Systems | 100 | Engineering Managers, Product Development Leads |

| Healthcare Device Software | 60 | Regulatory Affairs Specialists, Software Architects |

| Consumer Electronics Firmware | 85 | R&D Managers, Quality Assurance Engineers |

| Industrial Automation Software | 50 | Operations Managers, Systems Integrators |

| Smart Home Solutions | 55 | Product Managers, UX/UI Designers |

The Saudi Arabia Embedded Software Market is valued at approximately USD 200 million, driven by the increasing demand for smart devices, IoT applications, and advancements in automotive technologies, as well as digital transformation initiatives across various sectors.