Region:Asia

Author(s):Dev

Product Code:KRAA1491

Pages:80

Published On:August 2025

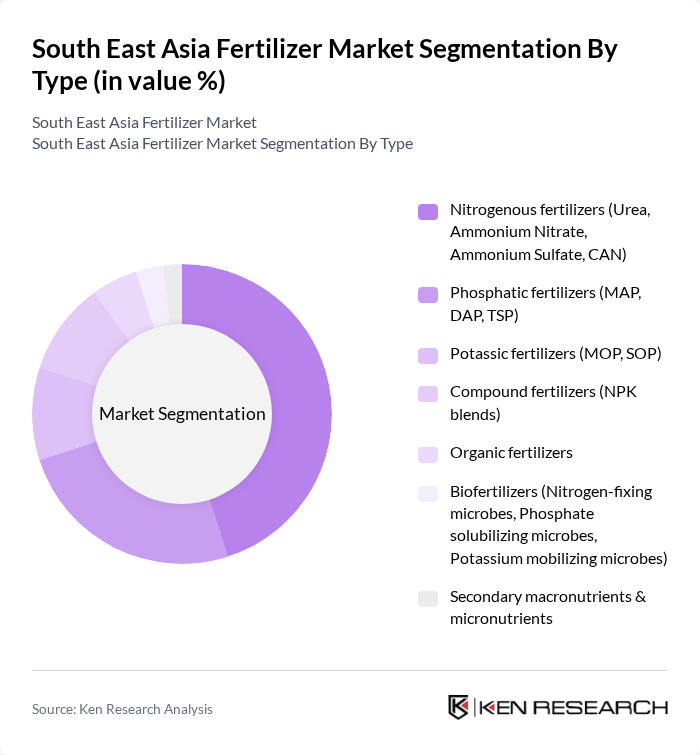

By Type:The market is segmented into various types of fertilizers, including nitrogenous, phosphatic, potassic, compound, organic, biofertilizers, and secondary macronutrients & micronutrients. Among these, nitrogenous fertilizers, particularly urea, dominate the market due to their essential role in enhancing crop yields and their widespread application across various agricultural practices. The increasing focus on food security and sustainable farming practices has further propelled the demand for these fertilizers.

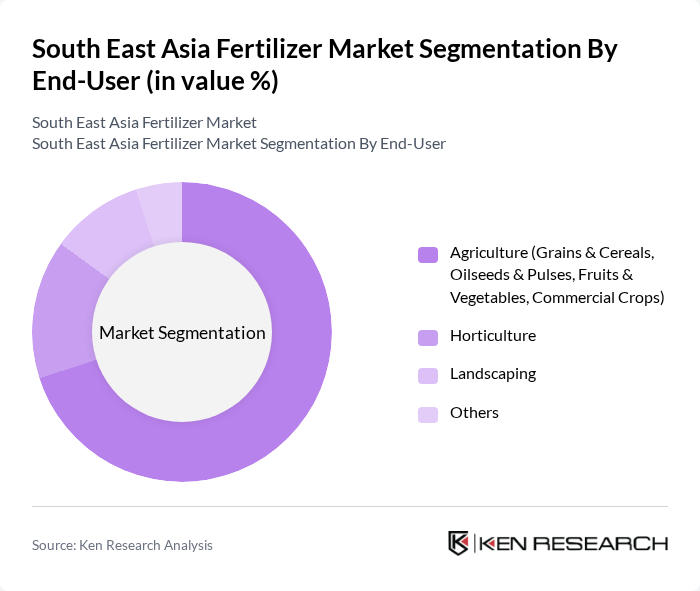

By End-User:The end-user segmentation includes agriculture, horticulture, landscaping, and others. The agriculture sector, particularly grains and cereals, dominates the market due to the high demand for food production. The increasing adoption of advanced farming techniques and the need for higher crop yields are driving the growth of fertilizers in this segment, making it the leading end-user category.

The South East Asia Fertilizer Market is characterized by a dynamic mix of regional and international players. Leading participants such as Yara International ASA, Nutrien Ltd., CF Industries Holdings, Inc., OCP Group, ICL Group Ltd., K+S AG, Haifa Group, Sinochem International Corporation, EuroChem Group AG, PhosAgro, The Mosaic Company, Uralchem Integrated Chemicals Company, Acron Group, SQM S.A., Song Gianh Corporation, Thai Central Chemical Public Company Limited, Sak Siam Group contribute to innovation, geographic expansion, and service delivery in this space.

The South East Asia fertilizer market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As precision agriculture gains traction, farmers are increasingly adopting data-driven solutions to optimize fertilizer use, enhancing efficiency and reducing waste. Additionally, the rising focus on eco-friendly fertilizers is expected to reshape product offerings, aligning with global sustainability trends. These developments will likely create a more resilient market, capable of adapting to changing consumer preferences and regulatory landscapes.

| Segment | Sub-Segments |

|---|---|

| By Type | Nitrogenous fertilizers (Urea, Ammonium Nitrate, Ammonium Sulfate, CAN) Phosphatic fertilizers (MAP, DAP, TSP) Potassic fertilizers (MOP, SOP) Compound fertilizers (NPK blends) Organic fertilizers Biofertilizers (Nitrogen-fixing microbes, Phosphate solubilizing microbes, Potassium mobilizing microbes) Secondary macronutrients & micronutrients |

| By End-User | Agriculture (Grains & Cereals, Oilseeds & Pulses, Fruits & Vegetables, Commercial Crops) Horticulture Landscaping Others |

| By Application | Crop production Turf and ornamental Greenhouse Others |

| By Distribution Channel | Direct sales Retail outlets Online sales Others |

| By Region | Indonesia Thailand Vietnam Malaysia Philippines Singapore Others |

| By Price Range | Low-cost fertilizers Mid-range fertilizers Premium fertilizers |

| By Packaging Type | Bulk packaging Bagged packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Fertilizer Retail Market | 80 | Retail Managers, Store Owners |

| Agricultural Producers | 70 | Farm Owners, Crop Managers |

| Fertilizer Distributors | 50 | Distribution Managers, Sales Representatives |

| Government Agricultural Agencies | 40 | Policy Makers, Agricultural Officers |

| Research Institutions | 40 | Agricultural Researchers, Soil Scientists |

The South East Asia Fertilizer Market is valued at approximately USD 11 billion, driven by increasing food production demands due to population growth and urbanization, as well as the adoption of modern agricultural practices.