Region:Middle East

Author(s):Dev

Product Code:KRAD0335

Pages:91

Published On:August 2025

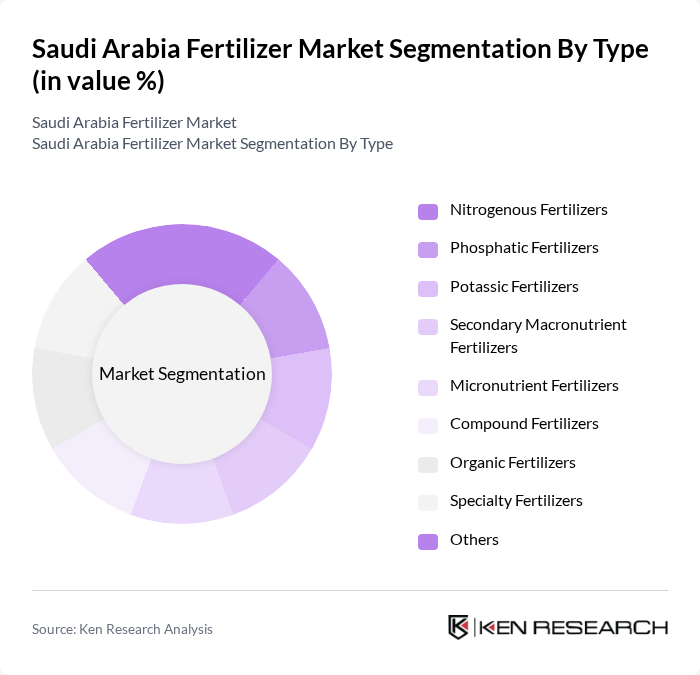

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, secondary macronutrient, micronutrient, compound, organic, specialty, and others. Among these, nitrogenous fertilizers, particularly urea and ammonium nitrate, dominate the market due to their essential role in enhancing crop productivity. The increasing adoption of modern farming techniques, government support for food security, and the need for higher agricultural output are driving the demand for these fertilizers .

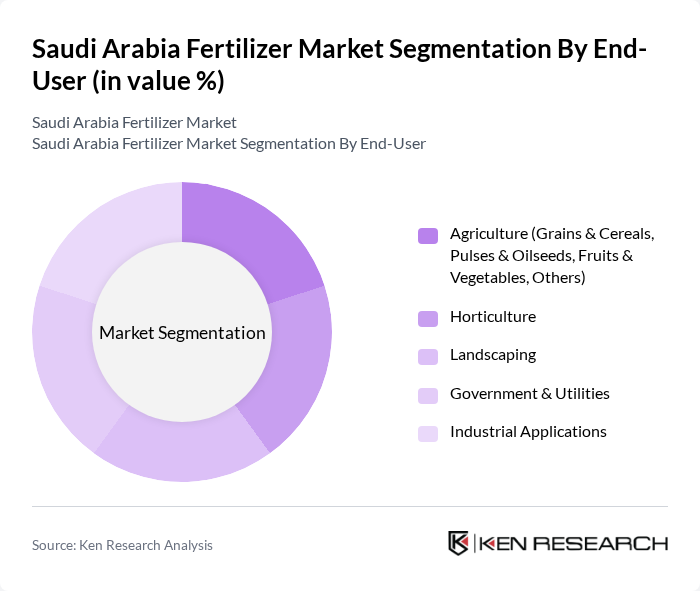

By End-User:The end-user segmentation includes agriculture, horticulture, landscaping, government and utilities, and industrial applications. The agriculture sector, particularly grains and cereals, is the largest consumer of fertilizers, driven by the need to enhance food production and ensure food security. The increasing population, changing dietary preferences, and government incentives for sustainable agriculture are further propelling the demand for fertilizers in this segment .

The Saudi Arabia Fertilizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Arabian Fertilizer Company (SAFCO), Ma'aden (Saudi Arabian Mining Company), Al-Jouf Agricultural Development Company, National Agricultural Development Company (NADEC), Arabian Agricultural Services Company (ARASCO), Gulf Fertilizers & Chemicals Company (GFC), Al-Faisaliah Group, United Fertilizer Company Limited (UFC), Al-Munajem Group, Al-Babtain Group, Al-Rajhi International for Investment, Al-Muhaidib Group, Al-Safi Danone, Al-Hokair Group contribute to innovation, geographic expansion, and service delivery in this space .

The Saudi Arabia fertilizer market is poised for transformative growth driven by increasing agricultural demands and government support for food security. As the nation invests in sustainable practices and technological advancements, the market is expected to adapt to environmental regulations while exploring innovative production methods. The focus on precision agriculture and digitalization will likely enhance efficiency, ensuring that the sector remains competitive and responsive to both domestic and international market needs.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous Fertilizers Urea Calcium Ammonium Nitrate Ammonium Nitrate Ammonium Sulfate Anhydrous Ammonia Others Phosphatic Fertilizers Mono-ammonium Phosphate (MAP) Di-ammonium Phosphate (DAP) Single Super Phosphate (SSP) Triple Super Phosphate (TSP) Others Potassic Fertilizers Muriate of Potash (MOP) Sulfate of Potash (SOP) Secondary Macronutrient Fertilizers Micronutrient Fertilizers Compound Fertilizers Organic Fertilizers Specialty Fertilizers Others |

| By End-User | Agriculture (Grains & Cereals, Pulses & Oilseeds, Fruits & Vegetables, Others) Horticulture Landscaping Government & Utilities Industrial Applications |

| By Application | Soil Application Foliar Application Fertigation Specialty Applications (Lawn Care, Golf Courses, Landscape Management) |

| By Distribution Channel | Direct Sales Retail Outlets Online Sales |

| By Packaging Type | Bulk Packaging Bagged Packaging Liquid Packaging |

| By Price Range | Economy Range Mid-Range Premium Range |

| By Region | Central Region Eastern Region Western Region Southern Region |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retailers | 100 | Store Managers, Sales Representatives |

| Agricultural Producers | 120 | Farm Owners, Crop Managers |

| Fertilizer Distributors | 60 | Logistics Coordinators, Supply Chain Managers |

| Government Agricultural Agencies | 50 | Policy Makers, Agricultural Advisors |

| Research Institutions | 40 | Agricultural Researchers, Environmental Scientists |

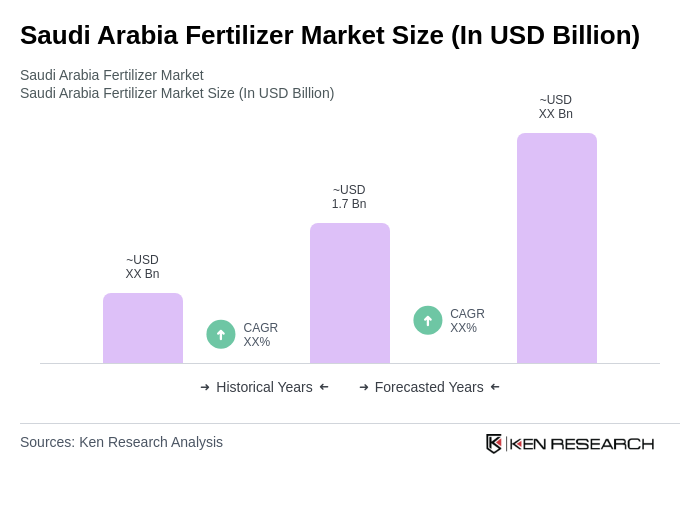

The Saudi Arabia Fertilizer Market is valued at approximately USD 1.7 billion, driven by increasing food security demands, advancements in agricultural practices, and government initiatives to boost domestic production.